Mumbai : Country’s top 100 companies in terms of market valuation have generated Rs 28.4 lakh crore wealth in the last five years, with Tata Group firm TCS retaining the numero uno position in the chart, says a latest study.

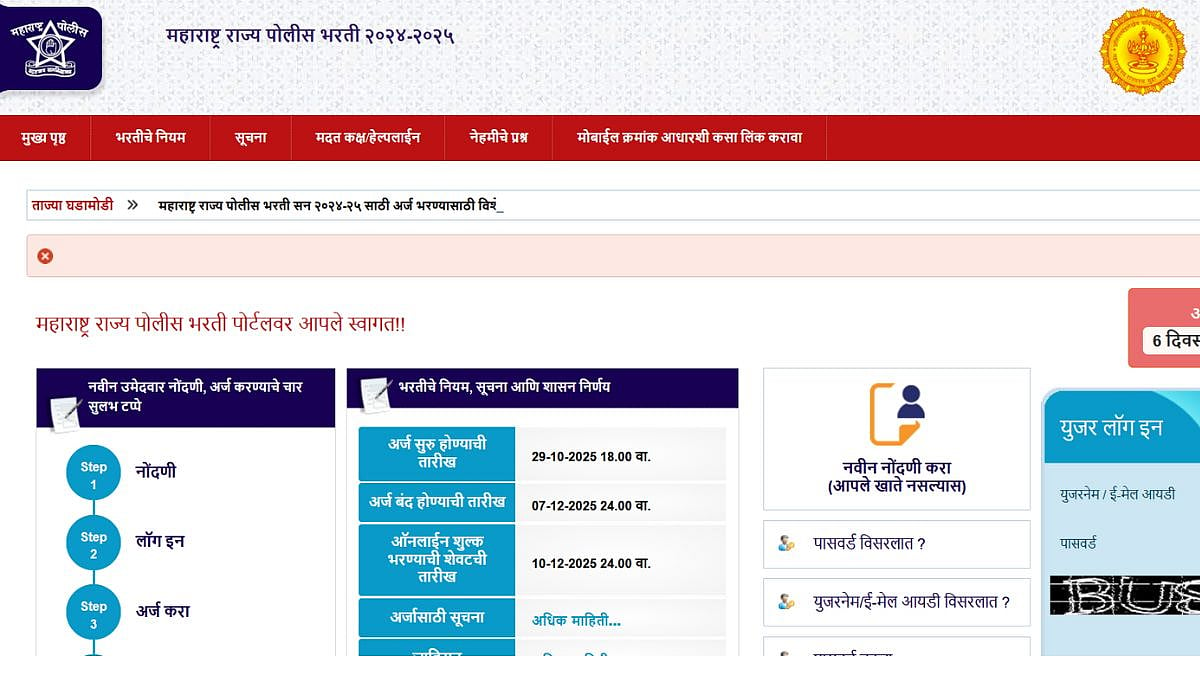

According to the leading brokerage firm Motilal Oswal’s ’21st Annual Wealth Creation Study’, TCS is the biggest wealth creator for generating over Rs 2.6 lakh crore for the period 2011-16. The firm has retained the rank for the fourth year in a row. The IT giant was followed by private sector lender HDFC Bank, as per the study, which looks into top 100 wealth creating companies during the period 2011-16. Overall, top 100 companies created Rs 28.4 lakh crore during 2011-16, which is the third highest-ever quantum of amount generated. The wealth created is calculated as change in the market cap of companies between 2011 and 2016, duly adjusted for corporate events such as mergers, de-mergers, fresh issuance of capital, buyback, among others, reports PTI.

While Ajanta Pharma was found to be the fastest wealth creator for the second year in a row, Asian Paints emerged as the most consistent wealth generator. Sector-wise, consumer/retail emerged as the country’s biggest wealth creating industry for the second consecutive time.

The report noted that public sector undertakings wealth creation performance continues to be dismal during 2011-16. Only 7 PSUs — BPCL, HPCL, Petronet LNG, Concor, LIC Housing, Bharat Electronics and Power Grid Corporation — figure in the top 100 wealth creators list and contributed to 4 per cent of the total wealth generation. Meanwhile, wealth worth Rs 15 trillion was destroyed during 2011-16. This accounts for 53 per cent of the total wealth created by top 100 companies.

“Seven of the top 10 wealth destroyers are in the business of global commodities,” Motilal Oswal said. “Metals/mining is the biggest wealth-destroying sector as was the case last year, followed by banking and finance, which mainly includes state-owned banks at the wrong end of the NPA cycle,” it added.