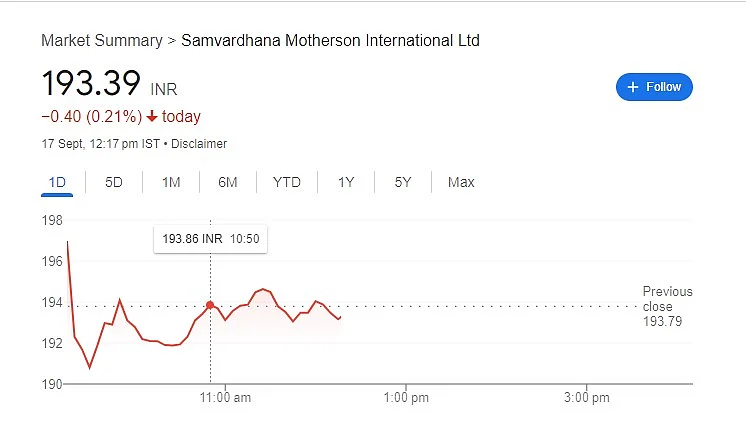

Samvardhana Motherson, a multinational automotive component manufacturer with headquarters in Noida, began accepting qualified institutional placements (QIPs) in order to raise capital. There will be a 5 per cent dilution of the total equity due to the Rs 6,398.6 crore equity issue, according to reports, on Monday, September 16.

The QIP floor price, which is 2.6 per cent less than Monday's closing price, has been set at Rs 188.85. The company's shares were trading on the NSE for Rs 192.70 a share, 0.54 per cent lower at 11.58 am.

11 per cent stake in Israel's REE Automotive Ltd.

The auto components giant announced on Monday that, in addition to this QIB, it will pay up to USD 15 million to purchase an 11 per cent share in Israel's REE Automotive Ltd.

Through its wholly-owned subsidiary MSSL Consolidated Inc., Samvardhana Motherson International Ltd. (SAMIL) intends to subscribe up to 36,39,010 Class A ordinary shares of REE Automotive Ltd.

In a regulatory filing, the company stated that at a price of USD 4.122 per share, it translates to a fully diluted 11 per cent shareholding in REE Automotive Ltd.

It further stated that REE is an automotive technology company that designs, develops, and integrates different vehicle components into a module and a whole modular platform intended exclusively for commercial electric vehicles.

What is QIB (Qualified Institutional Buyer)?

Qualified Institutional Buyers (QIBs) are qualified institutional buyers who can purchase stocks or other equity convertible securities from listed companies in order to raise capital.

On May 8, 2006, the capital market regulator Securities and Exchange Board of India (SEBI) launched Qualified Institutional Placement (QIP) to assist Indian businesses in obtaining funding from local markets. Reducing the companies' reliance on foreign funding sources was the aim.

Qualified institutional buyers, also known as QIBs, are large, seasoned investors who possess the resources and in-depth knowledge necessary to make informed investing decisions. Banks, insurance companies, mutual funds, and pension funds are a few instances of QIBs.

Company financials Q1 FY25

In the first quarter that ended on June 30, 2024, the company reported a 69.3 per cent increase in consolidated net profit at Rs 1,097.18 crore, primarily due to robust revenue growth. In the same fiscal quarter prior, it reported a profit of Rs 648.12 crore.

In comparison to the same period last year, when it was Rs 22,462.18 crore, the total revenue from operations for the quarter under review was Rs 28,867.96 crore. According to Samvardhana Motherson, total spending in the first quarter was Rs 27,601.7 crore, up from Rs 21,629.09 crore in the same period the previous year.