Mumbai: Indian stock market benchmarks Sensex and Nifty closed marginally lower on Wednesday as selling pressure in select sectors pulled the indices down. Investor activity remained limited, with many choosing to stay cautious ahead of the Christmas holiday on Thursday.

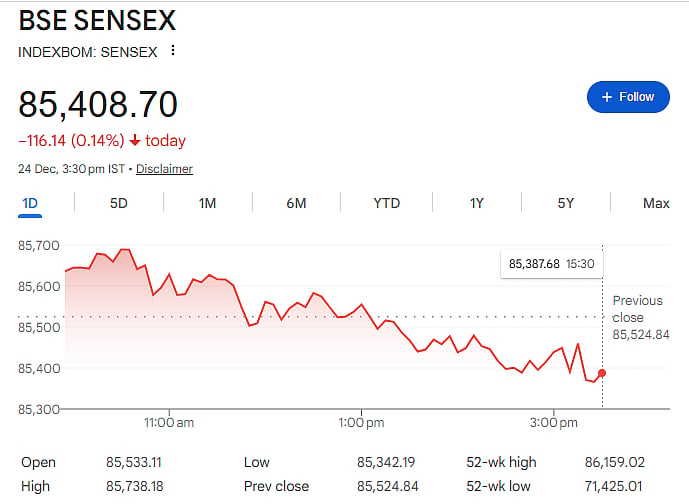

The Sensex ended the session at 85,408.70, down 116.14 points or 0.14 percent. The Nifty also slipped, closing at 26,142.10, losing 35.05 points or 0.13 percent compared to the previous session.

Cautious Mood Limits Recovery

Market experts said the Nifty moved close to the 26,100-26,130 support zone during the session. While some buying interest was seen at these levels, it was not strong enough to push the index higher.

Analysts added that unless the Nifty moves clearly above the 26,200 mark, the short-term outlook remains cautious. There are still chances of further downside, with support seen near 26,100 or even lower levels.

Winners and Losers on Sensex

On the BSE, shares of Trent, UltraTech Cement and Maruti Suzuki ended higher. These stocks saw selective buying, which helped limit the overall market fall.

However, losses in Tata Motors’ passenger vehicle business, Sun Pharma and Asian Paints weighed on the Sensex and dragged the index lower by the end of the session.

Performance on the NSE

On the NSE, Trent, Shriram Finance and Apollo Hospitals were among the better-performing stocks and closed with gains. On the other hand, IndiGo and Dr Reddy’s Laboratories declined and put pressure on the broader market.

Mixed Trend in Broader Market

The broader market showed mixed performance. The Nifty SmallCap 100 index rose by 0.28 percent, indicating buying interest in select smaller stocks. In contrast, the Nifty MidCap 100 index fell by 0.60 percent.

Among sectors, Nifty Oil and Gas was the worst performer, declining 0.76 percent. Nifty Metal and Pharma indices also fell 0.51 percent each. Nifty Media rose 0.44 percent, while Realty and Metal indices closed with modest gains.

Outlook Remains Subdued

Market analysts said trading remained range-bound as investors stayed on the sidelines due to the holiday. Going forward, market activity is expected to remain muted, though investors will keep an eye on global trade-related developments.