Indian equity bourses closed on a lower note for the straight second week amid weak global cues. Nifty index lost 0.6 percent so far this week as banking, auto and FMCG stocks remained under pressure. Weak quarterly results of selective companies further dented sentiments of domestic investors. However, strong weekly gains of 8 percent in BSE Metal index capped benchmark losses to some extent.

Metal stocks remained under investor’s buying radar on a report that China may consider export duties on steel. Fear of Delta variant and Chinese tech sell-off were among the key factors that disturbed traders during the week.

Sentiments were dented across Asian market as China released new regulations on education firms. The US GDP grew 6.5 percent in April-June quarter which was below estimation. Meanwhile optimism over earnings and economic revival scaled Wall Street to all time during this week.

Going ahead, investors will keep an eye over corporate results and global economic data to assess the pandemic recovery. Key crucial data for the equity market next week include India’s auto sales, GST collection and PMI data, BoE interest rate decision and US non-farm payrolls.

From a technical perspective, the Nifty index has been trading in a range from 15,600-15,900 levels. During the week gone by, we witnessed further correction initially for three days, but recovery followed and the index reached near to its weekly highs at 15,862.80 on Friday session but did not sustain higher and settled at 15,763.05 levels.

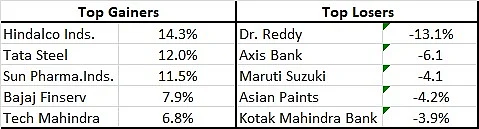

Gainers and losers for week ended July 30, 2021 | Sumeet Bagadia

The Bank Nifty ended at 34584.35 levels with a weekly loss of 1.3 percent. In the coming week, we are expecting bullish movement in the Nifty index. On the higher side, the resistance is intact at 15960 levels above that it may test 16,200/16,300 levels while support is at 15600 levels.

Top gainers last week

Hindalco and Tata Steel: Metal stocks like Hindalco and Tata Steel were among the top gainers in the Nifty 50 index. Development in China has cheered Indian steel makers as the country raises export tariffs for some steel products. China has decided to not incentivize companies to export steel and the country's goal to achieve lower carbon emissions have further cheered investors.

Sun Pharma: India's biggest drug maker's stock touched upper circuit on result day due to upbeat quarterly result.

Bajaj Finserv: The stock despite 31 percent fall in quarterly net profit. Expectations of healthy business prospects have led the rally in stock.

Tech Mahindra: The IT firm's stocks jumped on the back of good results.

Top losers

Kotak Mahindra Bank: The stock has plunged nearly 3.9 percent in the last one week. Weak quarterly results have dented sentiments as asset quality witnessed deterioration.

Asian Paints: Shares of the leader in the decorative paints market gained over 3 percent in the previous week following triggers like quarterly results and falling crude prices. However, the stock witnessed profit booking during the week due to weak sentiments in the domestic market and rising crude prices further spook investors as rising input cost could impact the profit margins.

Maruti Suzuki: Shares fell after India's largest car maker's profit declined on account of second COVID wave that disrupted production and sales. The company reported quarterly net profit below estimates; revenue jumped 333 percent YoY due to lower base.

Axis Bank: Shares fell nearly 6.1 percent in the last one week as the company misses result estimates. Large banking stock HDFC Bank' also missed estimates, which further hurt market sentiments on banking stocks.

Dr Reddy's Laboratories: The shares tanked post-disappointing quarterly results. The company reported a consolidated profit of Rs 570.8 crore in the quarter, a 1.5 percent drop from a year ago. A report of US legal action further weighs on the stock.

(Sumeet Bagadia is Executive Director, Choice Broking)