IIFL Finance Limited on Thursday (September 19) through an exchange filing announced that the Reserve Bank of India (RBI) has lifted the restrictions imposed on the company's gold loan business,

As per the regulatory filing, the company added that these restrictions, which had been in place since March 4, 2024, prevented the company from sanctioning, disbursing, or assigning/securitising its gold loans. With the RBI's new communication dated September 19, 2024, IIFL Finance can now fully resume its gold loan operations.

"The RBI's decision is effective immediately and allows the Company to resume the sanctioning, disbursal, assignment, securitization, and sale of gold loans in compliance with all relevant laws and regulations," added the company in the regulatory filing.

In response to the RBI's decision, IIFL Finance has assured that all their future gold loan operations will comply with regulatory standards.

"The Company is committed to upholding the highest standards of compliance and will continue to ensure that the remedial actions taken are sustained," added the company in the BSE exchange filing.

Share performance

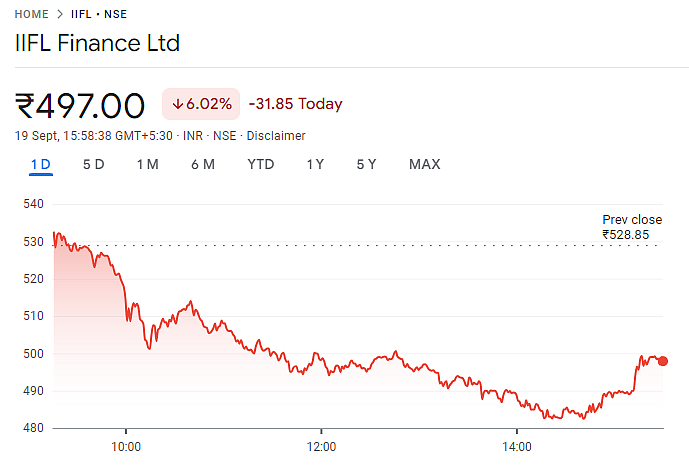

The shares of the company ended the day on a red note today.

IIFL share performance |

IIFL Finance Ltd shares opened at Rs 531.00 today, reaching a high of Rs 533.90 and touching a low of Rs 482.00 during trading hours.

The company's current market capitalisation stands at Rs 21,080 crore, with a price-to-earnings (P/E) ratio of 12.36.

Investors can expect a dividend yield of 0.78 per cent.

Over the past year, the stock has seen a 52-week high of Rs 683.19 and a 52-week low of Rs 304.25, markinhg a significant price fluctuations in the market.