Mumbai: The Indian rupee surged 39 paise to open at 85.71 against the US dollar in early trade on Tuesday, continuing its upward momentum from the previous session. The local currency benefited from a combination of favorable global and domestic cues, including a rally in equity markets and a dip in international crude oil prices.

The rupee had earlier closed at 86.10 on Friday, posting a sharp gain of 58 paise. With forex markets shut on Monday due to Ambedkar Jayanti, Tuesday’s trade began on a strong note, with the rupee opening at 85.85 before firming up further.

Tariff Suspension and Weak Dollar Fuel Optimism

Forex traders attributed the rupee’s rally to the US administration’s decision to suspend additional tariffs of 26 per cent on Indian goods till July 9. This move boosted investor sentiment and provided a positive backdrop for the local currency.

Additionally, the US dollar index, which tracks the greenback’s performance against six major currencies, remained under the critical 100 mark at 99.46 — down from recent highs — offering further support to the rupee.

Crude Prices and Market Rally Add to Momentum

Brent crude prices remained near record lows, falling marginally by 0.06 per cent to USD 64.92 per barrel in futures trade, easing concerns over India’s import bill and boosting the rupee.

Domestic equity markets mirrored this optimism, with the BSE Sensex climbing 1,516.53 points (2.02 per cent) to 76,673.79, and the NSE Nifty gaining 454.60 points (1.99 per cent) to 23,283.15. Both indices had ended Friday nearly 2 per cent higher.

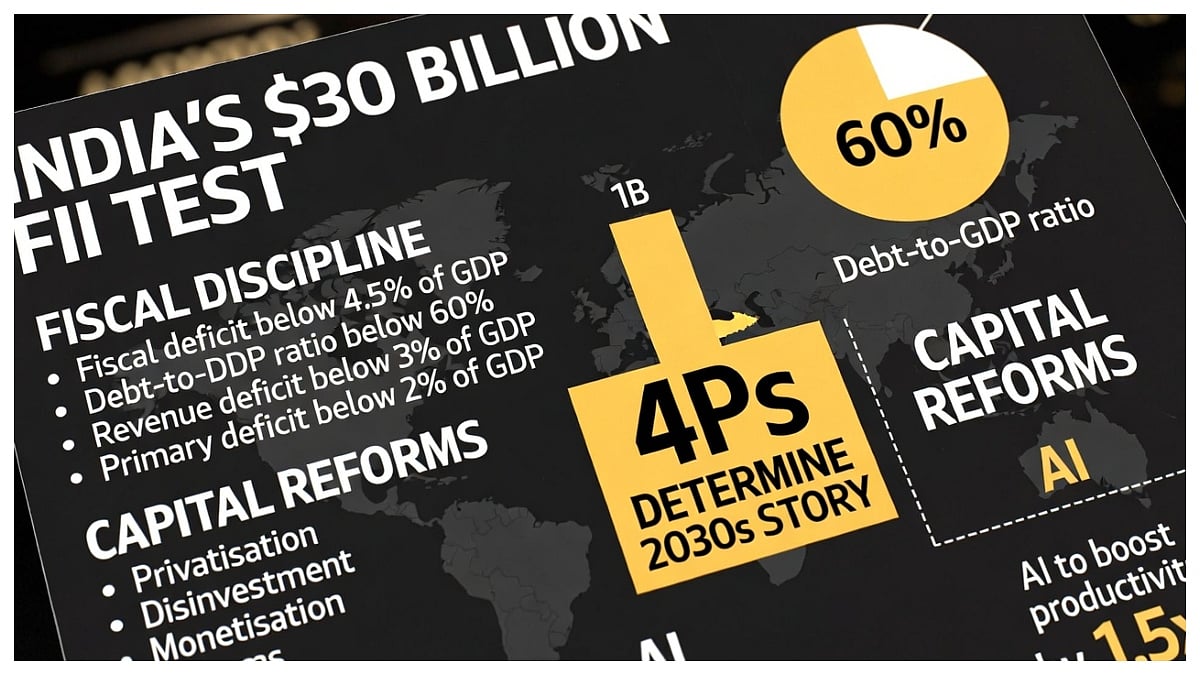

Foreign Investors Turn Cautious

Despite the rupee’s gains, foreign institutional investors (FIIs) continued to offload shares, selling equities worth Rs 2,519.03 crore on a net basis on Friday. However, the strong performance of local markets and a weaker dollar helped offset the impact of these outflows.

(With PTI Inputs)