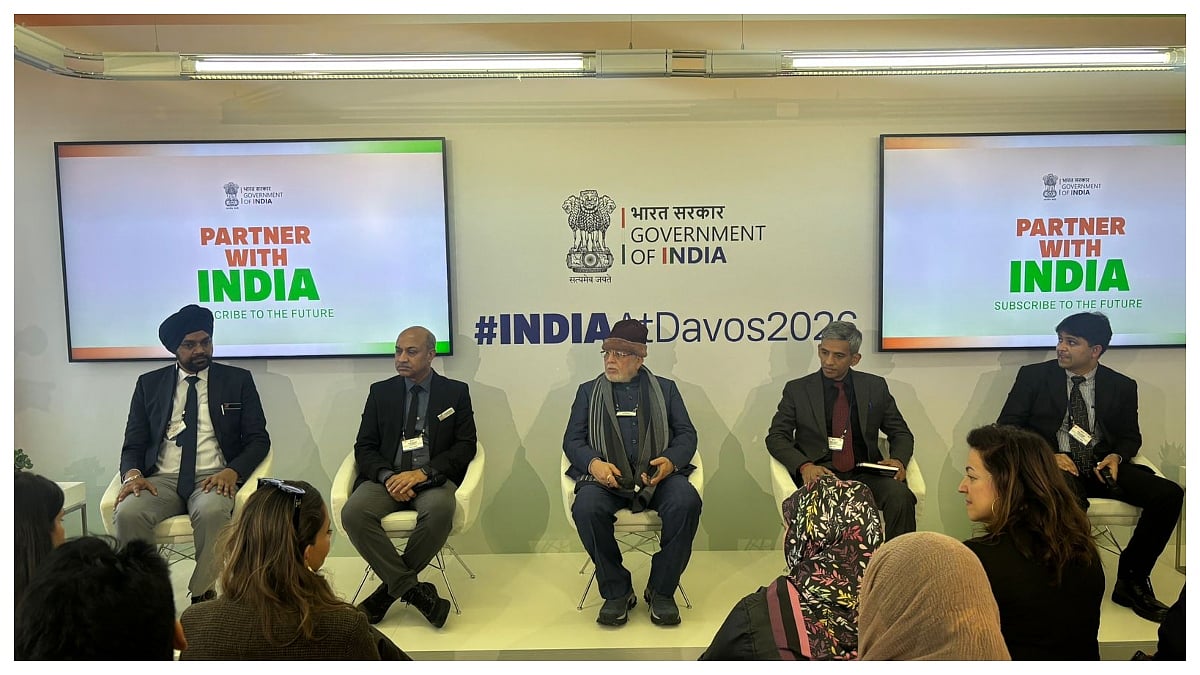

The Central Board of Direct Taxes (CBDT) Chairman, Ravi Agarwal, has urged taxpayers with foreign income or assets to take advantage of the opportunity to rectify any omissions in their income tax returns before December 31.

Speaking at India International Trade Fair (IITF) after the inauguration of Income Tax lounges Agarwal emphasized the department's proactive approach in identifying discrepancies using data received through the Automatic Exchange of Information system.

"We are receiving regular updates on foreign assets and income through this system.This information is meticulously compared with taxpayers' declarations in their income tax returns. This exercise is aimed at informing and sensitizing taxpayers," Agarwal stated.

He added, "If there are gaps in the disclosures, taxpayers can file revised returns to correct these omissions. This window is open until December 31." To assist taxpayers, the department has released detailed guidance notes on relevant tax laws. Agarwal acknowledged that discrepancies often arise from ignorance or a lack of understanding, and this initiative aims to encourage voluntary compliance.

On the broader tax collection front, Agarwal expressed optimism about surpassing the government's ambitious direct tax collection target of Rs22 lakh crore for the current fiscal year.

On the broader tax collection front, Agarwal expressed optimism about surpassing the government's ambitious direct tax collection target of Rs22 lakh crore for the current fiscal year.

"The Rs12 lakh crore collection reflects the progressive policies of the government and the taxpayers' compliance. A growing economy naturally boosts tax collections, and we are witnessing this trend," he noted.

Reflecting on the Income Tax Department's participation in the India International Trade Fair (IITF), Agarwal recalled that it was he, as additional commissioner of income tax, posted in Systems directorate, who first came up with the idea of having a tax payers lounge in the IIFT.

Recalling its humble beginnings 16 years ago, he stated, "In 2008, I started with just three kiosks in a small space," he stated.

He added, "Today, we have a significant presence at the IITF, offering a wide array of taxpayer services under one roof." The transformation, he said, symbolizes the department's commitment to improving taxpayer outreach and accessibility.

"Over the years, the department has evolved to provide services spanning various areas, making compliance easier and more transparent for taxpayers. It has been a remarkable journey," he added.