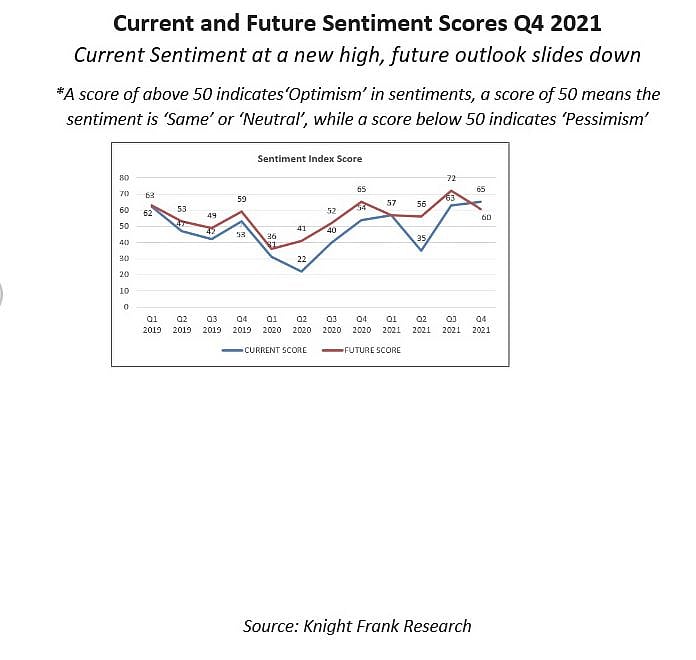

Mumbai: The Current Sentiment Index Score of the real estate sector has notched up to an all-time high of 65 in Q4 2021, according to a report by Knight Frank India.

The report titled “Knight Frank-FICCI-NAREDCO Real Estate Sentiment Index – Q4 2021 (October – December 2021)" has noted that the achievement was despite the ongoing challenges of the third wave of COVID-19.

The previous high reached was a sentiment score of 63 in Q3 2021. This improvement in the Current Sentiment Score is on account of the reduced uncertainty on the economic front leading to stability in demand in the real estate sector.

The Future Sentiment score, which gauges the stakeholders’ expectation in the short to medium term, also remains in the optimistic zone, albeit, dipped from 72 in Q3 2021 to 60 in Q4 2021, reflecting a prudent optimism as the Omicron inflicted risk on the Indian economy is yet to be discerned. The quarterly report is in its 31st edition.

With respect to the Economic outlook, 75% of respondents in Q4 2021 expect the overall economic momentum to remain stable over the next six months, while in terms of Credit Availability outlook, 60% of the respondents expect the credit situation to maintain status-quo over the next six months, while 37% expect it to increase during the period.

Knight Frank research

Shishir Baijal, Chairman and Managing Director, Knight Frank India said, “While good demand conditions prevail for the real estate sector, stakeholders are adopting a cautious approach in the wake of the uncertainty arising from the third wave of COVID -19. Thus far the economic, social and human cost of the pandemic has been very high. Therefore, the entire country is currently awaiting to see the complete extent of the ongoing wave. Having said that, businesses and consumers have adapted better to these disruptions, which reflects in India’s 9.2% growth estimate for Gross Domestic Product (GDP) in 2021-22. The real estate sector has demonstrated an indomitable spirit and has remained robust in the last 5 quarters mostly led by the residential sector growth. Home loan interest rates are at a historic low and the RBI’s firm assurance in maintaining the status quo has further boosted demand in the market. The segment has also been supported by conducive government policies keeping market sentiment buoyed. In terms of commercial real estate sector, the segment retained its momentum from the previous year as corporates continue to sign up for new spaces for their future growth as demonstrated by the robust hiring in the last 3- 4 quarters.”

Score >50: Optimism Score =50: Neutral/Same Score <50: Pessimism. | Knight Frank research

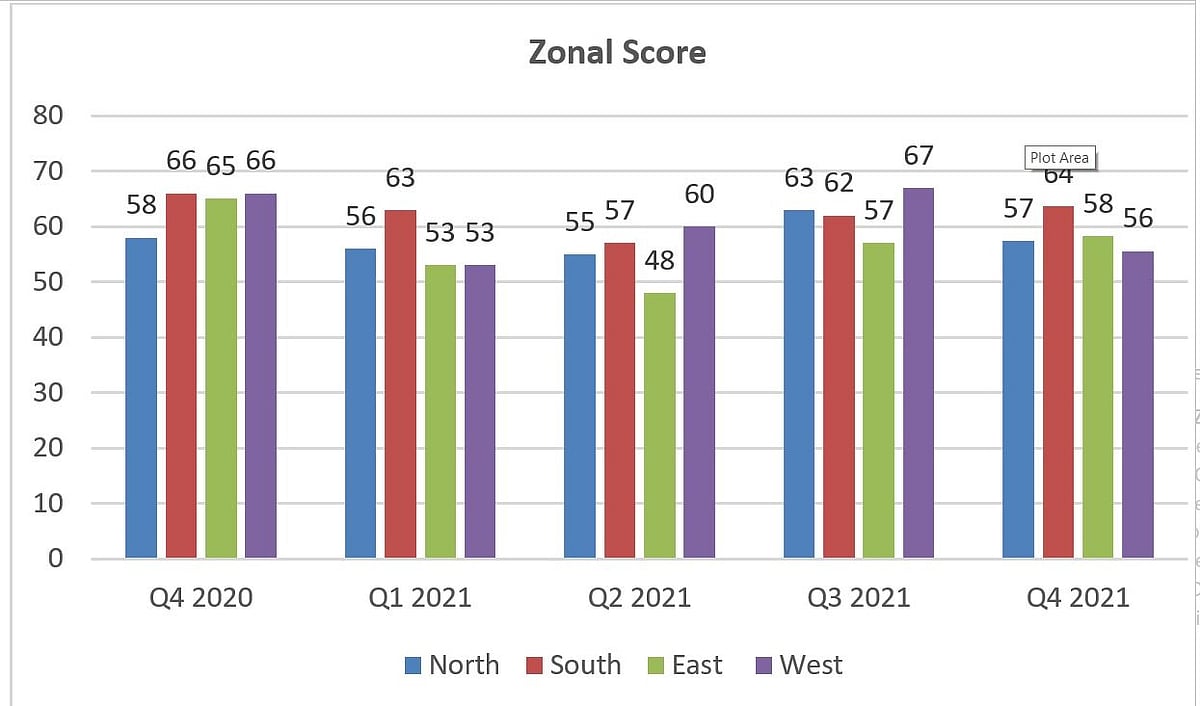

As per the report, the South and East Zones’ Future Sentiment score has inched up in Q4 2021 as compared to Q3 2021. The Future Sentiment score for South Zone increased to 64 in Q4 2021 from 62 in Q3 2021 as key southern markets recorded good traction in both office and residential sectors. Whereas, for the East Zone the score rose from 57 in Q3 2021 to 58 in Q4 2021. The North and West Zones remained optimistic with scores of 57 and 56 respectively in Q4 2021. As the Omicron variant of COVID – 19 related risks unfold, stakeholders in these zones remain cautiously optimistic for the near term.

Sanjay Dutt, Joint Chairman – FICCI Real Estate Committee and Managing Director and Chief Executive Officer – Tata Realty and Infrastructure Ltd said, “2020 and 2021 can be coined as historic years for real estate. While the pandemic disrupted the sector globally, it also presented an opportunity to take a step back and put in place building blocks for long-term sustainable growth. The commercial real estate is now focused on wellness besides sustainability and optimisation. It is now a hybrid work environment. The homes are now all about liveability supported by workability. With housing affordability in India at its decadal best, residential sales registered 59% growth. On the commercial side, leasing activity is again ramping up due to robust underlying demand from IT/ITES and global MNCs, augmented by a surge in smart cities and CBDs. As we deal with each wave more confidently, I am sure that we are on the cusp of a very exciting and unprecedented cycle of real estate growth.”

Rajan Bandelkar President, NAREDCO India and Director Raunak Groupsaid, “The Knight Frank-FICCI-NAREDCO Real Estate Sentiment Index has been a very true reflection of the actual consumer sentiment and how the market performs. I am very glad to see that the Current Sentiment score has increased from 63 in Q3 2021 to 65 in Q4 2021 which is indicative of the steady revival that the real estate sector has observed in the year 2021. The Covid scenario globally is improving, and countries are getting better at dealing with it. The same is being observed in India also. We are currently in the third wave of Covid, which has definitely impacted the Future Sentiment score with a dip from 72 in Q3 2021 to 60 in Q4 2021. However, I must add that it still remains in the optimistic zone and is temporary and will inch back up soon. I thank the Government for its constant efforts towards revival of the economy. It has certainly boosted the demand and that reflects optimistically in the zonal scores and stakeholders’ take on the sector. We plan to carry forward the momentum from last year and intend to make 2022 a benchmark year for the real estate sector.”

On the Office Market outlook, 61% respondents in Q4 2021 opined that office leasing will remain stable over the next 6 months. Stakeholder outlook for office rents improved in Q4 2021. Compared to Q3 2021 - when 27% respondents felt office rents may increase in next six months – this time, 47% opined the same. In terms of new office supply, 88% of the Q4 2021 respondents are of the opinion that new office supply will either remain stable or will witness an increase over the next six months.

On the Residential Market Outlook, 72% of the Q4 2021 survey respondents opined residential sales to remain stable over the next six months, while 75% of surveyed stakeholders fear new supply may decrease in the next six months. An overwhelming majority, 62% of the respondents, expect a decline in residential prices over the next six months due to the Omicron virus-related disruptions.

About Knight Frank

Knight Frank LLP is a leading independent, global property consultancy. Headquartered in London, Knight Frank has more than 20,000 people operating from over 488 offices across 57 markets. The Group advises clients ranging from individual owners and buyers to major developers, investors and corporate tenants. For further information about the Company, please visit www.knightfrank.com.

Knight Frank India is headquartered in Mumbai and has more than 1,200 experts across Bengaluru, Delhi, Pune, Hyderabad, Chennai, Kolkata and Ahmedabad. Backed by strong research and analytics, our experts offer a comprehensive range of real estate services across advisory, valuation and consulting, transactions (residential, commercial, retail, hospitality, land and capitals), facilities management and project management. For more information, visit www.knightfrank.co.in.