The term 'Inheritance Tax', recently came into the spotlight with Sam Pitroda, Chairman of Indian Overseas Congress, describing the inheritance tax in the United states as an interesting law during an interview.

What is inheritance tax?

Inheritance tax is a basically a tax that is levied by governments on the property and money that an individual leaves behind when they die. It is typically calculated based on the total value of the inheritance and can vary depending on the relationship between the deceased and the inheritor.

For example,

Let's say, if a person named X passes away, and leaves you their house worth Rs 50 lakh, you might have to pay inheritance tax on that amount before fully claiming the house.

However, the tax rate exemptions can differ from one place to another. For instance, in some countries, close relatives such as spouses or children might be exempt from paying inheritance tax or may have low tax rates compared to others, again depending upon certain circumstances.

In simpler terms, inheritance tax is a way for the government to collect a portion of the wealth transferred from one person to another after someone dies.

In the case of India, there is currently no inheritance tax. However, it exited from 1953 to 1985 until the then-Prime Minister Rajiv Gandhi scrapped it in 1985. It was introduced then through the Estate Duty Act, 1953 and tax rates could be as high as 85 per cent on properties at that time.

Which countries have inheritance tax?

Inheritance taxes are collected by these states in the US including Iowa, Maryland, New Jersey, Kentucky, Pennsylvania, and Nebraska.

Pennsylvania - Direct descendants (like children or grandchildren) pay 4.5 per cent, siblings pay 12 per cent, and other heirs pay 15 per cent. However, spouses are exempt from these taxes.

In Iowa - inherit is worth less than USD 25,000 - no tax.

Maryland - inheritance is less than USD 50,000 - no tax.

Countries ranked by the percentage of inheritance tax collected:

In terms of inheritance tax collected, Japan collects 55 per cent, followed by South Korea at 50 per cent, and France at 45 per cent.

The United Kingdom and the United States each collects 40 per cent in inheritance tax. Spain follows with 34 per cent, while Ireland and Belgium collect 33 per cent and 30 per cent respectively.

Germany also stands at 30 per cent. Further down the list, Chile collects 25 per cent, Greece and the Netherlands both collect 20 per cent, while Finland stands at 19 per cent.

Denmark follows with 15 per cent, Iceland and Turkey with 10 per cent each, and Poland and Switzerland share 7 per cent.

Italy collects 4 per cent in inheritance tax collected.

Pitroda on Inheritance Tax

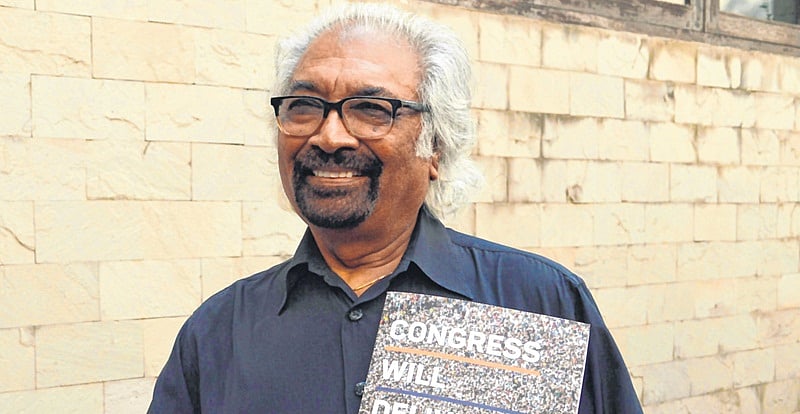

Chairman of Indian Overseas Congress |

Pitroda described the concept of inheritance tax in America, stating, "In America, there is an inheritance tax. If one has 100 million USD worth of wealth and when he dies he can only transfer probably 45 per cent to his children, 55 per cent is grabbed by the government. That's an interesting law. It says you in your generation, made wealth and you are leaving now, you must leave your wealth for the public, not all of it, half of it, which to me sounds fair."

"In India, you don't have that. If somebody is worth 10 billion and he dies, his children get 10 billion and the public gets nothing...So these are the kinds of issues people will have to debate and discuss. When we talk about redistributing wealth, we are talking about new policies and new programs that are in the interest of the people and not in the interest of the super-rich only," he added.

After Pitroda's comments on the inheritance tax, the term came into the limelight, sparking many debates and discussions among ruling and opposition parties alike.

On Wednesday, April 24th, Pitroda took to his X account, formerly Twitter, to clarify his position, stating, "It is unfortunate that what I said as an individual on inheritance tax in the US is twisted...to divert attention from what lies PM is spreading about Congress manifesto. PM's comments Mangal Sutra and gold snatching are simply unreal."