Mumbai: The US Dollar Index has dropped by around 9.7 percent, now trading near the 97 level. This is the biggest yearly fall since 2017. At the start of the year, the index was around 110, a three-year high. However, weak economic data, interest rate cuts, and political uncertainty have slowed the dollar down.

Why the Dollar is Falling?

There are several reasons for the dollar’s decline. US job data has been weak, and the unemployment rate has gone up. The Federal Reserve cut interest rates by 25 basis points and has signaled two more possible cuts this year.

The US debt-to-GDP ratio has touched 130 percent, and massive treasury bond issues have made foreign investors less interested in buying US assets. Also, President Donald Trump’s new tariffs, announced on 'Liberation Day' in April, caused a big sell-off in US assets.

Many investors are also worried about political pressure on the Federal Reserve, raising questions about its independence. This has weakened investor confidence even further.

Global Capital Moves to Gold and Emerging Markets

Due to the falling dollar and fear in US markets, investors are now putting their money into gold and emerging markets. According to experts, the record supply of US treasuries and massive selling of dollar assets have made this shift even faster.

Impact on India

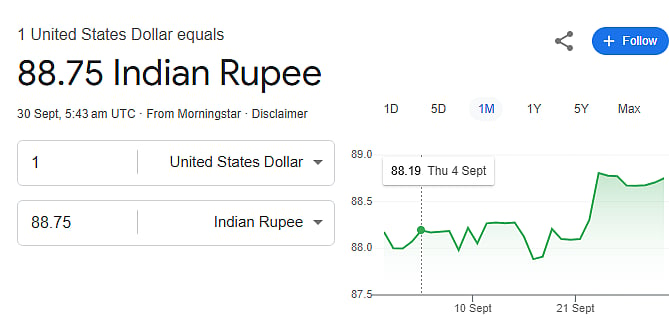

Normally, when the dollar falls, emerging market currencies get stronger, but India is seeing the opposite. The Indian Rupee has fallen from 83 to 89 as foreign portfolio investors (FPIs) are pulling money out of Indian stocks and bonds. Also, US tariffs have hurt India’s export outlook.

Overall, The sharp fall in the US dollar has created big movements in the global currency market. But in India, foreign investor selling and US trade issues are putting heavy pressure on the rupee, despite strong fundamentals at home.