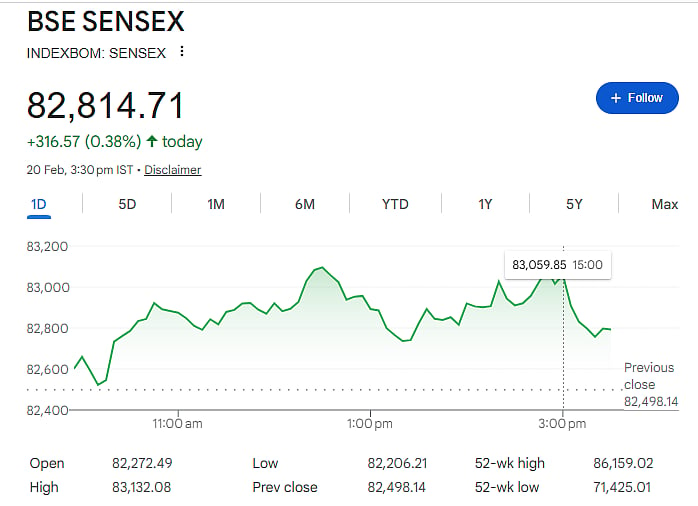

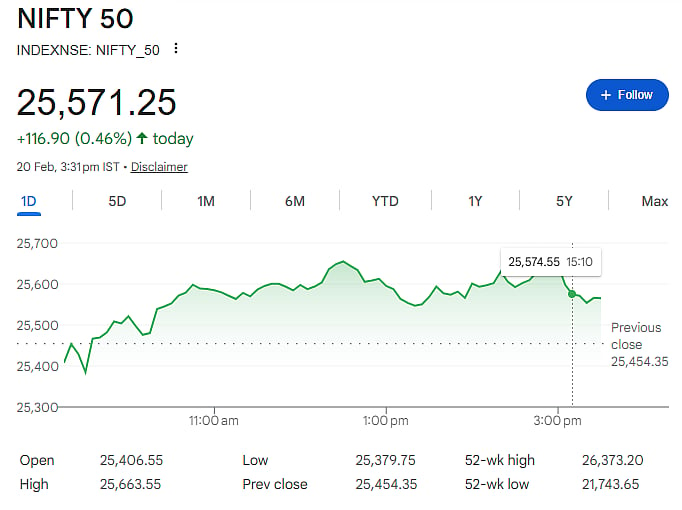

Mumbai: Indian stock markets ended Friday on a strong note. The Sensex gained 316 points, or 0.38 percent, to close at 82,814. The Nifty rose 116 points, or 0.46 percent, finishing at 25,571.

The rally was mainly driven by metal and PSU bank stocks. Buying interest improved as the day progressed, helping markets recover from a weak and volatile start.

Sector Performance

Most sector indices closed in the green. PSU banks were the top performers, rising 1.68 percent. Metal stocks also saw strong buying and gained 1.25 percent.

Other sectors such as power, capital goods and FMCG witnessed steady buying during the session.

However, not all sectors performed well. Nifty IT was the biggest loser, falling 0.98 percent. The media index also slipped 0.28 percent.

Midcaps and Smallcaps

The broader market showed mixed trends. The Nifty Midcap 100 rose 0.48 percent, in line with the benchmark indices. The Nifty Next50 gained 0.62 percent.

However, the NSE Smallcap 100 index slipped 0.11 percent.

Market breadth was slightly negative. Around 2,043 stocks advanced, while 2,511 stocks declined. This shows that even though the main indices rose, many stocks ended lower.

Rupee and Bank Nifty

The Indian rupee traded slightly stronger during the day. It gained 0.02 percent to trade at 90.99 against the US dollar.

Bank Nifty also saw a strong rebound. It stayed above the 61,200 level, which analysts see as a positive sign. The 61,000 level is now viewed as key support, while 61,350–61,400 is considered immediate resistance.

Caution Remains

Analysts said investors bought quality stocks at lower levels, helping the market recover from early losses. However, some caution remains due to ongoing US–Iran geopolitical tensions and mixed global signals.

Overall, the market continues to trade within a range, waiting for clearer global and domestic triggers.