Tata Power Solar Systems Limited (TPSSL), a leading solar company in India and a wholly-owned subsidiary of Tata Power Renewable Energy Limited (TPREL), has announced the renewal and expansion of its partnership with Union Bank of India (UBI) to offer financing solutions for Residential customers, in-line with the Government's PM Surya Ghar Muft Bijli Yojana as well as for Commercial and Industrial (C&I) customers, the company on Tuesday announced through an exchange filing.

Enhanced Loan Limits

With loan limits extended up to Rs 15 lakh for Residential and Rs 16 crore for C&I customers, the renewed scheme plans to provide financing up to 80 per cent and 85 per cent for the respective categories. Notably, both the categories will have access to collateral-free financing options, making the transition to solar energy more accessible.

Extended Loan Tenure

The loan tenure has also been extended up to 10 years, allowing households and businesses ample time for repayment.

Inclusive Three-Year Agreement

This renewed three-year agreement includes both Residential and C&I segments compared to the earlier one which focused only on C&I segment and resulted in the financing of approximately Rs 165 crore for the segment, the company said in the regulatory filing.

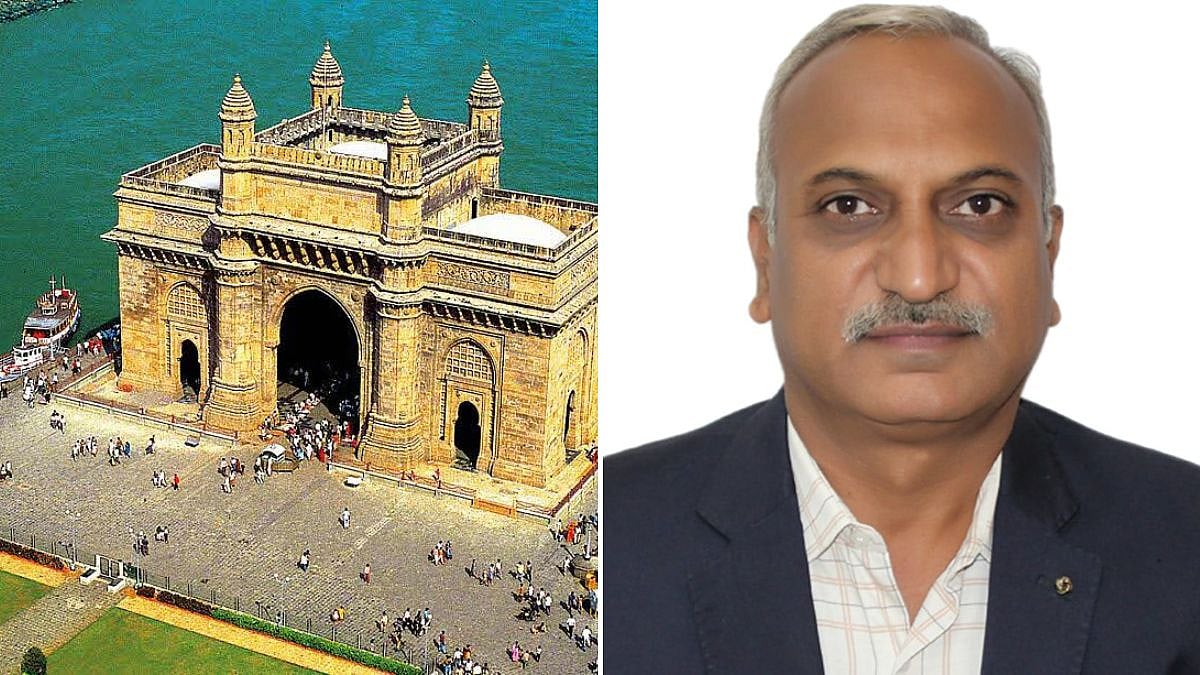

Deepesh Nanda, CEO & Managing Director, Tata Power Renewable Energy Limited, stated, “We are glad to announce the renewal of our association with Union Bank of India by including Residential consumers in our solar financing scheme. We believe that the access to easy financing will mainstream the roof-top solar adoption among the Residential segment in the country and replicate the success of the C&I segment as witnessed in our first phase of association."

The initiative by TPSSL and UBI is well aligned with the recently launched Government scheme PM-Surya Ghar Muft Bijli Yojana. As part of this collaboration, a special scheme under the extended agreement has been introduced, specifically tailored for Residential customers. The aim of this initiative is to improve accessibility and affordability for a wider audience, thereby making a significant contribution to the widespread adoption of solar solutions.