New Delhi: The government has clarified that redesigned Income Tax Return (ITR) forms under the Income Tax Act, 2025, will be issued before the 2027–28 financial year. This will give taxpayers clarity on the transition to the new tax system.

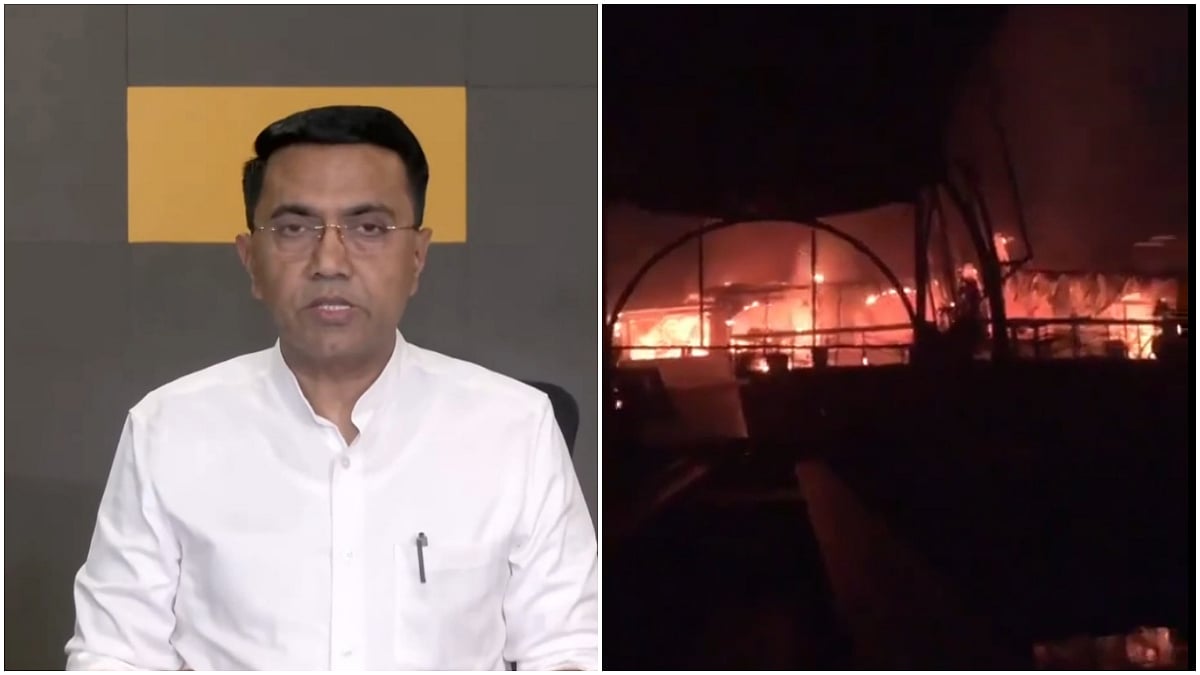

The update was shared by Minister of State for Finance Pankaj Chaudhary in the Lok Sabha.

Extensive Consultations Underway

Chaudhary said the CBDT’s committee on ITR simplification is consulting tax practitioners, institutional stakeholders, and field officers to make the forms more intuitive. The goal is to align the forms with the new law and make compliance simpler and more transparent. This exercise covers annual ITRs and related forms, such as quarterly TDS statements.

New Tax Act Comes Into Effect Next Year

The Income Tax Act, 2025, enacted on August 21, 2025, will take effect from April 1, 2026, replacing the six-decade-old 1961 law. The new law aims to simplify tax provisions, remove outdated clauses, reduce ambiguity, and make compliance easier for individuals and businesses.

First ITRs Will Reflect 2026 Budget Proposals

Chaudhary explained that the first ITRs under the new system for Assessment Year 2026–27 will include changes proposed in the 2026 Budget. Forms will be notified well ahead of FY28, giving taxpayers, professionals, and digital platforms time to adjust.

For the current financial year, ITR forms will continue to follow the legacy 1961 Act, ensuring no immediate disruption to ongoing filings.