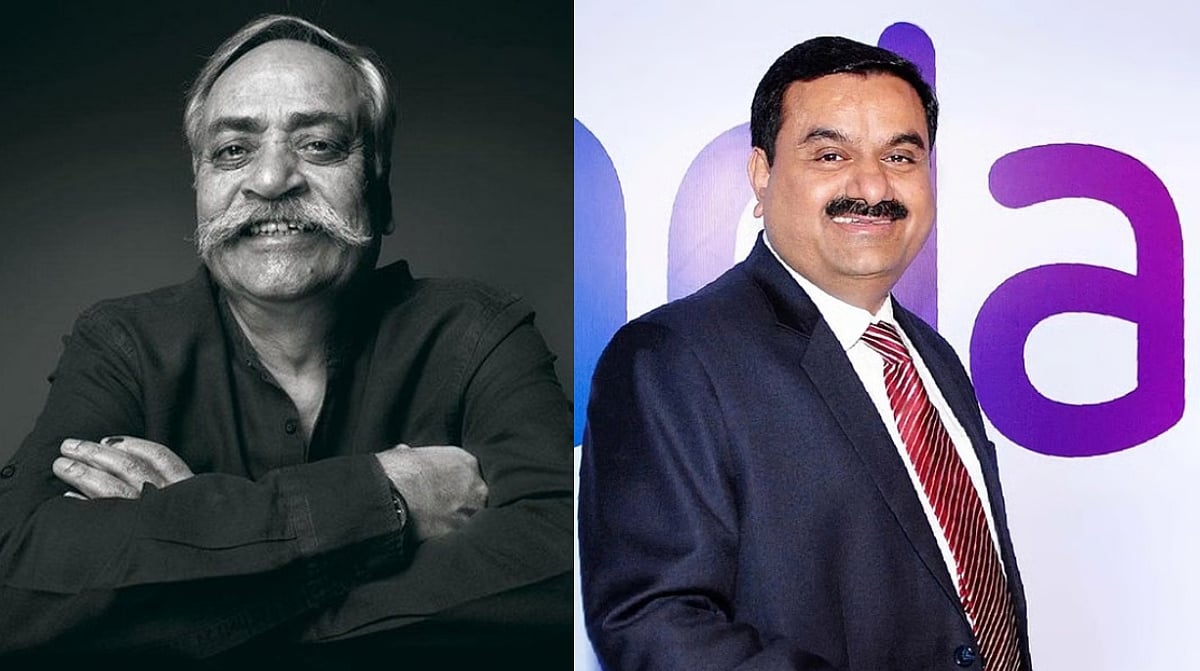

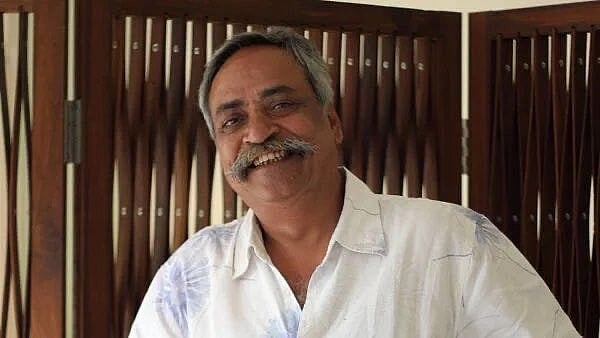

Hyderabad: Satya Santosh, a well-known stock market analyst and wealth guru based in Hyderabad, has been providing in-depth market research and investment advice on various economic and corporate trends. He is a partner in a SEBI-registered advisory firm that provides stock market advice and manages over Rs 100 crore in assets for investors across India. His analyses are followed by over 3000 retail and HNI investors.

Satya Santosh has a proven track record of accurately predicting market trends and developments. He successfully predicted the success of the equity market, the pre-IPO market, global equities, the Twitter deal, real estate trends, and local and international politics. His specialty is pre-IPO market analysis, and he advised pre-IPO stocks Reliance Retail and Tata Technologies in 2019, which returned 300% and 600%. His predictions on IPO listing gains are 90% accurate.

During uncertainty in 2022, he created a model portfolio based on electric and green energy vehicles which did better than the Nifty by 15%, while the Nifty only went up by 5%. True, his FREE EV theme model had outperformed several other Funds and Small cases. His forecasts for Tata Motors in 2020 and 2022 were almost as accurate as his forecasts for M&M that year.

Satya Santosh believes in the active management of several portfolios.

He consistently advises investors to make long-term investments while staying vigilant about regular trends and active fund management.

Investors are able to outperform the market since he actively advises them to spread their funds among different segments and funds.

Satya Santosh is renowned for his forecasts on the Elon Musk-Twitter deal and Tesla trends. He also warned about US markets, particularly FAANG stocks. Recent underperformance by Facebook and Google, as well as the emergence of a new challenge posed by Chat GPT, have validated his predictions about their futures.

The analyst Satya Santosh confirms that Present Volatility will not pose a big threat to the Indian market and that, India will not experience a recession. The inflation issues are currently hindered by a few structural and technical errors, but all is likely to be resolved soon.

Mr. Satya Santosh forecasted in a June 2022 analysis video that inflation would fall from recent high levels beginning in November 2022. The CPI, which measures retail inflation, reached a 1-year low of 5.72% in December 2022, down from 5.88% the previous month. Another side, U.S. inflation dipped to 6.5% in December from 7.1% in November, it's clear that inflation has been gradually decreasing over the past 12 months. The same is documented.

He said,” a recession cannot be predicted based only on the number of layoffs in a few sectors and startups or low-income firms”. He asserts India would not have a recession similar to the 2008's experience. In addition, he asserts that IT jobs will not have the same effect as prior recessions.

When critiquing the market research of other specialists or seasoned professionals, Satya Santosh holds nothing back. Unlike Warren Buffett and Goldman Sachs, he was against the Paytm IPO. Numerous market experts and renowned economists throughout the world agree that a recession on par with 2008's is likely to occur in the year 2022. But Mr. Satya Santosh has stated to his clients and followers that he is optimistic about the Indian economy based on real-time analytical indicators.

He affirms the importance of understanding actual circumstances rather than historical charts or occurrences. At this time, several indicators, including the yield curve and others, will be inaccurate. There are numerous uncertainties right now, but none of them are related to 2008. The average citizen and investor are now well aware of the financial cycles.

With regard to previous rallies or missed opportunities during a crisis or recession, investors typically do not want to sell their assets, such as stocks and real estate, at a loss. India has the highest purchasing power and is more self-sufficient than ever before. People are happy to invest, build, and consume even in rural India. Everything will contribute to India's GDP growth.

At the beginning of the year 2020, he advised investors to put their money into commodities, speculating that silver might offer higher returns than gold. According to the tendency, silver has been performing better than gold in 2020.

In addition to being an expert in stock advisory and business analysis, Santosh is also a political analyst. According to him, understanding politics is essential for investment and company management. In Amaravathi, the capital of Andhra Pradesh, political shifts ruined land prices, and few stocks and their prices were exclusively governed by politics.

With recent trends at the Davos summit and the opinions of prominent financial experts such as IMF’s Gita Gopinath and Nithi Aayog Chairman P Arvind, who are quite optimistic about the Indian economy, it is clear that India would not experience a recession even if the global economy is under attack. Recent trends and updates in inflation rates back up what he said.

He said that on the one hand, it is important to consider long-term growth and how the GDP could increase from $3 trillion to $10 trillion in the next five years and $25 trillion in the next ten to fifteen years, which would result in Indian investors making more money than ever before. He advised to invest for the long term with suitable investments and added that he doesn't want to talk about possibilities or wishes, but he thinks that the current Indian government needs to create a new framework to improve the education and healthcare of the average person and make it easier to collect taxes, which would help Indians overcome their financial problems.

Budget analysis:

In his statement, Satya anticipated that the focus of the 2023 budget will be on increasing capital expenditures and providing more opportunities for economic growth for all Indians. He also highlighted that stock market indexes are expected to rally leading up to and following the budget announcement, with the Nifty index predicted to see a 2-3% increase on budget day. However, he cautioned investors against buying options, as many experienced significant losses last year due to unexpected market movements. Despite potential volatility in the coming months, Satya emphasized that those invested in stocks can still expect to see gains in the year ahead.

"Even Satya Santosh was right 90% of the time, and the only time he was wrong was when he tried to guess when the Russian war would end. When there is war, economies will suffer and there will be a lot of uncertainty for a while.

He still recommends retail investors plan for the long term regarding equities, learn well about investments, and consult with a SEBI-registered advisor for guidance on how to create wealth with equities, rather than relying on emotions and market rumors. Social media tips and unrealistic analyses are discouraged by him.

For more information about Satya Santosh and his predictions