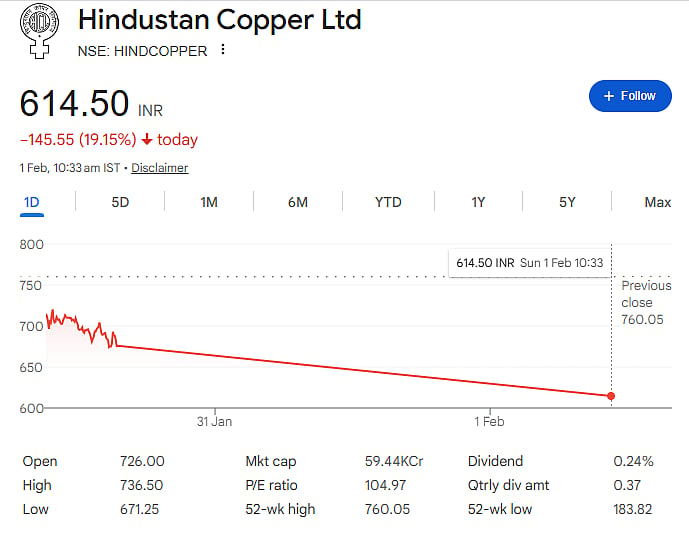

Mumbai: After a record one-day fall in global silver prices on Friday, shares of Hindustan Zinc Ltd. witnessed heavy selling in the stock market.

The company, which is a subsidiary of Vedanta Ltd., saw its shares fall another 10 percent on Sunday, February 1, hitting the lower circuit. With this, the stock has dropped nearly 20 percent over the last two trading sessions. This sharp fall has wiped out around Rs 60,000 crore from the company’s market capitalisation.

What Happened on Friday?

The fall in silver prices started during Indian trading hours on Friday. However, after Indian markets closed, global selling in silver became even stronger.

On Friday alone, Hindustan Zinc shares fell 12.5 percent, marking their biggest single-day fall since January 2008. On that day, the company lost nearly Rs 36,000 crore in market value.

Before this sharp correction, Hindustan Zinc was the most valued metal company in India, with a market capitalisation above Rs 3 lakh crore. It is also India’s only listed company that gives direct exposure to silver.

Q3 Performance and Silver Realisation

In the third quarter of the financial year, Hindustan Zinc had again become net cash positive. Due to the earlier rise in silver prices, expectations were high that the fourth quarter would be even stronger.

During the December quarter, the company reported silver net realisation of $54.7 per ounce, much higher than $31.4 per ounce in the same quarter last year. This strong price performance had supported the stock rally before the recent crash.

Leverage and Margin Trading Data

In the last two months, Hindustan Zinc shares had almost doubled, mainly due to the sharp rise in silver prices. Along with this rally, leveraged positions in the stock also increased strongly.

According to data from the National Stock Exchange of India, margin trading positions in Hindustan Zinc reached Rs 763.6 crore as of January 29. This is a 97 percent jump from Rs 387 crore on December 1. High leverage means that many investors were using borrowed money, which increases risk during sharp price falls.

Vedanta’s OFS Adds to Pressure

Recently, Vedanta sold up to 1.1 percent stake in Hindustan Zinc through an Offer for Sale (OFS), raising around Rs 3,300 crore. After Friday’s crash, Hindustan Zinc shares slipped below both the OFS indicative price and the floor price, adding further pressure on the stock.

On Sunday, the stock fell to around Rs 565. Along with Vedanta, Hindustan Zinc contributed nearly 56 percent to the Rs 1.25 lakh crore market value loss in the Nifty Metal Index on Friday.

Disclaimer: This article is for information only and does not constitute investment advice. Stock prices are subject to market risks. Investors should consult certified financial advisors before making any investment decisions.