As per a Financial Express report, “Indians are among the highest number of property owners in London”. The said report, published in 2022, stated that ‘desis’ are willing to “shell out anywhere between GBP 290,000-450,000 for a one-, two- or three-bedroom apartment in the capital city”. Needless to say, this also makes them one of the most prolific property investors in the country.

In the current scenario, house prices in the United Kingdom are witnessing a sharp rise, following a timid 2023. As per a recent report by The Guardian, the growth in March 2024 was said to be 1.5 percent, the highest in the last 10 months. Even with prices going up, one would want to have their line in the water, to get the maximum advantage when the opportunity presents itself.

While the usual suspects, comprising industrialists and movie stars, form the key Indian investors in the UK, the market in the recent past has witnessed a change.

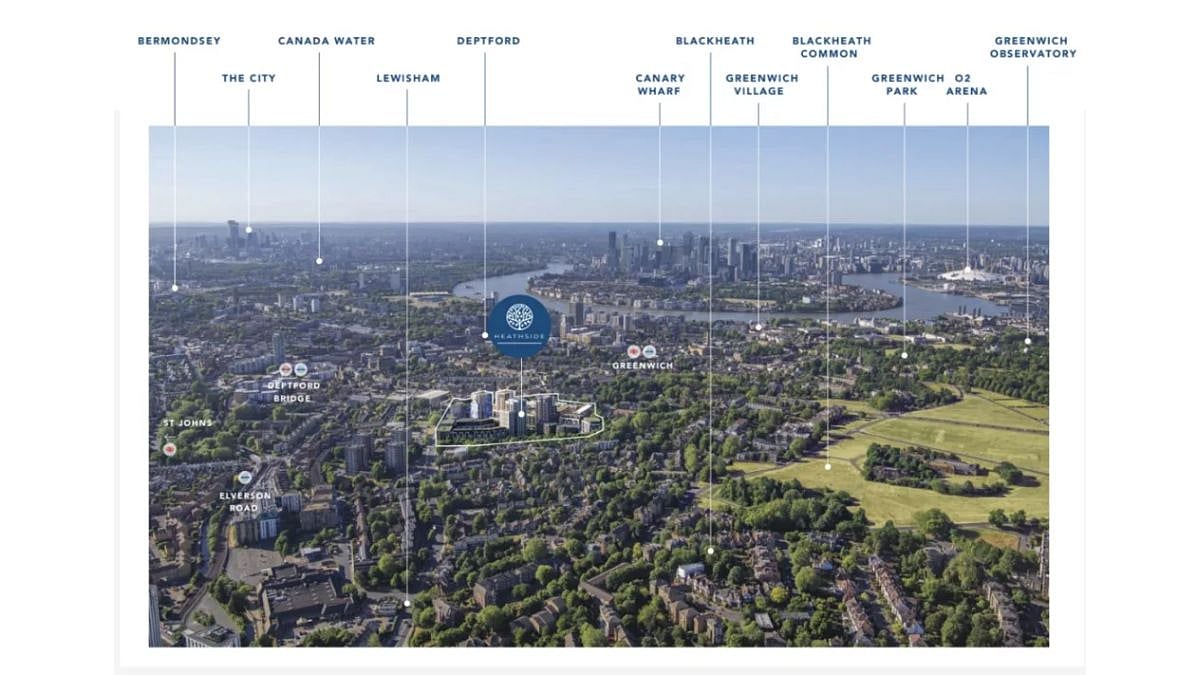

Investment hotspots in the UK. Photo: API Global |

As per a November 2023 report from Money Control, “Indians [are now] preferring to invest in property in London for their children pursuing higher studies in the city.”

However, investing in UK property as an Indian national involves several tax considerations, which can be handled well under professional guidance. Depending on your circumstances and investment goals, you may want to consider different ownership structures, such as owning the property individually, through a company, or LLP. I will be speaking at – Unlock Opportunities in UK Property Market* – on this topic and other matters linked with it.

In the meantime, here are eight key points to get you started:

Stamp Duty Land Tax (SDLT): SDLT is a tax paid when purchasing property in the UK. Different rates apply for residential and commercial properties, as well as for first-time buyers and additional properties. Make sure to factor this into your budget when purchasing a property.

Income Tax on Rental Income: Rental income earned from UK property is subject to UK income tax. Non-resident landlords have different tax rules compared to residents. Non-residents may need to pay tax on gross rental income or have the option to pay tax on net rental income after allowable expenses.

Non-Resident Landlord Scheme (NRLS): If you are a non-resident landlord (living outside the UK), you need to register with the NRLS. The letting agent or tenant usually withholds tax from the rental income and pays it directly to HM Revenue & Customs (HMRC) unless HMRC agrees that you can receive your rental income gross.

Capital Gains Tax (CGT): When you sell a property in the UK, you may be liable to pay CGT on any profit made. The rate depends on various factors, including your residency status and the amount of gain. Principal private residence relief may apply if the property has been your main residence.

Inheritance Tax (IHT): If you own property in the UK, it may be subject to UK inheritance tax upon your death. However, there are exemptions and reliefs available, and tax treaties between India and the UK may provide relief from double taxation.

Tax Treaties: India and the UK have a double taxation avoidance agreement (DTAA) to prevent double taxation on the same income. Understanding the provisions of this agreement can help in optimizing your tax liability.

Structuring Investments: Depending on your circumstances and investment goals, you may want to consider different ownership structures, such as owning the property individually, through a company, or via an LLP. Each structure has different tax implications.

Professional Advice: Given the complexity of international tax laws, it’s crucial to seek advice from tax professionals who are knowledgeable about both Indian and UK tax laws. They can help you navigate the intricacies and ensure compliance while minimising your tax burden.

Always keep yourself updated with the latest tax regulations and seek personalised advice tailored to your specific situation before making any investment decisions.

Abbas Jaorawala from Khaitan Legal Associates. Photo: Connected to India |

Unlock Opportunities in UK Property Market is an exclusive session to unravel the potential of investing in Real Estate in the UK through property and real estate bonds. It is jointly hosted by Khaitan Legal Associates, Connected to India, property marketing and management company Turn-Key Investments, UK’s leading property marketing company API Global, the 79th Group, British Asset Management company at the Aftab Mahtab Room, Taj Mahal Hotel, Delhi on April 4, 2024.

About the writer: Abbas Jaorawala is a Senior Director and Head-Direct Tax at Khaitan Legal Associates, a corporate law firm with offices in India and the United Kingdom.

Disclaimer: Opinions expressed in this article are the author’s personal opinions and do not reflect the views of Connected to India.

The article is published under a mutual content partnership arrangement between The Free Press Journal and Connected To India)