The Indian markets, after giving a promising start, quickly slumped in deep red. Some of the individual shares that have contributed to this decrease in overall value are Tata Motors.

The stock price of the automobile wing of the conglomerate declined in value after its disappointing showing in the monthly auto sales results.

Tata Motors Monthly Sales Decline

The company came in third behind its rival Mahindra & Mahindra. The Mumbai-based Tata Motors sold a total of 79,344 units compared to 86,406 last year, marking a year-over-year decline in total sales numbers.

These sales numbers fell behind Mahindra's 83,702 units, that were sold in the same period, ie February 2025. This marked a 15 per cent jump in its monthly sales compared to last year.

Total passenger vehicle sales also saw a drop in their sales number, as the company managed to sell 46,811 units of passenger vehicles, much lower than the previous year's 51,321. | File/ Representative image

Drop Across All Segements

Tata Motors sold a total of 32,533 units in the commercial vehicles segment, lower than last year's 35,085 units.

Total passenger vehicle sales also saw a drop in their sales number, as the company managed to sell 46,811 units of passenger vehicles, much lower than the previous year's 51,321.

There was an even bigger 23 per cent drop in the sale of EVs, as Tata Motors sold 5,343 units in the previous month, compared to 6,923 units in February 2024.

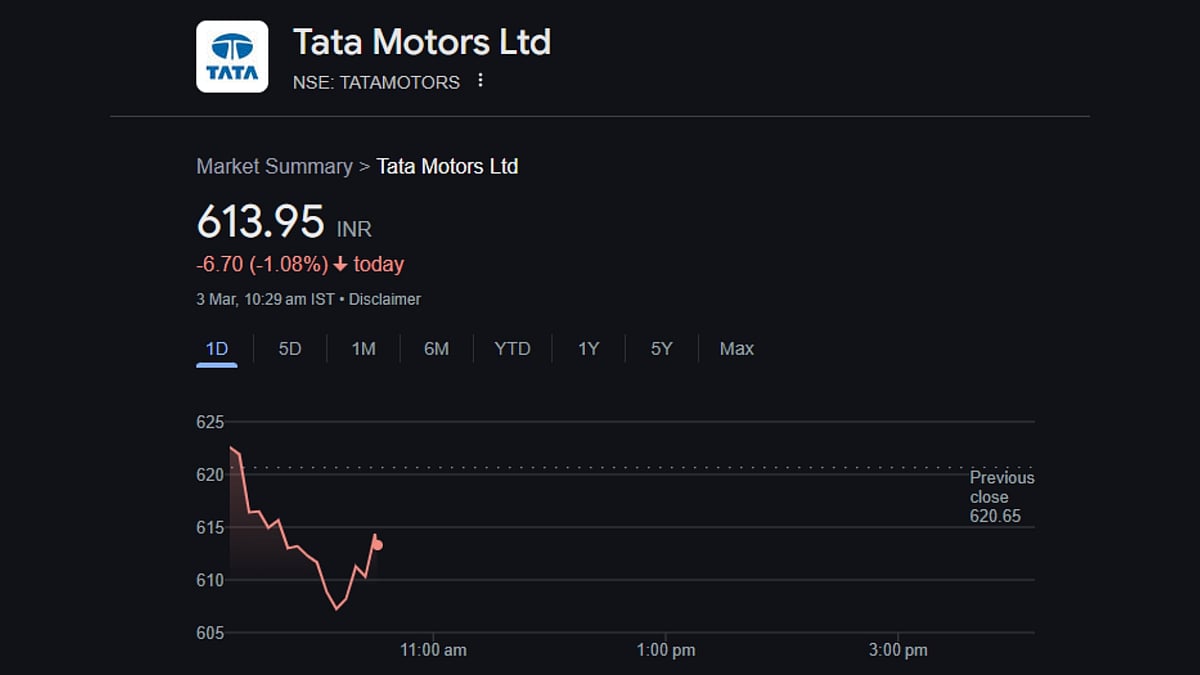

Tata Motors Shares

When we take a close look at the company shares, the value of Tata Motors shares dipped by over 2 per cent in the early hours of the intraday trade, However, the company shares appear to have managed to gird the loins on the losses.

At the time of writing, the said overall decline decreased, while continuing to trade in red.

At the time of writing, the company shares' slump stood at 1.08 per cent or Rs 6.70. This took the overall value of the Tata Motors shares to Rs 613.95 per piece. The stock's 52 week-high stands at Rs 1,179.00 per share. The overall losses in the past 5 trading sessions now amount to over 8 per cent.