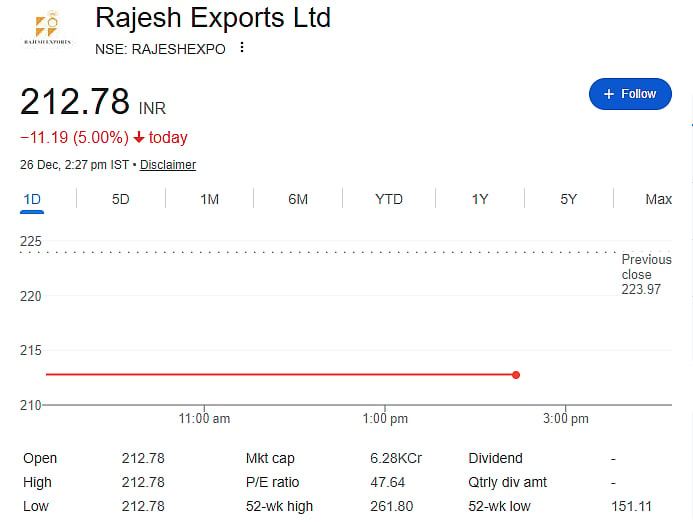

Mumbai: On December 26, morning, Rajesh Exports shares opened at Rs 212.78, hitting the 5 percent lower circuit from the previous close of Rs 223.97. The selling pressure was so intense that the exchange had to halt trading. Investors were left wondering why a stock that had recently surged suddenly faced panic selling.

Recent Rally and Context

Earlier, the stock had shown strong momentum. Starting at Rs 188 on December 18, it jumped to around Rs 230 by December 22, giving investors a quick 22 percent gain in just four trading sessions. However, this surge came after a three-year decline of nearly 68 percent, with the stock falling from above Rs 600 to current levels, causing long-term value erosion.

Promoter and Institutional Holdings

Promoters hold 54.55 percent of the company, remaining stable over the last five quarters. Interestingly, foreign institutional investors (FIIs) increased their stake from 14.7 percent in June 2025 to 15.18 percent by September, a five-quarter high. Domestic institutional investors (DIIs), however, reduced their holdings to 10.98 percent, the lowest in five quarters, reflecting reduced confidence from local investors.

Company Business Overview

Rajesh Exports is a leading global gold processor, handling around 35 percent of the world’s gold refining. The company also runs a retail jewelry business under Shubh Jewellers. Recent high gold prices, reaching nearly Rs 1.2 lakh per 10 grams, had temporarily boosted revenue and the stock price.

Why the Sudden Decline?

Investors concerns include low profitability, with a PAT of only Rs 132 crore despite large revenues, and a low RoE of 4.23 percent. High debt, low margins, no dividends, and weak market capitalization of Rs 6,613 crore have added to uncertainty. The jewelry sector faces heavy competition from China, import duties, and weak retail demand. These pressures prevented the recent rally from sustaining, pushing the stock back to the risky Rs 180–190 range.

The sudden lower circuit highlights the volatility in gold-related stocks. Despite strong global presence and FII interest, the combination of thin profits, debt, and sector challenges makes Rajesh Exports’ shares vulnerable, prompting caution among investors.

Disclaimer: This content is for informational purposes only and does not constitute financial advice. Investors should conduct their own research or consult a professional before making any investment or trading decisions.