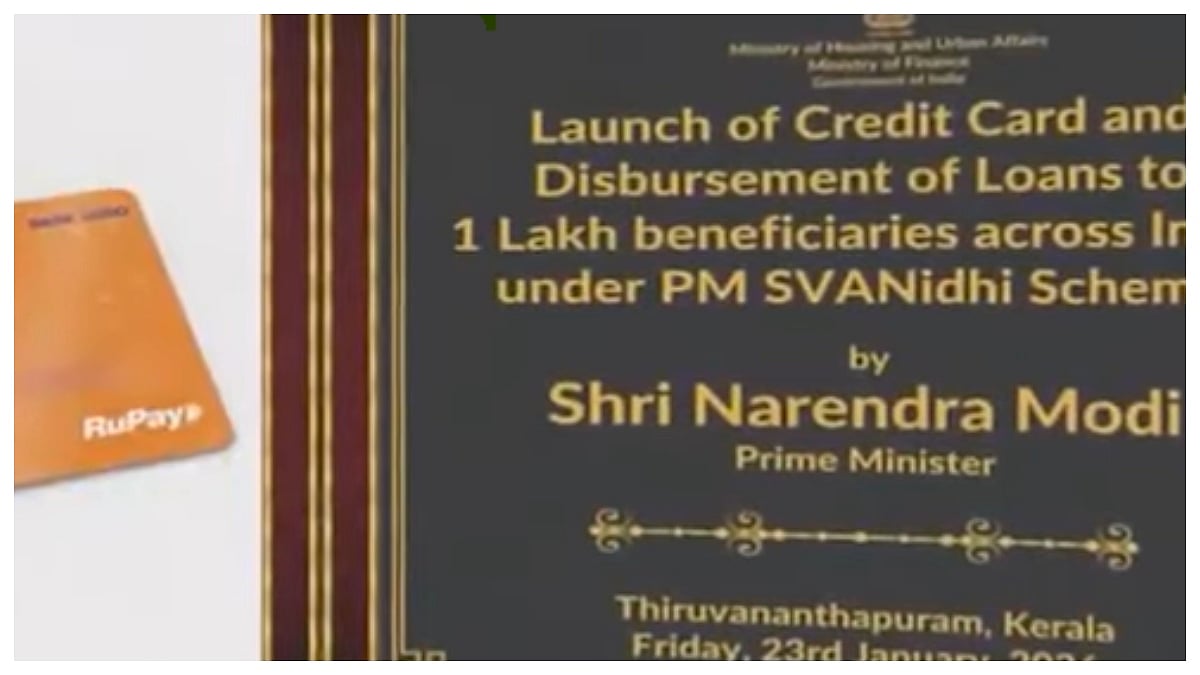

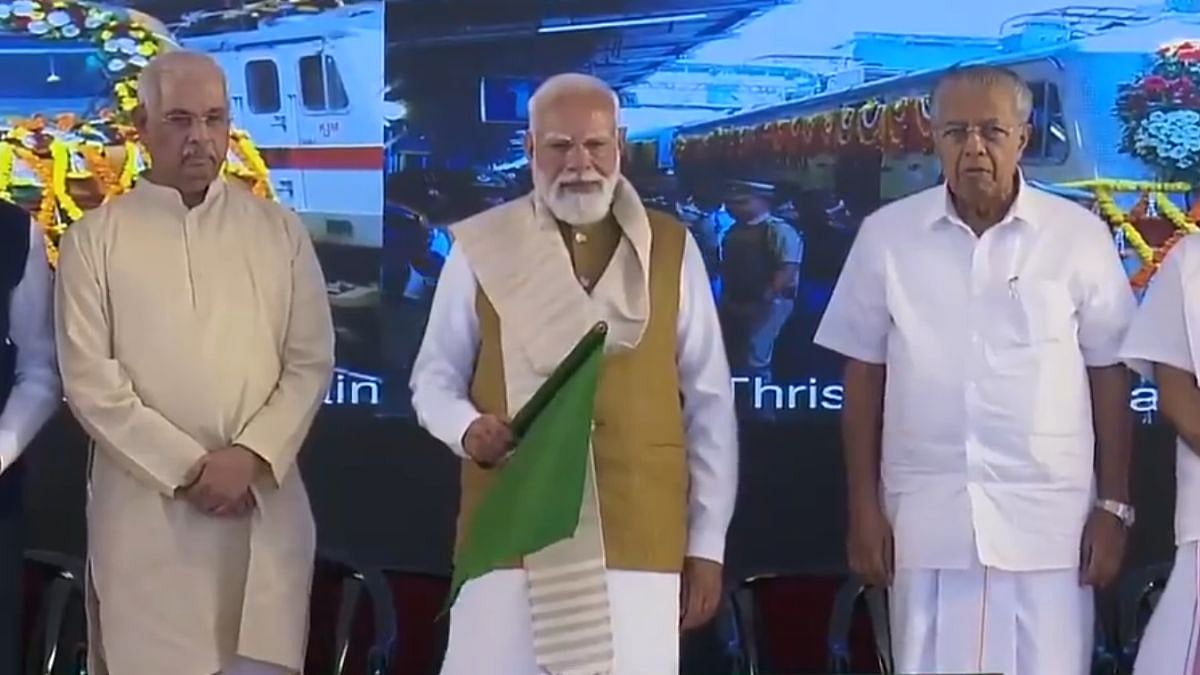

Kochi: Prime Minister Narendra Modi on Friday launched the PM Svanidhi Credit Card in Kerala while inaugurating and laying foundation stones for several development projects. He also flagged off new train services, strengthening rail connectivity across southern states.

During the event, the Prime Minister laid the foundation stone of the CSIR-NIIST Innovation, Technology and Entrepreneurship Centre and distributed loans and credit cards to beneficiaries under the PM Svanidhi scheme.

The Prime Minister said the scheme aims to improve the lives of the poor in Kerala and across India by providing easier access to formal credit.

What is the PM Svanidhi Credit Card?

The PM Svanidhi Credit Card offers an interest-free revolving credit facility linked with UPI. It is designed for street vendors who have shown good repayment behaviour under the PM Svanidhi loan scheme. Vendors who have fully repaid the first two loan instalments can access short-term, interest-free credit for daily business needs.

By following credit discipline, beneficiaries can enjoy an interest-free period of 20 to 50 days, helping them manage cash flow better and plan expenses more efficiently.

Key features of the credit card

The card carries a total credit limit of Rs 30,000, starting with an initial working limit of Rs 10,000, which can be gradually increased based on usage. The card will remain valid for five years from the date of issue.

It is fully UPI-linked, allowing vendors to make digital payments using their credit limit. Auto-debit facilities like ECS, NACH, or AutoPay will help ensure timely bill payments directly from bank accounts.

Usage restrictions and safety measures

The card cannot be used for cash withdrawals or international and foreign currency transactions. Certain merchant categories such as alcohol, gambling, foreign airlines, and international hotel chains will be restricted. This ensures responsible usage focused on livelihood needs.

Eligibility and implementation

The scheme will be jointly implemented by the Ministry of Housing and Urban Affairs and the Department of Financial Services. Eligible applicants must be between 21 and 65 years, have no non-performing loan accounts, and submit basic documents such as Aadhaar, PAN, vendor identity proof, and bank details.

Wider development push

Alongside the card launch, PM Modi flagged off three Amrit Bharat Express trains and a Thrissur-Guruvayur passenger train, improving regional connectivity.