Are you looking to diversify your investment portfolio beyond the Indian market? Consider this – the United States is home to some of the largest and most inventive companies globally. Think of technology giants such as Apple, Google, and Microsoft, or finance powerhouses like JPMorgan Chase and Goldman Sachs.

These companies are often inaccessible for direct investment through Indian markets. But they present a golden opportunity for broadening your investment horizon and potentially increasing your financial returns. The increasing interest of Indian investors in the US stock markets is evident, as trading volumes saw a remarkable growth of 45% in 2023.

As an Indian investor, why should you consider diversifying your portfolio with US stocks? Here are a few compelling reasons:

— It can help reduce your investment risk across different sectors and regions.

— Investing in a stronger currency like the US dollar can offer additional financial gains like a hedge against local currency depreciation, and the potential for higher returns in terms of exchange rates.

Why are ETFs a Convenient Investment Option

ETFs provide Indian investors seeking US equity exposure some major advantages over purchasing individual stocks.

Instant Diversification

By buying shares in just one ETF that tracks a broad market index, you gain exposure to potentially hundreds of underlying constituent stocks. This allows you to mitigate the company-specific risks that come with buying individual stocks.

Flexibility

ETFs also provide flexibility for different investor types. You can invest a small amount to gain access to US stocks. Many online trading platforms like Appreciate Wealth allow ETF purchases in small quantities, making them accessible for those with limited capital.

Strategic Investment Options

ETFs enable various investment strategies, each with its unique advantages:

— Swing Trading: This strategy involves taking advantage of short-term price movements in the market to earn profits.

— Sector Rotation: Investors shift their assets from one industry sector to another, aiming to capitalise on the changing economic cycles.

— Thematic Investing: This approach focuses on investing in trends or themes that are expected to play a significant role in future growth, such as technology or sustainability.

Lower Expense Ratios

Generally, ETFs have lower expense ratios compared to mutual funds, often ranging from 0.05% to 0.25%. This cost-efficiency is particularly advantageous for investors with limited capital, ensuring more of your investment goes towards your financial growth rather than fees.

Top Performing ETFs in the US

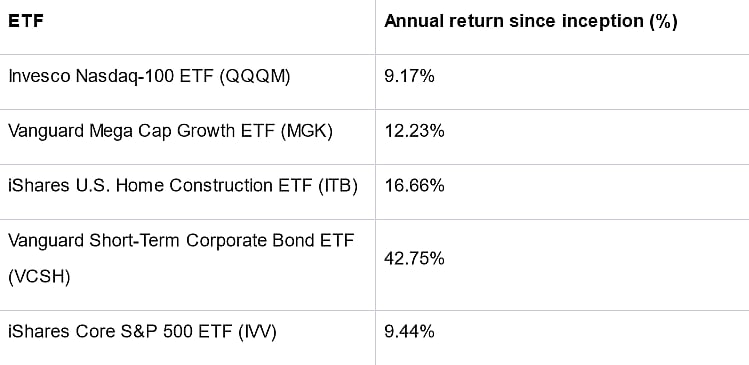

Below is a table listing some of the standout ETFs in the US market along with their returns since inception.

The Invesco QQQ ETF lets you invest in the NASDAQ-100 index, which includes 100 big companies from various industries listed on the Nasdaq stock exchange. IVV, however, follows the S&P 500 index, which includes the top 500 large companies listed in the US. Both these funds focus on large companies and are good choices for Indian investors who want to invest in the US market as a main part of their portfolio.

How to Invest in US ETFs

Here’s a simple, step-by-step guide to get you started:

— Start by learning about different US ETFs. Understand their performance history, the sectors they cover, and their expense ratios.

— Platforms like Appreciate Wealth make the entire process very simple even for first-time investors. Their easy-to-use mobile app allows you to discover, evaluate, and invest seamlessly across global assets.

— Open an international trading account with a SEBI-registered broker that gives you access to US markets.

— Transfer money into your trading account through an NRE or NRO bank account.

— Search for the ETF ticker symbol on the app to fetch the quote and pricing data.

— Enter the amount you wish to invest and place the buy order for the ETF.

— The ETF units will be reflected in your demat account once the transaction is processed.

Final Thoughts

"Buy when everyone else is selling," as Baron Rothschild famously advised. This holds especially true in turbulent market times.

During market dips, while many hesitate to invest, historical trends show that those who invest wisely in these times can see substantial benefits. This is where ETFs come in, allowing you to gradually invest in undervalued, high-quality assets.

For Indian investors, one of the best stock market apps Appreciate Wealth provides a gateway to some of the world's most promising investment opportunities.

Yogesh, Co-Founder at Appreciate |

Author Bio: Yogesh is a Co-Founder at Appreciate, a fintech platform helping Indians achieve their financial goals through globally diversified one-click investing.