Maruti Suzuki India Limited’s last quarter of Financial Year 2020 results were lower than the street’s estimates. The company posted lower-than-expected margins on account of subdued capacity utilisation and higher discounts. Volumes are expected to remain under pressure in the near term due to weak consumer sentiment and subdued economic activity because of COVID-19. Demand normalisation would take time as the pick-up in economic activity and consumer sentiments would be gradual.

Teji Mandi

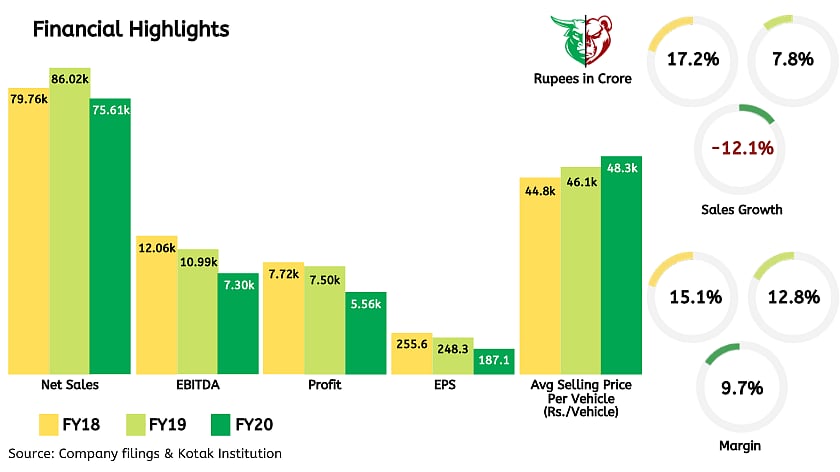

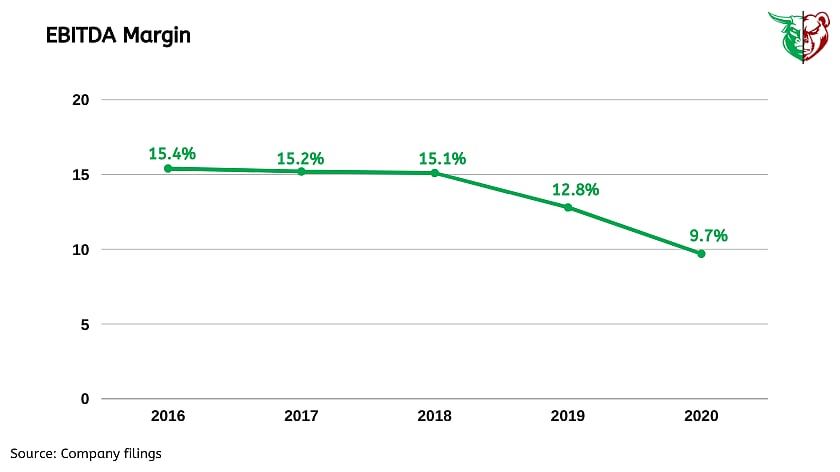

Margins remained under pressure

Maruti Suzuki India's EBITDA Margin fell to 9.7% in the Financial Year 2020 as compared to 12.8% in the last Financial Year 2019. This is due to lower capacity utilization impacting overhead costs, adverse product mix, adverse currency movement (JPY/INR), and weak demand leading to higher discounts. However, the margins are expected to recover once the demand picks up.

Teji Mandi

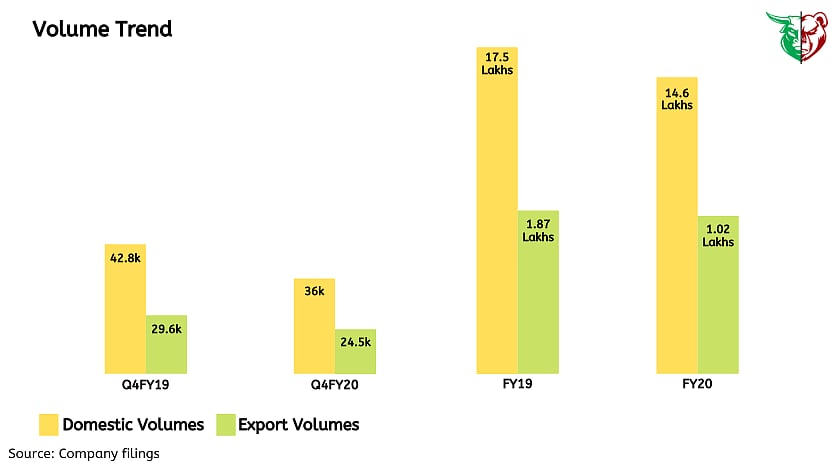

The decline in Domestic and Export volume

In the last quarter of Financial Year 2020, Maruti Suzuki India's domestic volume declined by 16% to 3,60,428 units because of the transition to BS-VI and Covid-19. For Financial Year 2020, domestic volume declined by 16.7% to 14,61,126 units, in line with the industry. 7 of the top 10 selling models for the year belonged to Maruti. In exports, the volume was lower by 16.9% to 24,597 units. Exports for the year declined by 6% to 1,02,171 units. Geopolitical uncertainty and increased protectionism impacted exports during the year.

Teji Mandi

Discount per vehicle

During the quarter, the average discount increased from last year and stood at Rs 19,051 per vehicle against Rs 15,125 per vehicle in the last quarter of the Financial Year 2019 and Rs 33,000 in the third quarter of Financial Year 2020. Management indicated that the supply of vehicles will remain limited for some time till the situation stabilizes and discounts going forward will depend on the market situation and will vary from region to region.

Going digital

Maruti Suzuki India has been working on improving digitalization since last year and has identified that from the time a consumer decides to buy a car to the time it takes delivery, it goes through 28 touch-points. Out of these, 21 touch-points are already digitized and some of the remaining include financing, test drive and delivery of vehicles. Of the remaining touch-points, 4-5 touch-points the company plans to digitize in the near term.

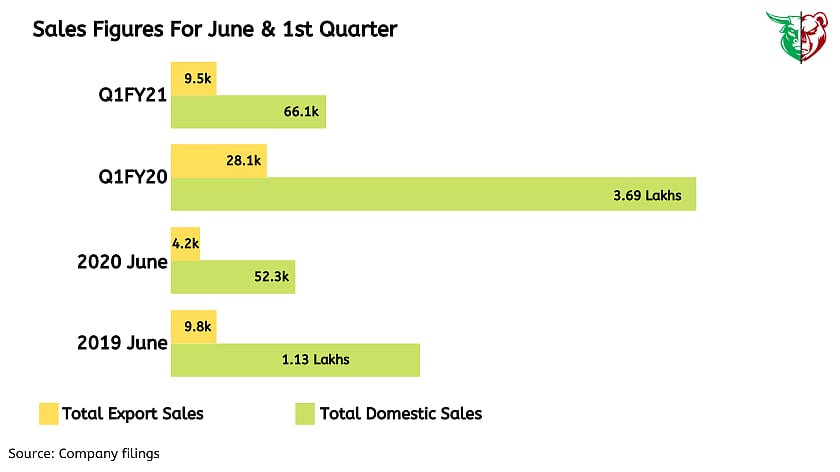

Performance in the first quarter of the Financial Year 2021

Maruti Suzuki posted total sales of 57,428 units in June 2020 (including 52,300 units in the domestic market and 839 units to another OEM). Besides, the company exported 4,289 units in June 2020. With this, the Company closed the first quarter of Financial Year 2021 with total sales of 76,599 units (66,165 units domestic, 862 units to other OEM and 9,572 units exported.)

Teji Mandi

From management's desk

Post the June and the first quarter performance in Financial Year 2021, the management of the country's largest carmaker Maruti Suzuki India said that they are seeing better demand in rural areas due to less number of COVID-19 cases as compared with urban regions which continue to reel under the high number of cases of the infectious disease.

Buying sentiment in rural areas is also better due to the good initial spell of rains in June which has led to a better sowing of the kharif crop. In Maruti, the rural share has gone up to 40 per cent in June which is 1% increase over the last financial year.

Downward factor

The company is exposed to forex risks as raw materials and royalty payment are payable in Yen. So any movement in currency prices can impact margins

The parent company would manufacture and supply products from Maruti's portfolio to Toyota India. This would enhance competition.

Maruti plans to not have a diesel portfolio due to high costs under BS-6. However, if the market continues to prefer diesel vehicles, it could impact the market share.

Teji or Mandi?

As the near term outlook likely to remain impacted due to ongoing COVID pandemic with both demand and supply remaining uncertain. Having said that, our take is Teji owing to 1) Maruti most likely to benefit from trend reversal; 2) Higher rural exposure where; 3) Concerns around diesel addressed through product interventions including hybrid and CNG; and 4) Dealer financials remain healthy.

So despite the challenging market conditions, Maruti Suzuki India will maintain its dominant position in the domestic Passenger Vehicle segment, supported by a large and successful product portfolio, new launches, strong distribution network, and smarter technology.

Teji Mandi is a proactive investment manager for everyone. To read more of our research, please visit https://tejimandi.com/research