We work to spend, but we also work to save for life's significant milestones, such as our children's further education, post-retirement plans, buying a house, etc. A salary of 15 lakhs per annum might seem to be enough to fulfill your life goals, but with taxes in the mix, that is not always the case. So, you might naturally think of finding a way to lower your taxes, which might lead you to tax-saving investments like life insurance in, NPS, PPF, etc.

But is it the best way to go about it? Or should you just choose the new tax regime for the lower tax brackets? With savings and investment plans widely available, the outcome is dependent on salary deductions and exemptions permitted under both tax regimes - to plan for the minimal tax deduction of Rs. 15 lakhs.

The following article will answer your questions about which tax regime is best for a salary of Rs. 15 lakhs and how to save tax liabilities on a salary of Rs. 15 lakhs.

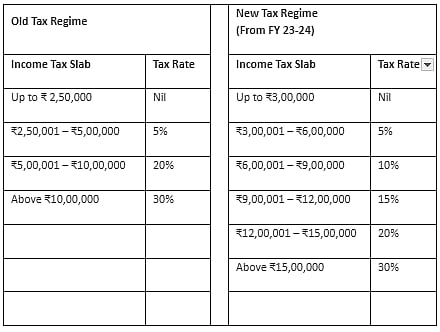

What are the Tax Slabs Under the Old and the New Tax Regimes?

The old regime allowed for various deductions that the new regime does not. However, the new regime's tax rates are lower than those of the previous system. Let's take a look:

For the sake of simple comparison, we will take the tax rates of the new tax regime at face value and then apply all possible deductions under the old tax regime to compare the total tax liability under both. All of the deductions in this article are only accessible under the old regime.

Methods to reduce taxes on a 15-lakh income under the old tax regime

Several components of your wage structure are free from taxes. The net taxable income on your pay can be calculated as follows:

Salary (-) Exemptions = Taxable Salary Income

Taxable Salary Income (-) Deductions = Net taxable income.

If you belong to the tax slab above 15 lakhs, you can avail tax deductions from the following:

1. Exemptions

The CTC will provide you with the salary structure, which will normally look like:

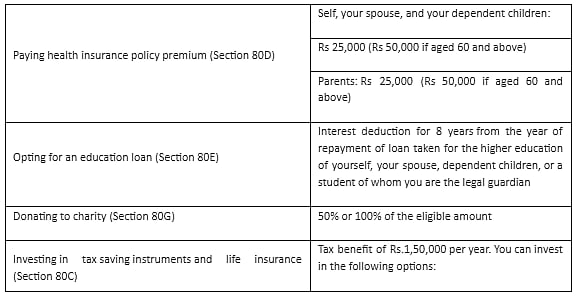

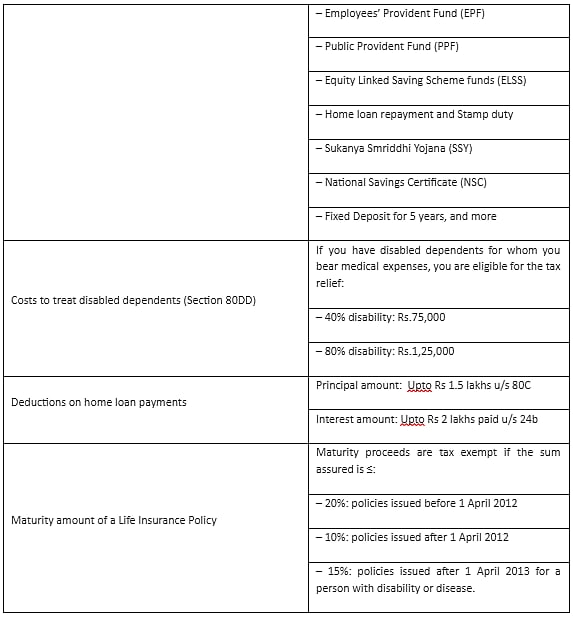

2. Deductions

When you are tax preparing for a salary of more than 15 lakhs, you can deduct the following:

How do you calculate income tax on a salary of more than 15 lakhs?

As an individual earning more than Rs 15 lakh per year, you must be wondering how much tax would be deducted.

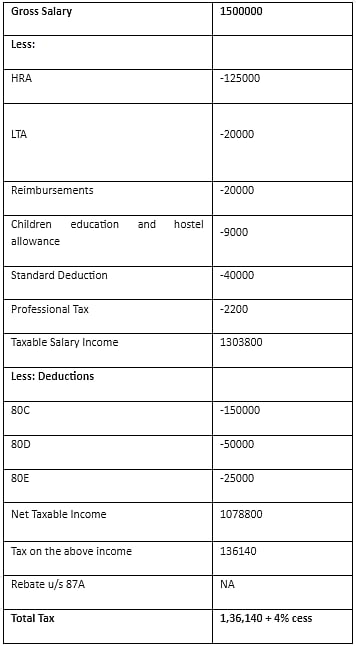

To understand the taxes of an INR 15 lakh wage under the old tax regime, consider the following scenario. Ms. Bharati's annual remuneration is INR 15,000,000. The tables below reflect Ms. Bharati's tax liability due under the old system.

As per the new tax regime, you need to pay Rs 90,760 plus a 4% cess as your tax amount.

There is a significant difference here, but you must note that under the old regime, you are already benefiting from your tax-saving investments in the form of getting life coverage, health coverage, and tax-free returns on some of your investments (in the case of ULIPs). If you factor in the costs of getting these benefits over the tax liability under the new tax regime, the comparison becomes much closer.

Conclusion

You may apply the methods you learned about how to save tax on a 15 lakh salary to minimize your taxable income. For a salary of more than 15 lakhs, a good strategy to lower taxes is to use the old tax regime and try to claim all applicable deductions and exemptions on tax-saving investments.

If you wish, you have the option to file your income tax return using the new tax regime. However, if you opt for this, you won't be able to claim any carried forward losses or deductions for tax-saving investments. It's important to keep in mind that the government's tax policies tend to change every year. Therefore, it is crucial that you stay updated on the latest developments while creating tax-saving plans.