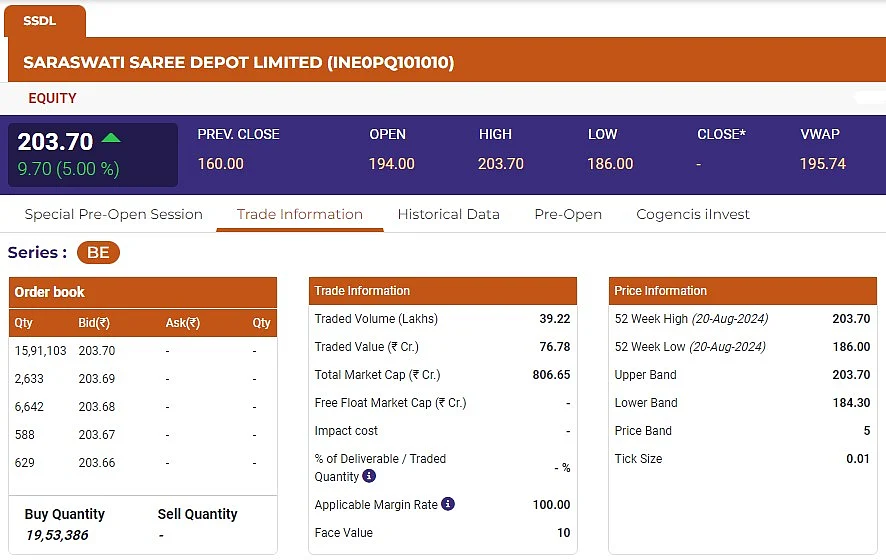

Saraswati Saree Depot Ltd. made headlines when its shares listed at Rs. 194, which was 21 per cent more than the Rs. 160 issue price.

The stock opened at Rs. 194.00 per share on the National Stock Exchange. Touching a day high price of Rs 203.70 per share, the stock hit an upper circuit of 5 per cent after a bumper debut on the Indian Stock Exchanges with over a 21 per cent premium on the issue price.

IPO details

The Rs 160.01 crore IPO was made up of an offer to sell 35 lakh shares, worth Rs 56.02 crore, and a new issue of 65 lakh shares, worth a total of Rs 104 crore. The price range for shares at Saraswati Saree Depot was set at Rs 152–Rs 160.

The allotment was finalised on August 16th, after the IPO bidding had opened on August 12 and ended on August 14. Unistone Capital Pvt Ltd served as the issue's lead manager, and Bigshare Services Pvt Ltd served as the registrar.

Total subscription received

By the time the IPO closed on August 14, it had been subscribed to 107.39 times. In the retail category, the public issue was subscribed 61.6 times, in the QIB category, 64.1 times, and in the NII category, 358.5 times.

Company's earnings

The company's revenue climbed from Rs 603.52 crore in FY23 to Rs 612.58 crore in FY24, a gain of more than 1 per cent. The company's profit-after-tax (PAT) climbed from Rs 22.97 crore in FY23 to Rs 29.53 crore in FY24, a gain of more than 28 per cent.

From Rs 35.38 crore in FY23 to Rs 64.91 crore in FY24, the apparel manufacturer's net worth increased by more than 83 per cent.

Company's top revenue stream

Saraswati Saree Depot has established itself as a leader in the production and distribution of women's clothing. Although the company's sarees are its best-known product and generate over 90 per cent of its revenue,