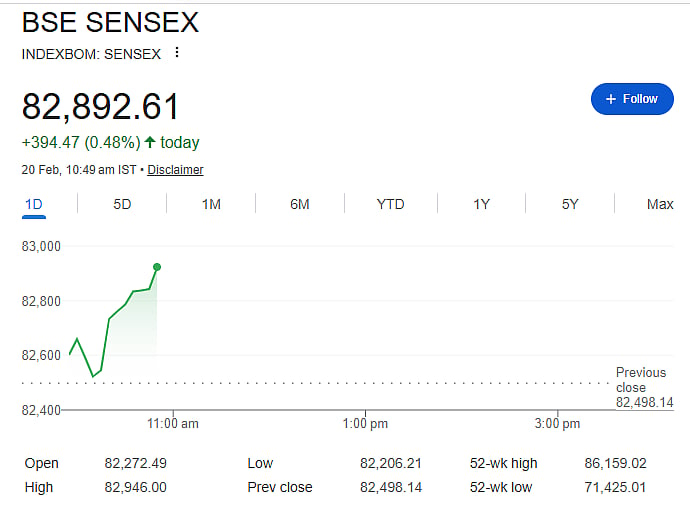

Mumbai: Indian stock markets recovered sharply on February 20 after a weak opening. The Sensex bounced nearly 700 points from its intraday low of 82,206. At 10:42 am, the Sensex was up 409.99 points or 0.5 percent at 82,908.13.

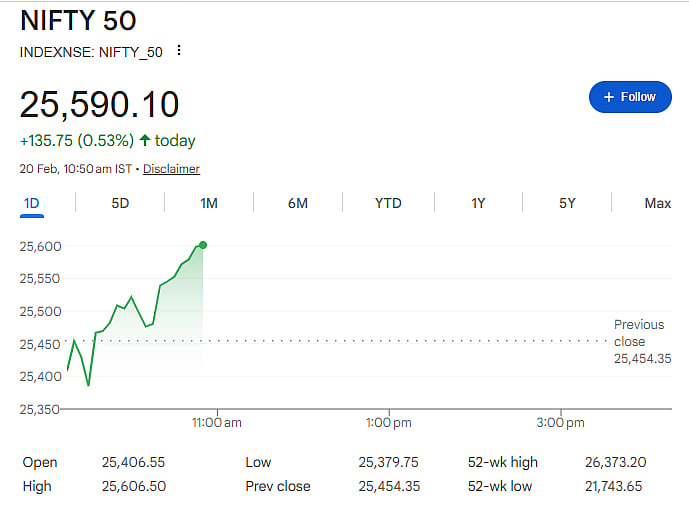

The Nifty also climbed from its day’s low of 25,379.75 and was trading near the key 25,600 level. It was up 138.30 points or 0.54 percent at 25,592.65.

Market breadth was positive. Around 1,831 shares advanced, 1,573 declined and 179 remained unchanged.

Value Buying After Recent Fall

One key reason for the recovery was value buying. Markets had fallen nearly 1.5 percent in the previous session. Investors used the dip to buy quality stocks at lower prices.

Among top gainers in the Nifty 50 were state-run companies like Coal India, Bharat Electronics and Oil and Natural Gas Corporation, each rising about 2 percent.

Other major stocks such as Titan, Larsen & Toubro, Hindustan Unilever, Hindalco Industries and NTPC gained nearly 1 percent.

IT stocks remained under pressure. Infosys, Tech Mahindra, Wipro and HCL Technologies fell between 0.4 percent and 1 percent. Shares of Tata Consultancy Services opened lower but later recovered and traded 0.4 percent higher.

Stock-Specific Moves

ABB India was the top gainer in the Nifty 200 index, rising more than 4 percent. The company reported nearly 6 percent growth in revenue to Rs 3,560 crore in the December quarter. However, its net profit fell 18 percent year-on-year to Rs 433 crore.

On the other hand, Godfrey Phillips India was the worst-performing stock on the index, falling over 4 percent.

Positive Global Signals

Global cues also supported the recovery. Wall Street futures were trading slightly higher.

However, markets remain cautious after US President Donald Trump warned Iran to reach a nuclear deal within 10 to 15 days. Any tension involving Iran could disrupt oil supplies through the Strait of Hormuz, which is important for India as it imports large amounts of crude oil.

Experts expect markets to stay cautious in the short term due to geopolitical risks.