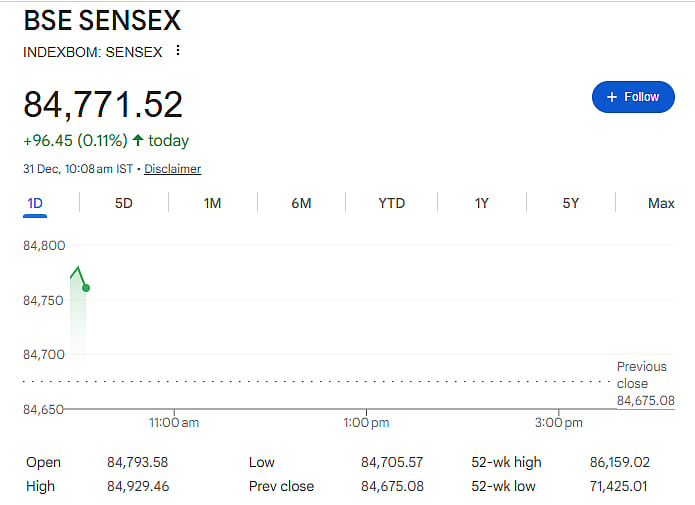

Mumbai: Indian stock markets showed a fresh recovery on Wednesday morning after facing continuous losses in the previous sessions. Both benchmark indices, the Sensex and the Nifty, moved into positive territory during early trade, bringing some relief to investors.

The rebound came mainly due to steady buying by domestic institutional investors, which helped counter weak global signals and selling pressure from foreign investors.

Sensex and Nifty Gain After Recent Losses

The 30-share BSE Sensex rose by 254.38 points to reach 84,929.46 in early trade. This came after five straight days of decline. Similarly, the NSE Nifty climbed 89.15 points to trade at 26,028, snapping a four-day losing streak.

Market experts said that bargain buying in select heavyweight stocks supported the recovery.

Top Gainers and Laggards

Among Sensex companies, shares of Tata Steel, Bharat Electronics, Titan, Axis Bank, Adani Ports, and Hindustan Unilever were among the biggest gainers in early trade. These stocks saw good buying interest from investors.

On the other hand, some stocks failed to join the rally. Bajaj Finserv, Tata Consultancy Services, Mahindra & Mahindra, and Infosys were trading lower and remained among the laggards.

Global Markets Remain Weak

Asian markets were mostly trading in the red. South Korea’s Kospi, China’s Shanghai Composite, and Hong Kong’s Hang Seng index were all quoting lower during morning trade. Meanwhile, US stock markets ended lower on Tuesday, adding pressure to global sentiment.

Investor Activity and Other Factors

Exchange data showed that Foreign Institutional Investors sold shares worth Rs 3,844.02 crore on Tuesday. In contrast, Domestic Institutional Investors bought equities worth Rs 6,159.81 crore, supporting the market.

Brent crude oil prices slipped slightly by 0.10 per cent to USD 61.27 per barrel, offering mild relief on the inflation front.

Previous Day’s Closing

On Tuesday, the Sensex fell marginally by 20.46 points to close at 84,675.08, while the Nifty slipped 3.25 points to settle at 25,938.85.