Mumbai: India’s benchmark indices ended lower for the second straight session on Tuesday, as heavyweights Reliance Industries and HDFC Bank led losses amid renewed US tariff threats and softening domestic service sector data.

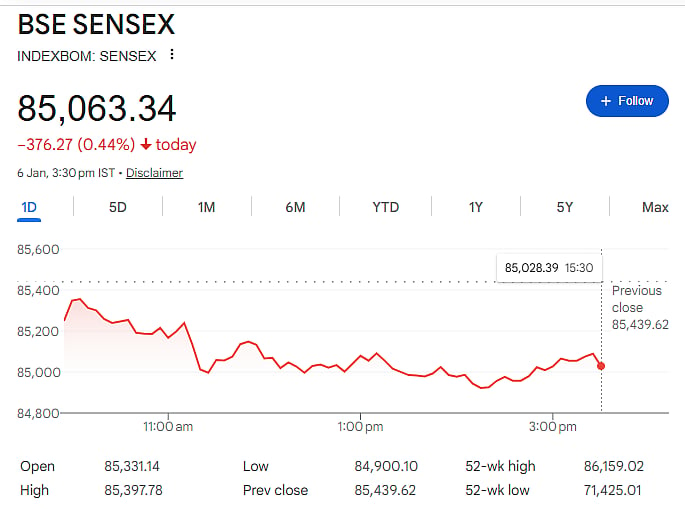

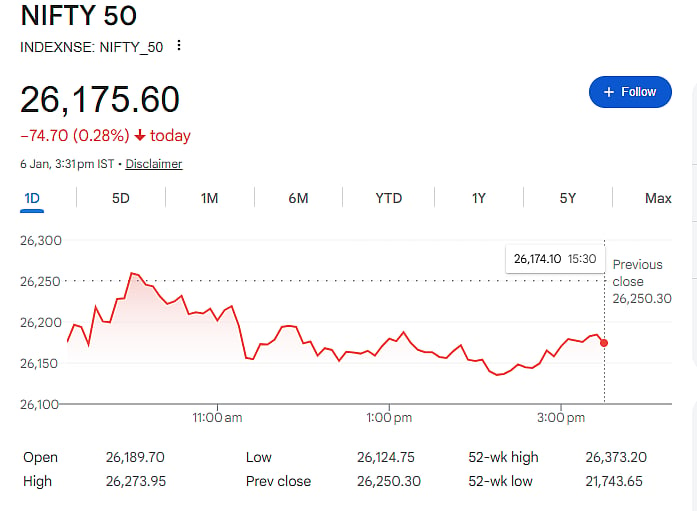

Investors faced another rough day as concerns mounted over US trade policy and sluggish domestic services growth. The Sensex fell 376.28 points to 85,063.34, while the Nifty slipped 71.60 points to 26,178.70.

Blue-chips slide sharply

Reliance Industries was among the steepest losers, dropping 4.42 percent, while HDFC Bank and ITC also pulled down the indices. Trent plunged 8.62 percent after its quarterly update disappointed. InterGlobe Aviation and Kotak Mahindra Bank added to the downside, erasing early gains.

Mixed cues from foreign flows

Foreign institutional investors turned net sellers again, offloading Rs 36.25 crore in equities on Monday, after a brief pause. Domestic institutional investors, however, bought Rs 1,764.07 crore worth of shares, helping to cushion some of the losses.

US warning rattles sentiment

US President Donald Trump’s comments over the weekend stirred unease, after he warned that tariffs on India could be raised 'very quickly' due to its continued imports of Russian oil. Trump, speaking aboard Air Force One, said Prime Minister Narendra Modi was aware of his dissatisfaction.

Services data points to slowdown

Domestic concerns deepened after the HSBC India Services PMI fell to 58.0 in December from 59.8 in November-the slowest expansion since January. Companies reported weaker new orders and output, and hiring remained flat. Business confidence also dipped to a three-and-a-half-year low, according to the survey.

Outlook remains cautious

Despite upbeat trends in Asian markets-with gains in Japan, South Korea, China, and Hong Kong-India’s equity market showed signs of strain. With global headwinds building and domestic growth moderating, traders may remain cautious in the near term.

Analysts expect further volatility ahead, with geopolitical risks and macroeconomic data likely to shape investor mood in the coming days.