Nirmala Sitharaman, the finance minister of the country, presented her 8th record budget in the Lok Sabha on February 1. Her speech lasted for nearly 1 hour and 15 minutes.

Emphasis on Tax Payers

Sitharaman used the word 'Tax' 51 times in her speech, which was shorter than the longest speech of 2 hours and 42 minutes, a record set by Sitharaman herself in 2020.

Sitharaman's budget laid emphasis on easing the lives of taxpayers and bringing about convenience to them. Some of the major developments from the budget also came from the realm of the budget.

FM announced that those who earn up to Rs 12 lakh will not have to pay any tax bringing them out of any tax liability.

In addition, FM also made some other major announcements, which have brought about an increase in purchasing capabilities by bringing their prices down.

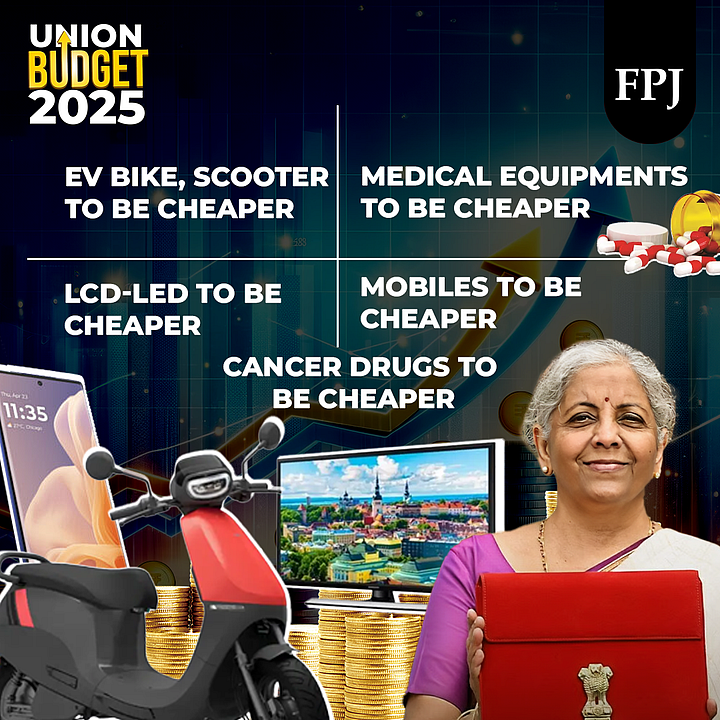

What Gets Cheaper?

Some of the items that are expected to get cheaper after the budget are as follows.

Due to exemptions and changes introduced to the customs duty regime, some crucial items have gotten cheaper.

Medicines

Most importantly dozens of life-saving drugs will not be exempted from any basic customs duty or BCD.

The FM announced the exemption of a crucial list of 36 medicines, which also includes drugs for cancer treatment from any customs duty liability, thereby making them cheaper.

Battery and Electronics

As a result of the scheme announced by the FM to aid the production and availability of electronic equipment, mobile batteries are set to get cheaper.

This would also mean a potential reduction in the price of mobile phones.

Electric Vehicles

The move to aid the availability of crucial lithium-ion batteries, the price of the much-talked-about Liithium-ion batteries, used in various items including EVs and other equipment will get cheaper.

As a result of the two above decisions, the purchase of Electric vehicles are set to get cheaper. Due to an expected reduction in the prices of lithium-ion batteries, EV prices are expected to go down.

Minerals

12 Essential minerals will be cheaper after a reduction in BCD or Basic Customs Duty on them.

Shipbuilding Raw Materials

After a blanket exemption from BCD for the next 10 years, the price of shipbuilding raw materials will also go down.

Food and Lifestyle

Other items that may get cheaper include frozen fish paste. Synthetic flavouring essences will also get cheaper

The price of medicinal equipment will also go down.

Leather Products will be cheaper as wet blue leather has been fully exempted from Basic Customs Duty.

What Gets Costlier?

While these important items get cheaper, some other items will get costlier.

Plastic and plastic products which have been at the centre of sustainability and environment debates will get costlier.

In addition, knitted fabric will also go up, making the costlier.

The price of Interactive flat-panel display will go up, thereby increasing the price of flat-screen televisions.