When it comes to paying income taxes, which play an important part of any country's financial system, it is intriguing to know the tax variation across different countries for the same amount of income that you are paying in your country and their significant difference with other countries.

Taxes fund essential public services and infrastructure, but the rates and structures vary widely from country to country.

As the Union Budget 2024 is set to be presented in Parliament on July 23 by the Union Finance Minister, Nirmala Sitharaman, many individual taxpayers are eagerly awaiting potential changes, especially in the limits of various exemptions and deductions.

Whether you are considering to have a move to abroad or just curious about how your tax burden stacks up globally, let us compare the income tax system of India and the USA to see how much tax a person earning Rs 15 lakhs per annum (LPA) in India would pay compared to someone earning an equivalent amount in the USA.

Understanding Tax Slabs

Before diving into the comparison on what a 15 LPA individual taxpayer has to pay, let's first understand the tax structures in both countries.

India’s Tax Slabs

A developing country like India offers two tax regimes: the old tax regimes, which allows for various exemptions and deductions, and the new tax regime, which has lower tax rates but does not allow for most deductions. Here is the breakdown:

.png)

USA’s Tax Slabs

The United States has a more progressive tax system with seven federal income tax brackets for the year 2024, which are as follows:

.png)

Tax Calculation for 15 LPA in India

Old Tax Regime

The first step in calculating income tax is to claim all applicable deductions, including standard deduction of Rs 50,000, and others like deduction under 80c.

For an individual earning Rs 15,00,000 per year in India, the tax calculation under the old tax regime is as follows:

Summing the amounts, the total tax under the old tax regime is Rs 12,500 (5 per cent of Rs.2.5 lakh) + Rs 1,00,000 (20 per cent of Rs.5 lakh) + Rs 1,50,000 (30 per cent of Rs.5 lakh). Thus, the total tax payable is Rs 2,62,500.

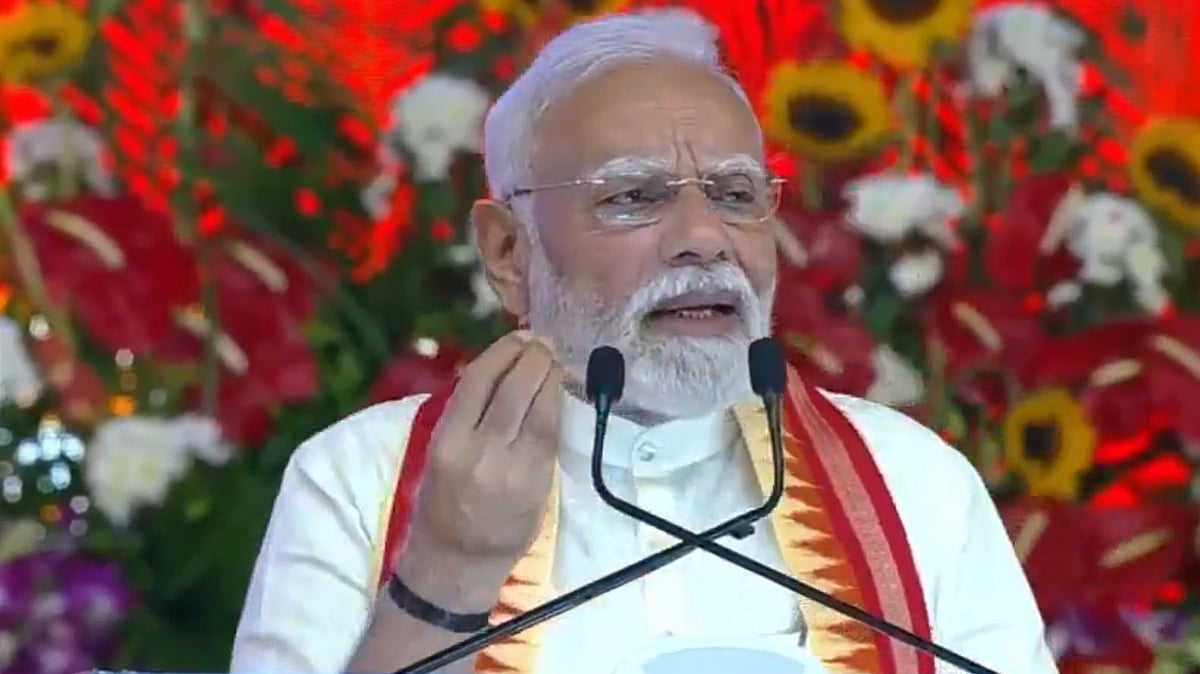

Image Source: Wikipedia (Representative)

New Tax Regime

For the same individual earning Rs 15,00,000 per year under the new tax regime, it is as follows:

The total tax under the new tax regime is for a 15 LPA individual is Rs 12,500 (5 per cent of Rs 2.5 lakh) + Rs 25,000 (10 per cent of Rs 2.5 lakh) + Rs 37,500 (15 per cent of Rs 2.5 lakh) + Rs 50,000 (20 per cent of Rs. 2.5 lakh) + Rs 62,500 (25 per cent of Rs 2.5 lakh). Thus, the total tax payable is Rs 1,87,500.

Representative Image | Wikimedia

Tax Calculation for Equivalent Earnings in the USA

Assuming that an income of 15 LPA in India is approximately equivalent to USD 18,500 USD (approx. Rs 1545573.25) in the United States.

The total tax payable in the USA for a earning same amount is USD 1,160 (10 per cent of USD 11,600) + USD 828 (12 per cent of USD 6,900).

Thus, the total tax payable is USD 1,988, which is approximately Rs 1,66,191 (assuming an exchange rate of 1 USD = 83.54 INR).

Comparison -India Vs US taxes

In India, under the old tax regime, the total tax payable on a 15 LPA income is Rs 2,62,500 meanwhile for new tax regime, the total tax payable on the same income is Rs 1,87,500.

However in USA, for an equivalent income of USD 18,500, the total tax payable is approximately Rs 1,66,191.