Indian rupee expected to bid well in today’s trade on expectation of dollar inflows of Star Health IPO and MSCI rebalancing, according to a report HDFC securities Retail Research.

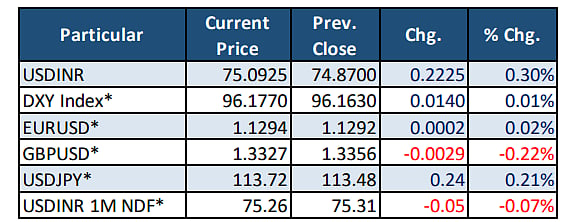

Currency Movements | HDFC Securities Retail Research

Market is expecting more than $1 billion inflows in next few days which could give support to rupee. Also, risk sentiments recovers as fears over the impact of the omicron virus strain eased.

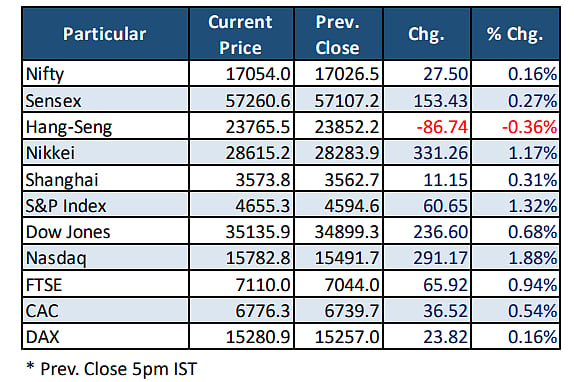

Global Equity Markets | HDFC Securities Retail Research

Spot USD-INR gained for the third month in row to end the month with best monthly closing since June 2020. So far this month foreigners have bought $427 million equities and $33.6 million debts. Major inflows were seen through primary market (IPOs) activities.

USDINR December Daily Chart | HDFC Securities Retail Research

On Monday, spot USDINR gained 0.30 percent or 22 paise to 75.09 following surge in crude oil price and institutional fund outflows. Technically, the pair has turned bullish following crossing of short term moving averages while overbought condition on hourly chart could limit the gains in today’s trade.

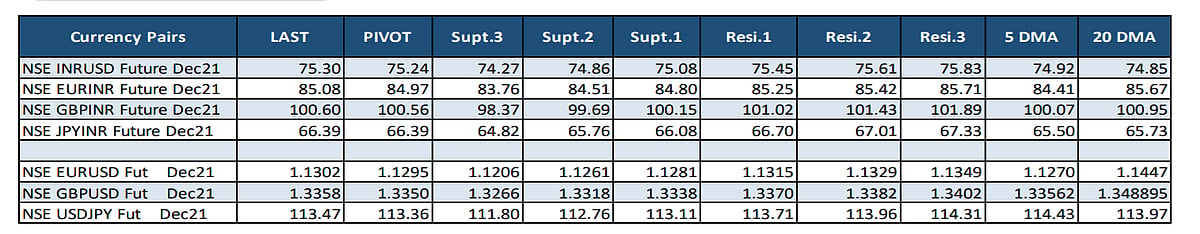

Currency Derivative Price Actions | HDFC Securities Retail Research

Technical Levels | HDFC Securities Retail Research

There are lots of month end economic data to be released after market hours which will clear the status of economic progress.

Market sets for India’s GDP likely rose to its pre-pandemic level in the July-September period, rebounding from a slump in the previous quarter caused by a massive second wave of COVID-19 infections.

The economy likely to grow by 8.3 percent YoY for the three month ended through September. India’s eight core sector likely to show growth of 4.4 percent in November.

Asian stocks and US equity futures advanced Tuesday amid easing concerns about the omicron coronavirus strain and data signaling an improvement in China’s factory activity.

Dollar Spot Index rises to 96.18 an up 2.4 percent in November, poised for best monthly performance since March 2020 on closing, daily basis.

USDINR December futures sustained above short term moving averages. Short-term moving averages are placed above medium term moving averages. The pair has given falling channel resistance breakout on hourly chart.

From the derivative data perspectives, the pair has seen rise in price and increase in open interest considered as fresh long buildup. However, volume remains lower following higher volatility.

Momentum oscillator, Relative Strength Index of 14 days period heading north with positive cross over indicating bullishness.

USDINR December futures expected to show some profit booking in today’s trade with downside support around 75 and resistance at 75.40.

(Dilip Parmar is an analyst with HDFC Securities Retail Research)