Nifty & Bank Nifty Outlook

Nifty has corrected a bit over the last week and we expect this correction and a slightly bearish sentiment to persist over the coming week. Nifty could retest its support levels of 16150 - 16000.

Nifty50 |

Bank Nifty has been within a large range for a few months now, this week was quite bearish and we expect this sentiment to carry forward this week too, The banking index could potentially test and challenge support levels of 34,200-34,000.

Bank Nifty |

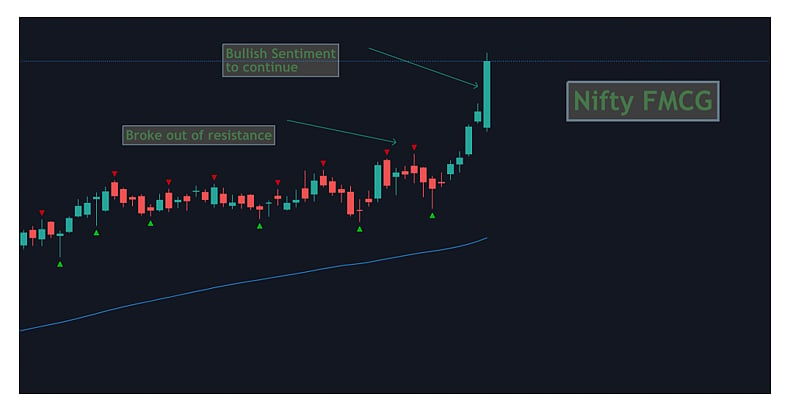

Nifty FMCG

The FMCG index has broken out of a consolidation channel and has given an extremely bullish close on the last closing of the week, this has typically always been the trend, when the broad market indices struggle, FMCG comes to the rescue and becomes a safe haven for conservative investors.

Nifty FMCG |

We are staring at a blue sky scenario for this index and we expect the bullish sentiment to continue on the back of dearth of quality investable universe.

NIFTY IT

Nifty IT |

The IT sector has gotten overheated at the moment, it doesn’t mean that the sector looks bearish, if anything, it will offer an opportunity to buy on dips, we expect this index to test support zones near the 32500 levels.

NIFTY Pharma & Nifty Auto

Just like last week, we maintain a mildly bearish stance on both these indices as the charts look weak, we would suggest participants to stay away from both these indices until some clarity emerges.

Derivative Outlook:

Nifty current month future closed with a discount of 30 points to its spot. Next month's future is trading at a premium of 5 points.

We saw open interest reduction of nearly 2.1 percent in Nifty and considering the price action it clearly hints a bearish sentiment.

Long Formation

The following stocks saw OI build up with a corresponding increase in price, suggesting a bullish sentiment.

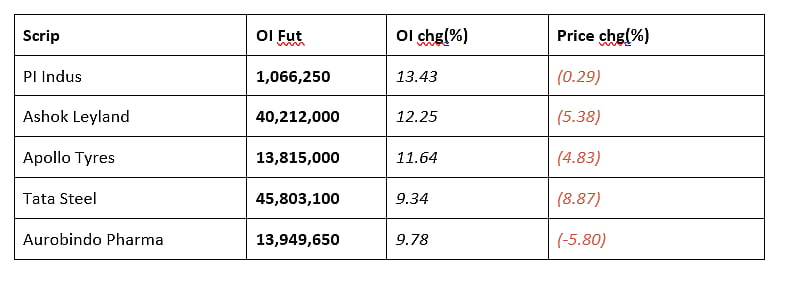

Short Formation

The following stocks saw OI build up with a corresponding decrease in price, suggesting a bearish sentiment.

(Gaurav Udani is founder and CEO, ThincRedBlu, boutique brokerage firm)