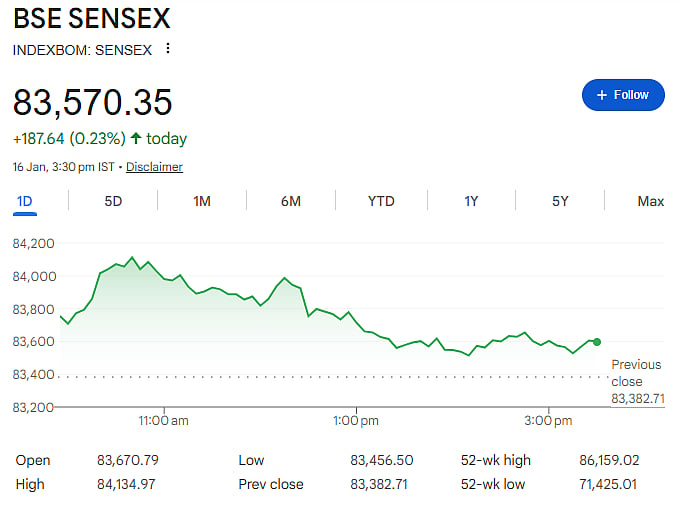

Mumbai: Indian equity markets ended the week on a positive note, though most of the day’s gains were trimmed in the afternoon due to profit booking. The Sensex rose 187 points, or 0.23 per cent, to close at 83,570. The Nifty added 28 points, or 0.11 per cent, settling at 25,694.

Both indices moved higher during the morning session but failed to hold on to stronger levels as investors chose to lock in profits after recent gains.

Broader markets remain under pressure

The broader market performance was muted. The Nifty Midcap 100 index slipped 0.07 per cent, while the NSE Smallcap 100 fell 0.34 per cent. This shows that buying interest remained largely limited to select large-cap stocks, while mid- and small-cap shares faced selling pressure.

Market participants stayed cautious in the broader space amid valuation concerns and uncertain global cues.

IT stocks shine on strong earnings

The Nifty opened flat but moved sharply higher during the day, touching an intraday high of 25,873. The rise was driven mainly by a strong rally in IT stocks after better-than-expected December quarter results.

The Nifty IT index jumped 3.34 per cent, making it the best-performing sector. Analysts said the rally was supported by higher revenue growth guidance from a major IT company and hopes of increased technology spending by global clients.

Banks support the rally

Banking stocks also performed well. The Nifty Bank index rose around 0.84 per cent to close near 60,082, moving closer to a fresh record high. Early quarterly results showed better asset quality and stable margins, which improved investor confidence in the sector.

Realty stocks also ended the day in positive territory.

Pharma, consumer stocks drag

On the downside, Nifty Pharma fell 1.30 per cent and consumer durables declined 1.15 per cent, as investors shifted money away from defensive sectors.

Outlook remains cautious

In the derivatives market, advances slightly outnumbered declines. Analysts believe strong Q3 FY26 results could drive stock-specific action, but foreign institutional selling may continue in the near term.