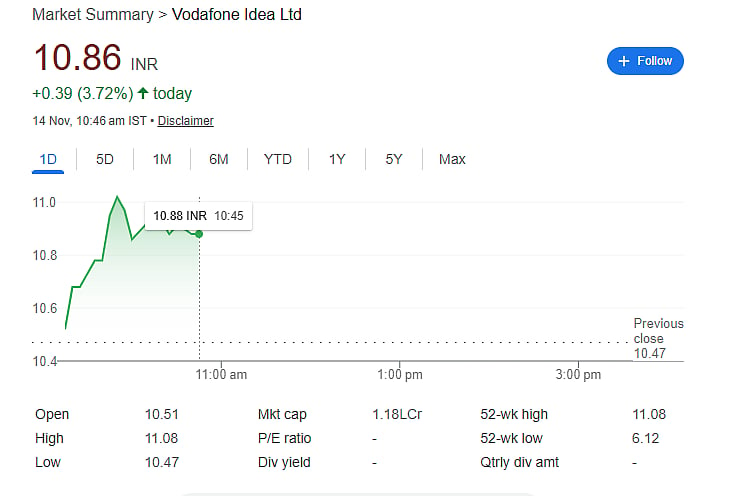

Mumbai: Vodafone Idea Ltd. witnessed a sharp rise of nearly 5 percent on Friday, 14 November, continuing a four-session rally that pushed the stock above the Rs 11 mark—its Follow-On Public Offer (FPO) price set in April 2024. This marks the first time the stock has crossed this level since September 2024, signalling renewed investor confidence.

Strong Momentum Backed by AGR Relief Hopes

Over the past four trading sessions, Vodafone Idea’s share price has climbed 15 percent. The surge is primarily driven by expectations of potential relief in the company’s long-standing Adjusted Gross Revenue (AGR) dues. Since hitting a low of Rs 6.12 in August, the stock has nearly doubled, fueled by optimism around easing regulatory pressures.

India’s Largest FPO and Market Performance

In April 2024, Vodafone Idea raised Rs 18,000 crore through the country’s biggest-ever FPO, priced at Rs 11 per share. Post-offer, the stock reached a yearly high of Rs 19.18 before slipping sharply in subsequent months. The recent rebound brings it closer to earlier highs and strengthens its market position in 2025, during which it has already gained 38 percent—after doubling in value in 2023.

Supreme Court’s Clarification Boosts Sentiment

Investor sentiment received a notable boost after the Supreme Court clarified that any relief granted to Vodafone Idea would apply to its total AGR dues, not just the additional demand. This ruling has been interpreted as a major positive development for the financially stressed telecom operator.

Quarterly Results Show Signs of Stabilisation

In its September quarter results, Vodafone Idea reported the lowest net loss in 19 quarters, signalling gradual financial improvement. The company’s Average Revenue Per User (ARPU) also increased from Rs 165 to Rs 167, indicating better operational performance.

Technical Indicators Suggest Overbought Conditions

Technical charts reveal that the stock is trading above all major moving averages. However, its Relative Strength Index (RSI) has reached 70, placing it in the ‘overbought’ zone. At present, Vodafone Idea shares are trading at Rs 10.9 with a 4.2 percent gain, reflecting strong but cautious market sentiment.