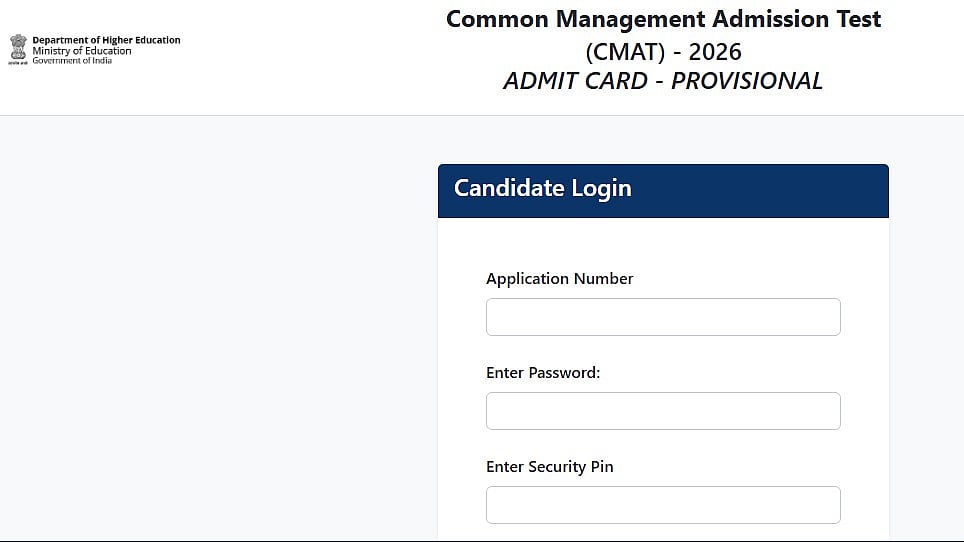

Mumbai: The Indian rupee fell sharply on Wednesday, hitting a fresh all-time low against the US dollar as foreign fund outflows continued and demand for dollars remained strong. The fall came amid weak domestic markets and rising global uncertainty, which kept investors cautious.

Sharp fall in intra-day trade

In early trade at the interbank foreign exchange market, the rupee opened at 91.05 against the US dollar. Selling pressure quickly built up, and the currency slipped further to touch a record low of 91.74. This marked a steep fall of 77 paise from its previous close.

On Tuesday, the rupee had already weakened by 7 paise to end at 90.97. The previous record intra-day low was seen on December 16, 2025, when the rupee touched 91.14.

Foreign fund outflows add pressure

Forex traders said the main reason behind the sharp fall was continued selling by foreign investors. Foreign institutional investors sold Indian shares worth about Rs 2,938 crore on Tuesday, according to exchange data.

Heavy demand for dollars from metal importers also weighed on the rupee, as companies needed more foreign currency to pay for imports.

Global tensions hurt sentiment

Global factors further weakened investor mood. Traders pointed to rising tensions in Europe over the Greenland issue and concerns over possible new tariffs. These issues increased risk aversion globally and pushed investors towards the US dollar, which is seen as a safe asset.

Expert view on currency volatility

Sachin Sawrikar, Founder and Managing Partner at Artha Bharat Investment Managers, said sharp currency swings are hurting foreign investment into India. He noted that even though India’s long-term growth outlook is strong, sudden currency moves reduce returns when investors convert money back into foreign currencies.

He added that high hedging costs are squeezing long-term returns, while short-term investors face the risk of quick capital outflows. According to him, controlling currency volatility and maintaining strong policy signals are important to keep investor confidence intact.

Other market indicators

The dollar index was slightly lower at 98.61, showing limited movement in the US currency globally. Brent crude prices fell nearly 2 per cent to USD 63.70 per barrel, offering some relief on the oil import bill.

In equities, markets were weak. The Sensex fell about 290 points to 81,890, while the Nifty slipped over 77 points to 25,155.