The Indian indices started the day's trade on a positive note in green. But the tech starts could have definitely asked for a better star as stocks of major names in the industry started on the day's proceedings in red. However, as the market proceeded further, the prospects improved for these stocks as they curved back to green.

Tech Stocks In Green

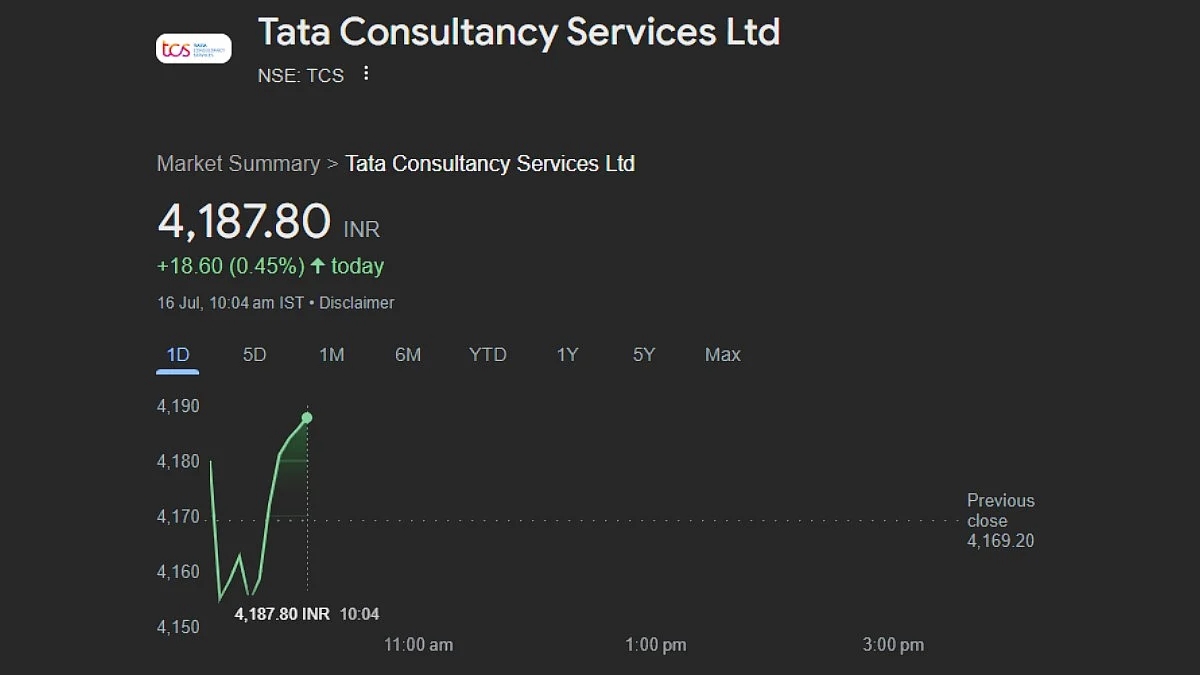

Tata Consultancy Services saw a steep decline from the beginning of the day, only to bounce back and gain 0.32 per cent or Rs 13.30, of its value, climbing to Rs 4,182.50 per share. Other major names were no different, as Bengaluru-based Wipro gained 0.063 per cent or Rs 0.35, rising to Rs 560.05 per share.

This comes at a time when brokerage and investment firm, Motilal Oswal moved the tech stocks in the country from underweight to overweight. Overweight is an investment suggestion when the system expects teh stock to outperform the sector in the future. | File/ Representative Image

Another major name, Gururgram-based HCL Tech, jumped to Rs 1,573.30, having risen by 0.24 per cent or Rs 3.70. Pune-based Tech Mahindra gained 0.68 per cent or Rs 10.25, taking the overall value to Rs 1,509.30 per share.

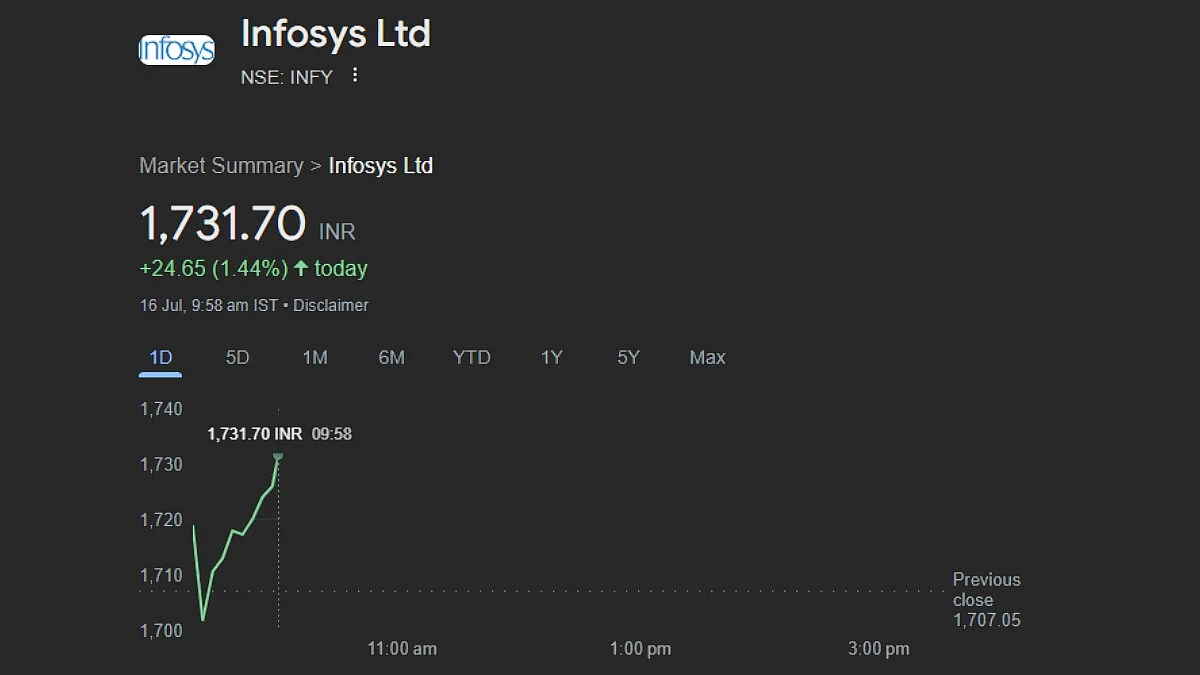

Another Bengaluru-based company, IT giant Infosys, saw the biggest rise of 1.44 per cent or Rs 24.65, taking the overall value to Rs 1,731.70 per share.

Tata Consultancy Services saw a steep decline from the beginning of the day, only to bounce back and gain 0.32 per cent or Rs 13.30, of its value, climbing to Rs 4,182.50 per share. |

Mumbai-based LTIMindtree also gained 0.20 per cent or Rs 11.05, taking the overall value to Rs 5,489.20 per share.

Underweight to Overweight

This comes at a time when brokerage and investment firm, Motilal Oswal moved the tech stocks in the country from underweight to overweight. Overweight is an investment suggestion when the system expects teh stock to outperform the sector in the future.

Another Bengaluru-based company, IT giant Infosys, saw the biggest rise of 1.44 per cent or Rs 24.65, taking the overall value to Rs 1,731.70 per share. |

This rating was decided upon despite the sectors and tech stocks's underperformance over the recent past, as the companies and their growth in the equity market have generally been perceived by many as below par. Despite their apparent underperformance, these companies are said to have 'decent valuation', making them a safer bet.

According to Motilal Oswal, although budget could be a moving factor in this week's trading activities, market fundamentals would also be at play in the developments at Dalal Street.