Key Highlights:

- Sensex dropped 542 points; Nifty lost nearly 158 points amid profit-taking and foreign fund outflows.

- Blue-chip stocks including Reliance, Infosys, and Bajaj Finserv led the decline.

- India-UK sign landmark Free Trade Agreement; to enhance exports and reduce tariffs on whisky, cars.

Mumbai: After a strong opening, Indian equity benchmarks reversed gains to end sharply lower on Thursday. The BSE Sensex declined 542.47 points or 0.66 per cent to close at 82,184.17. It had earlier plunged as much as 679.42 points to 82,047.22 during intraday trade. The NSE Nifty too fell 157.80 points or 0.63 per cent to settle at 25,062.10.

The slide came after a rally on Wednesday, where the Sensex had risen 539.83 points and the Nifty gained 159 points.

Blue-Chips Lead the Fall

The selloff was primarily driven by profit-taking in heavyweight stocks. Among the top losers were Trent, Tech Mahindra, Bajaj Finserv, Reliance Industries, Infosys, Kotak Mahindra Bank, HCL Technologies, and NTPC. Infosys shed over 1 per cent post its June quarter results as investors booked profits.

On the other hand, select stocks like Eternal, Tata Motors, Sun Pharma, Tata Steel, and Titan managed to post gains, offering some support to the indices.

Foreign Outflows Pressure Sentiment

Sustained selling by Foreign Institutional Investors (FIIs) further pressured domestic markets. FIIs offloaded equities worth Rs 4,209.11 crore on Wednesday, according to exchange data. In contrast, Domestic Institutional Investors (DIIs) remained net buyers, investing Rs 4,358.52 crore.

Positive Global Cues Ignored

Despite positive cues from Asian and European markets, as well as Wall Street’s overnight gains, Indian equities could not hold on to early optimism. Most Asian indices, including Japan’s Nikkei, South Korea’s Kospi, Shanghai Composite, and Hong Kong’s Hang Seng ended higher.

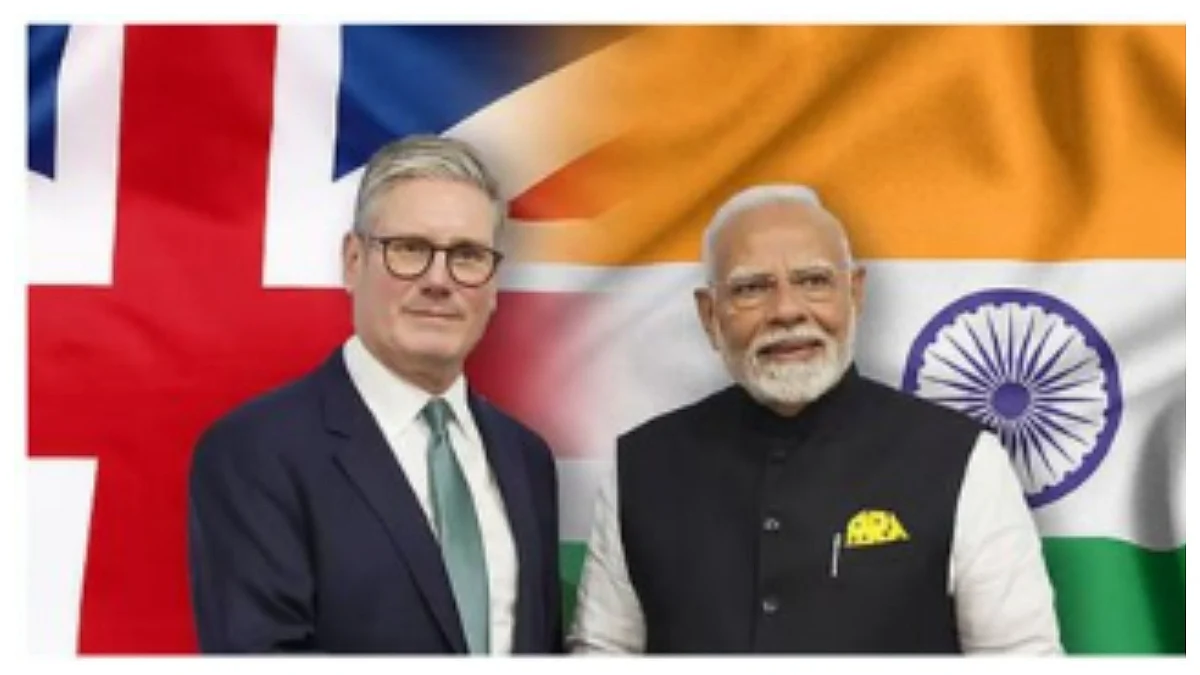

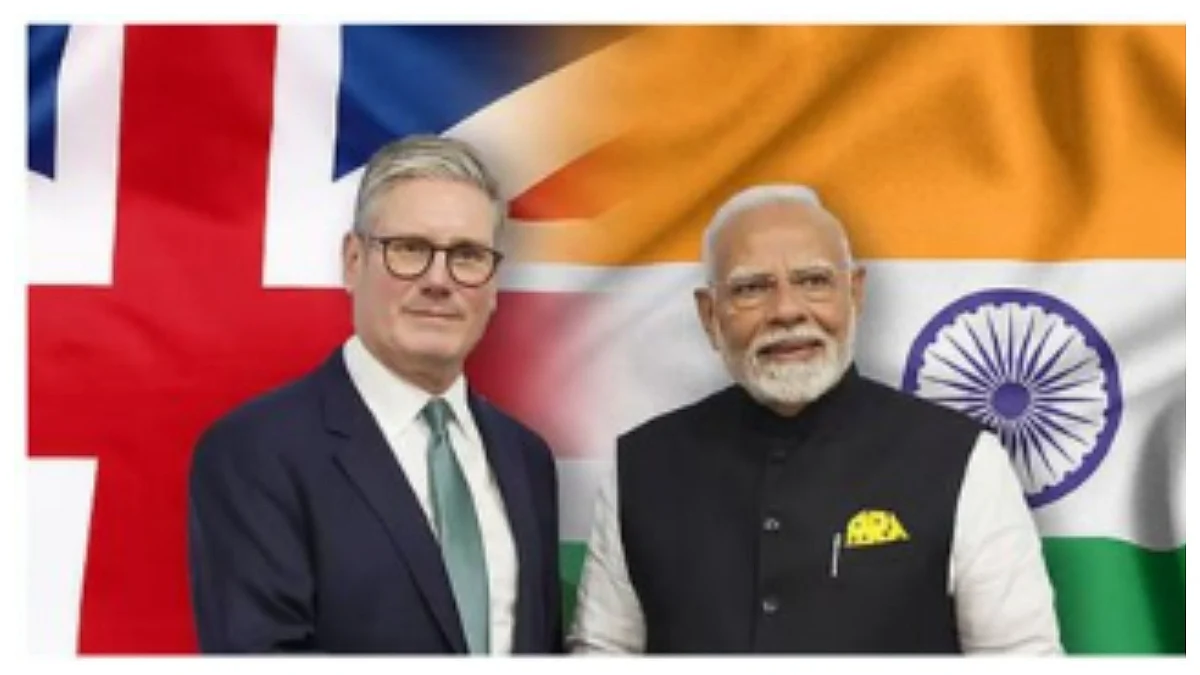

Indo-UK FTA Signed, Trade Boost Expected

In a significant development, India and the UK signed a landmark Free Trade Agreement (FTA) aimed at cutting tariffs and boosting bilateral trade by USD 34 billion annually. The deal will eliminate duties on 99 per cent of Indian exports and facilitate British exports of whisky, automobiles, and other goods.

Commerce Minister Piyush Goyal and UK’s Jonathan Reynold signed the agreement in the presence of Prime Ministers Narendra Modi and Keir Starmer.

(With PTI Inputs)