The skyline of Mumbai has surely got altered with the advent of towers that have become a constant sight across the city, extended city, suburbs and exurbs, which now comprise the Mumbai Metropolitan Region (MMR). I came across the word ‘exurb’ when reading a US report on Trends 2000. It said that one should invest in them as that would be a trend of the future. Exurbs are one beyond suburbs. Reading this in about 2005, I tried relating this to Mumbai.

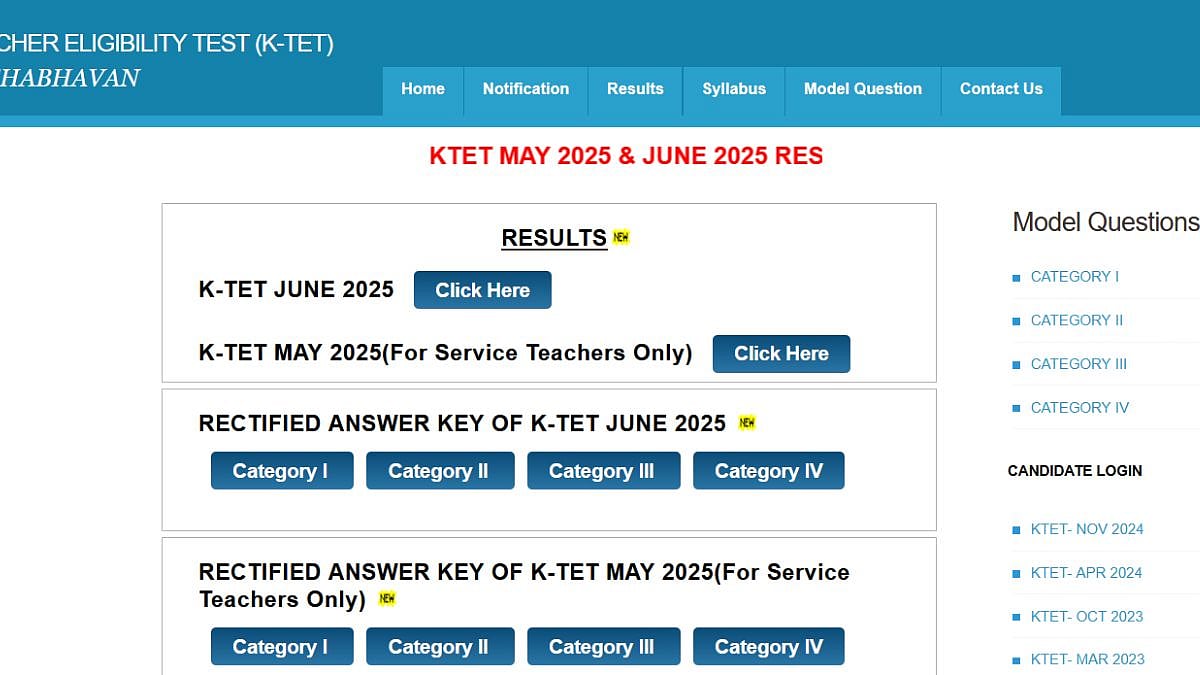

Rail connectivity

Mumbai has always been bursting at the seams. The city limits once ended at Matunga and Mahim. It then got extended; a portion of land called the ‘suburbs’ was ‘attached’ to the city. This could be defined as earlier from Bandra up to Jogeshwari, then further extended to Borivali along the Western Railway line and up to Mulund along the Central Railway line and Mankhurd on the Harbour line.

It is interesting to note that it was the development of the railway lines from the mid-nineties that gave rise to the exurbs. There were so many real estate projects coming up in areas beyond these like Thane, Navi Mumbai, Mira Road and so on.

Directional impact

When economists describe something as ‘headed south’ that would mean a downturn in the market. However, in Mumbai, when you are headed south, especially in the context of real estate, it means just the opposite as the rates per square foot (sq. ft.) are the highest there. What then fascinated me was the varying rates for buying an ownership house across the city, which would get defined as per the railway line.

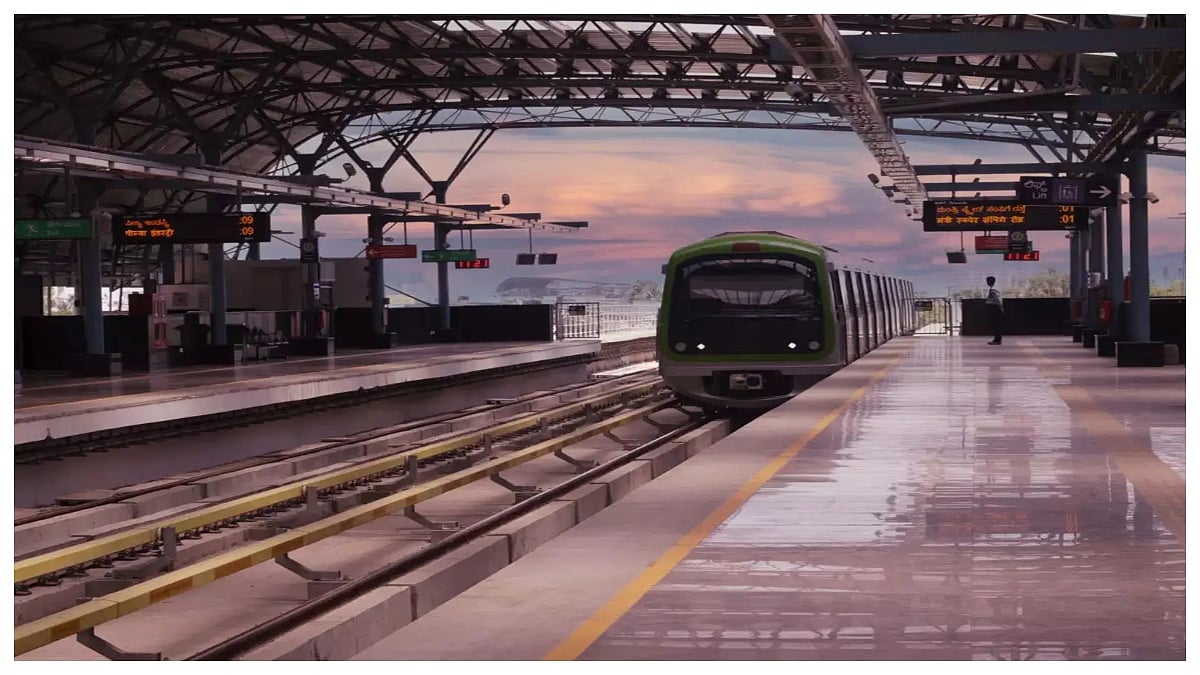

Connectivity modes

The efficiency of Mumbai’s local railway network boosted the real estate rates of properties in destinations on the basis of proximity to the station. These days, it has also boosted the rates of existing properties that suddenly developed proximity to a metro station. Leveraging the aspiration to be a car owner, proximity to the highway is now also highlighted as a feature while selling property.

Stations that came up on the existing network – Sri Ram Mandir Road in the Western Railway, and Kopar Road and Nahur on the Central Railway are a case in point. The other case in point is the Harbour line Route from CSMT getting extended up to Panvel. The properties in those areas suddenly had a reference point of proximity to the station. Further, with the route from Thane to Panvel also being commissioned, many stations cropped up, which provided impetus to real estate development along those areas.

Pricing strategy

Start from any of the farthest terminus of say Karjat, Kasara, Panvel, or Virar. Like a stock market share broker, instead of a station name, let us say you assign a value of 3000-4000 as the price of per sq. ft. for real estate. As you progress up the route moving south, and reach Chhatrapati Shivaji Maharaj Terminus (CSMT) or Churchgate, you could touch a cost of up to 60,000 per sq. ft. This provides us a differential of 20:1.

As a person who has been staying at Vile Parle for about forty years, a close-knit suburb, there is no scope for any expansion beyond a kilometre on either side of the railway station. The east is enveloped by the airport and the west by Juhu beach. The farthest locality would just be a maximum 15 minutes away from the station and that too by just walking.

Total recall

Sometime in 1997, I recollect an experience of travelling to Ghodbunder Road scouting for an ownership flat. The price was in the range of Rs. 300,000 to 500,000 only for typically an entry-level flat. What dissuaded me was that the locality then was in the middle of nowhere, though the builder tried to convince me that there was a proposed ring rail which would provide better access. I wasn’t convinced and am now repenting my decision, for even if I had brought the flat then, perhaps it would have fetched me something over a crore; 20-30 times appreciation in 25 years! If only I had brought a property in one of the exurbs at that time, then today I would have been a ‘Crorepati’!

Key takeaways

Peripheral areas develop gradually but consistently, it takes years and sometimes decades to realise their inherent potential

Expecting overnight value appreciation is unrealistic, only those who are looking for slow but sustained growth should book flats there

While comparing options, always track infrastructure development projects, especially rail or metro connectivity as the game changers

(The writer is a Trend Science, Communication & Marketing Consultant)