Despite the COVID-19 led disruptions, India remains a consumption-driven economy. Its retail industry is currently the 4th largest in the world and is expected to reach USD 1.75 trillion by 2027. Mall culture is an integral part of this story. Hence, their prospects remain bright despite the temporary blip. However, post the first COVID-19 wave, a few dynamics have changed and the industry needs to tackle them.

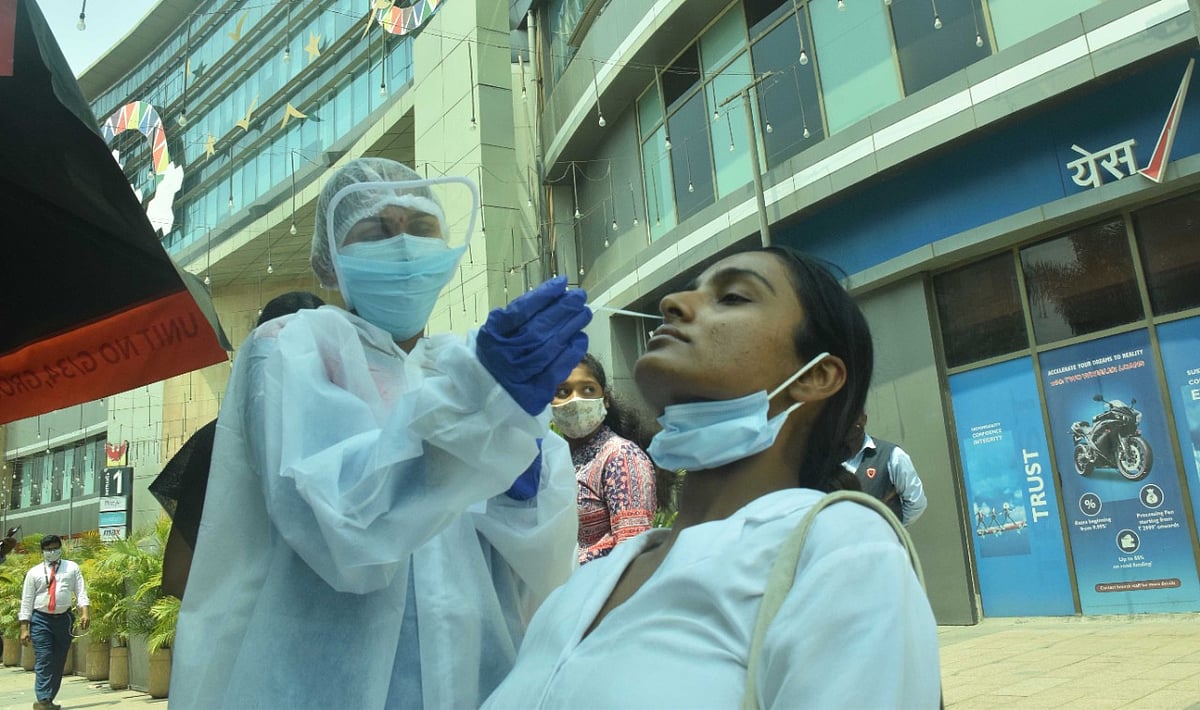

Second COVID-19 Wave Halts Swift Recovery

Retail malls were one of the hardest-hit segments due to the COVID-19 crisis. It led towards the complete closure of malls for a couple of months. However, post reopening around September, recovery was swift. It was supported by pent-up demand and festive season in the third quarter.

According to an Antique research report, better-managed malls by tier-1 players like Phoenix Mills, DLF, Oberoi, and Prestige did significantly better than grade B malls. Their footfalls increased from 10-15% in August to 60- 65% at the end of February. Consumption also reached around 70% of Pre-COVID-19 levels. However, the recovery is stalled now after the emergence of the second wave of COVID-19.

Changing Business Models

Mall management and tenant mix hold the key for any mall to succeed. Under the changed circumstances, mall operators are now forced to re-calibrate their working relationship with tenants.

Mall operators are forced to renegotiate their rental deals with tenants. Most of them have shifted to revenue-sharing rental structures from the fixed rental structure. It was a more convenient option for the mall operators.

The revenue sharing-based rental model was expected to be a stop-gap arrangement. However, with the ongoing second COVID-19 wave, moving back to the old rental structure is not happening anytime soon.

Business Model Facing Disruption

The entire mall concept is based on the idea of catering to the need for socializing. The malls emerged as viable hangout spots. However, growing emphasis on social distancing has brought the whole idea under scrutiny.

Growing trust in e-commerce platforms has also affected the business prospects of malls. The concept of providing a decent hang-out space remains a part of the overall strategy. However, the operators need to take the growing threat because of e-commerce into account and tweak their business model to stay relevant.

Phoenix Mills has recently ventured into this area and launched its digital initiative called ‘Phoenix Enhance’. It is a virtual mall which provides an e-shopping facility to selected retail partners.

Closing Comments

Recent events and their after-effects have put A-listed mall operators in a better position. The players like DLF in North, Forum Malls in the South, Phoenix malls in South and West enjoy better brand equity and financial strength over their B-listed counterparts. Most of these players remain well on track to go ahead with their mall expansion plans, albeit with a temporary delay of a couple of quarters.