After Shapoorji Pallonji (SP) Group blamed Tata Sons for jeopardising its fund raising plan, the board of Tata Sons denied any such intention. According to Livemint, the board of Tata Sons stated that it has not deliberately kept an ‘urgent application’ to the Supreme Court on hold.

Tata Sons in its reply on Friday said “the allegation that the listing of the application was somehow deliberately delayed is false and unfortunate and has been made without adequate inquiry in the court registry".

It said Tata Sons’ urgent application raises real concerns that SP Group will take steps to “frustrate the legal processes".

As of September 15, Shapoorji Pallonji sent a legal notice to Tatas seeking unquantifiable damages against the board of Tata Sons. This is after Tatas went to Supreme Court seeking the court’s help in blocking Mistry’s fundraising against the shares of Tata Sons.

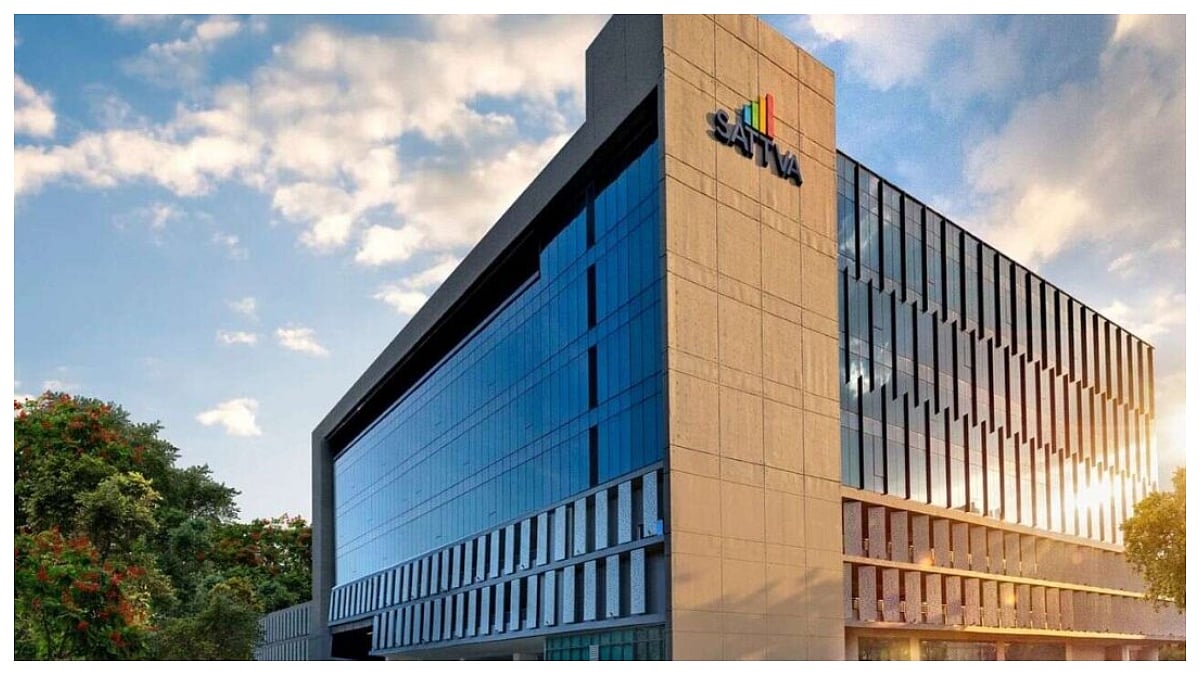

During the COVID-19 pandemic, the Shapoorji Pallonji Group’s real estate and infrastructure businesses are under financial stress. To get some relief, the group was looking at opting for fundraising by pledging shares in Tata Sons.

The group has an 18.4 per cent shareholding in Tata Sons through its two investment firms, Cyrus Investments and Sterling Investments.

Tata Sons‘ application before the court argues that the board of Tata Sons has the first right to buy the shares, under the company’s Articles of Association (AoA).