The Life Insurance Corporation of India (LIC) is the country's largest insurance provider with a market share of 66.2 percent/61.4 percent in terms of new business premiumfor FY2021/9MFY2022.

LIC is the largest asset manager in India with AUM of Rs 40.1 trillion, as on December 31, 2021, on a standalone basis.

LIC offers a wide variety of participating and non participating products to its customers including ULIP’s, saving insurance products, term insurance products, health insurance, and annuity and pension products. LIC has the largest individual agent network among life insurance entities in India, comprising approximately 1.33 million individual agents as on December 31, '21, which was 6.8 times the number of individual agents of the second largest life insurer.

Company background

LIC is India's only government-owned insurance provider company. It was established on September1, 1956, under the LIC Act by merging and nationalizing 245 private life insurance companies in India. It is providing life insurance in India for more than 65 years and is the largest life insurer in India. It is a part insurance and part investment products company. Their plans are a combination of insurance and investment with a guaranteed return.

LIC has over 13.5 lakh agents who help bring most of the new business. Largest Insurance Company in India with significant market share LIC is the largest life insurer in India, with a 61.6 percent market share in terms of total/gross written premiums (GWP) and a 61.4 percent market share in terms of New Business Premium (“NBP”) for 9MFY2022. Moreover, LIC has a 71.8 percent market share in terms of number of individual policies issued and 88.8 percen market share in terms of number of group policies issued for the 9 months ended December 31, 2021.

LIC’s market share

In the Indian life insurance industry for fiscal 2021, LIC's market share was 64.1 perceny in terms of GWP, 66.2 percent in terms of NBP, 74.6 percent in terms of number of individual policies issued, and 81.1 percent in terms of number of group policies issued. Wide product basket catering to all segments LIC has a broad, diversified product portfolio covering various segments across individual products and group products.

Continued dominant position in group insurance driving NBP growth

In terms of business parameters LIC’s new business premium (NBP) has grown at a CAGR of 13.5 percent between FY2019-FY2021 while total premium has grown at a CAGR of 9.2 percent during the same period. Total premium in India has grown at a CAGR of 9.3 percent while annualized premium equivalent (APE) has grown at a CAGR of 6.0 percent CAGR during the same period.

LIC continues to be an overall market leader in the insurance space with a 66.2 percent/61.4 percent market share in new business premium for FY2021/9MFY2022. LIC’s dominant position in the life insurance business is largely driven by its 75 percent+ market share in the group insurance business. However over the past few years LIC has lost significant market share in the high margin individual insurance business.

High proportion of Group & Participating businesses have been a drag on margins

In terms of annual premium equivalent (APE) LIC derives a significant portion of their business from group and participating businesses which are by nature low margin business as compared to individual and non-participating and protection business. Higher contribution from group insurance and participating business has been a drag on LIC’s NBP margins at 9.3 percent for 9MFY2022 which is significantly lower than the listed life insurance players despite its size and scale.

Over the last few years there has been a shift from participating to non participating policies in the product mix. However participating policies still accounted for 64.4 percent of LIC’s total APE in 9MFY2022 which is significantly higher than private life insurance companies like HDFC Life, ICICI Prudential and SBI Life where participating business account for less than 30 percent of total APE.

Positives

(a) The largest player in the fast growing and underpenetrated Indian life insurance sector, 5th largest life insurer globally by GWP

(b) Cross-cyclical product mix that caters to diverse consumer needs

(c) Presence across India through an omni-channel distribution network with an unparalleled agency force

(d) Trusted brand and a customer-centric business model. (e) Robust risk management framework.

Investment concerns

(a) Continued market share loss to private players

(b) Adverse persistency metrics (e.g, volatility in market, regulatory change, losing faith etc) could have a material adverse effect on company’s financial condition

(c) Adverse impact due to COVID-19 type pandemic. (d) Difficult to value the company given complex methodology involved in calculating embedded value.

Brokerage reports

Outlook & Valuation

Angel One Ltd. says: "At the upper end of the price band the LIC IPO is offered at P/EV (embedded value) of 1.1x as compared to other large listed private life insurance companies which are trading at multiples of 2.5-4.3x September ’21 EV.

"Though there are concerns over LIC regarding market share loss in individual insurance business and historically lower margins, we believe that valuations factor in most of the negatives. Expected improvements in product mix and greater transfer of surplus to shareholders account over the coming years are expected to drive profits from current low levels, which along with cheap valuations provide comfort.

"Moreover, discount of Rs 45 and Rs 60 for retail investors an LIC policyholders makes the issue more attractive for them. Hence, we are assigning a “subscribe'” recommendation to the issue," the brokerage report said.

Rating: Subscribe

ICICI Direct Research

Ongoing pandemic may adversely affect all aspects of business

Adverse variation in persistency may impact financial condition

Interest rate fluctuations may adversely affect profitability

Embedded value calculations, estimates may vary materially if key assumptions change

Competition in business may be materially impacted

Rating: ICICI Direct Direct has not rated the IPO

Marwadi Financial Services

LIC's business strategies

Capitalize on the growth opportunities in the Indian life insurance sector. It will further diversify the product mix by increasing the contribution of the non-participating portfolio. It reinforces omni-channel distribution network and increase its productivity. It continues leveraging technology to aid growth, drive operating efficiencies and provide digital support. It maximizes value creation through various commercial and financial levers as well as changes to corporation’s surplus distribution policy.

Key risks

The company’s individual agents procure most of its individual new business premiums. If the company is unable to retain and recruit individual agents on a timely basis and at reasonable cost, there could be a material adverse effect on its results of operations.

If actual claims experienced and other parameters are different from the assumptions used in pricing the company’s products and setting reserves for its products, it could have a material adverse effect on the business, financial condition and results of operations.

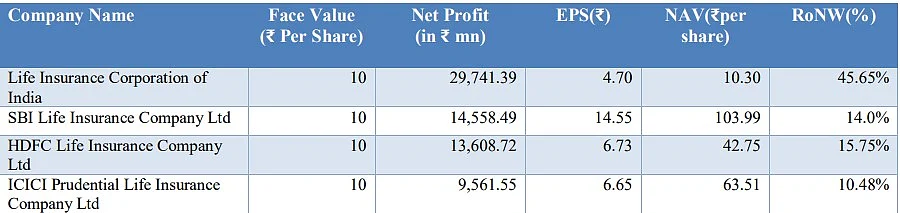

Peer Comparison

Marwadi Financial Services says: "Considering the September 21 Embedded Value of Rs. 53,96,860 mn, the company is going to list at a P/EV of 1.1 x with a market cap of Rs. 60,02,423 mn whereas its peers namely HDFC Life and SBI Life are trading at P/EV of 4.0x and 3.0x. We assign “Subscribe” rating to this IPO as LIC is the largest life insurer in India and a trusted brand with an established track record of financial performance and profitable growth. Also, it is available at reasonable valuation as compared to its peers.

Rating: Subscribe

GEPL Capital

Valuations and recommendation

The embedded value for LIC is Rs 5,39,686 and its post issue implied market capitalization is Rs 6,00,242 crore. Which is 11.2 percent premium to its IEV. The Mcap to EV ratio for its listed peers it in the range of 1.5x to 2.5x , Hence we believe Valuations of LIC with its majestic size are priced reasonably, said GEPL Capital.

As data suggest, its business is largely driven by agent based model (90%+), hence a larger digital on boarding of its network will be needed to pursue growth ahead. However, with Rs 6 lakh cr market cap on a PAT of Rs 3,000 crore makes a PE ratio of 200(x). The brokerage said, "In our view PE ratio is not comparable with private players as LIC’s distribution policy is now changed and higher allocation towards shareholders account in upcoming future to rise and thereby cool-off in earnings multiple".

The Company is losing its market share to private players, on which LIC could be focused on ahead. With its networks and expected double digit growth the industry complied with attractive valuation compared with peers makes LIC IPO a lucrative Investment.

Rating: We recommend Subscribe to the issue.

KR Choksey Research

Investment rationale

Strong brand with customer- centric business model

Cross-cyclical product mix responding to varied customer needs and an individual product portfolio dominated by participating life insurance policies

Presence across India through an omni-channel distribution network with an unparalleled agency force

Largest asset manager in India with an established track record of financial performance and profitable growth

Robust risk management framework

Future growth strategies

Capitalize on the growth opportunities in the Indian life insurance sector

Diversifying its product mix by increasing the contribution of the non-participating portfolio

Reinforce its omni-channel distribution network and increase its productivity

Continue leveraging technology to aid growth, drive operating efficiencies and provide digital support

Key Risks

Under the IRDAI Investment Regulations, LIC is required to invest its investment assets forming part of its controlled fund in certain specified categories of assets and instruments, subject to thresholds prescribed for each category of investment. Given the prescribed limits on the way the company’s assets are held and in which its investments can be made, LIC may be unable to mitigate market risks, while making investments, in the same manner as non-insurance companies

There is a risk of losses if LIC is forced to sell assets at unfavorable prices to meet the cash flow requirements as and when they arise if it holds insufficient liquid assets to support the liabilities. The company faces limited liquidity risk due to the nature of its liabilities and business structure.

Events such as changes in regulatory policies, volatility in capital markets, loss of customer confidence in the insurance industry or in the company, or sharp declines in its customers’ financial positions due to a severe deterioration in economic conditions, such as the economic deterioration caused by the COVID-19 pandemic, may cause discontinuations of its customers’ insurance policies.

The strength of the brand ‘LIC’ could be adversely affected by changes in customers’ and market perceptions about the company, particularly in the insurance sector, where integrity, trust and customer confidence are paramount. LIC is exposed to the risk that litigation, misconduct by its employees, agents or other distribution partners, operational failure and negative publicity could harm its brand, reputation, customer trust and business.

Outlook

LIC IPO size is Rs 2,10,085 million. The price band of the issue is Rs 902-949 per share. On the upper price band of INR 949 and the EV per share of Rs 853 for 9MFY21, the P/EV ratio works out to be 1.1x. While the industry P/EV is at 2.5x. We believe valuation for LIC is reasonable keeping in mind the valuations at which the peers are trading and the average industry.

The discount in the multiple for LIC could be considering its current dependence on the traditional product segment, lower VNB margins, higher employee expense, and agency distribution mix compared to its private peers.

KR Choksey Research said: "We expect the company to focus on its strong growth momentum by gaining its market share and focusing more on underwriting quality and the high margin product mix. Given the growth prospects for the pension/ annuity segment and the company's position as the market leader in the insurance sector, the company’s valuation will be at par with the private peers. As a result, we recommend to Subscribe the IPO for listing as well as long term gains."

Rating: Subscribe

Investmentz.com

Outlook and Valuations

India’s life insurance industry is expected to grow rapidly, owing to a relatively underpenetrated market and expanding awareness, which present a multi-year growth potential. LIC has been providing life insurance in India for over 65 years and is the country’s biggest life insurer, with a significant brand value advantage.

There are concerns about losing market share to private players and having lower profitability and revenue growth when compared to private players. However, we believe that LIC’s distribution advantage, increasing sales mix of direct and corporate channels, and a gradual shift to high margin Non- participating products could be possible drivers for LIC’s future growth, negating lower than industry growth rates.

At the upper price band, the stock is priced at 1.11x of its September 2021 Indian Embedded value(Market capital/Embedded value: 6 lakhCrore/5.39 lakh crore), which is at a significant discount to its listed peers. Currently listed insurance companies trade at Mcap/EV multiple of 2.5x to 3x.

Rating: Subscribe from long-term perspective

SMC

Outlook

LIC is the largest insurance company in India and 5th largest insurer globally by GWP. The Corporation enjoys a decent traction given its dominant market share in the insurance space. Besides its brand name, its years of experience in risk underwriting and managing a large AUM and its unique business model supported by phygital strategies indicate that would see a good growth going forward. It is valued reasonably as compared to its peers.

Rating: An investor can opt the issue for medium-to-long term perspective.

Dalal & Broacha Stock Broking Pvt Ltd.

Even after slashing 60 percent of its issue size (due to poor market conditions), LIC is still the country’s biggest IPO, surpassing the Rs 183 Bn offer by One97 Communications (Paytm) and Rs 152 Bn by Coal India. This IPO will be the true testimony of the country’s liquidity post-the recent FIIs exit as retail participation is expected to be high in this issue. With this IPO, investor can take part in the growth story of the highly underpenetrated insurance sector in India. LIC is the largest life insurer in India, with a 61.6 percent market share in terms of premiums (GWP), a 61.4 percent market share in terms of New Business Premium and a 71.8% market share in terms of number of individual policies issued for FY21, as well as by the number of individual agents, which comprised 55 percent of all individual agents in India as at December 31, 2021.

While there are some concerns like losing market share to private players, lower profitability & VNB margin, LIC has sufficiently discounted most issues, with the fair and attractive valuation of 1.1 times price to embedded value (EV), quite reasonable when compared with listed private peers (3x-4x EVs). Moreover, there is no plan to bring any FPO in the next year, dismissing the near term concerns of equity dilution.

"Investors must be aware that the business of insurance is long term in nature; therefore we recommend this issue for long term. However, investor can take the exit on substantial listing gains as valuation will stretch."

Rating: Subscribe for long-term

InCred Equities

Life Insurance Corporation of India (LIC) is launching its IPO on 4 May 2022, valuing the entity at Rs6tr, which is 1.1x Sep 2021 embedded value (EV).

The valuation commanded is lower compared to initial market expectations of 2x EV, and the dilution is also low at 3.5 percent against initial estimate of 5 percent.

There is uncertainty over bureaucratic functioning and low margins, but the valuation is attractive, mitigating concerns.

Rating: Subscribe

BP Wealth

Valuation and Outlook

LIC has the leading market position in the sector with the strong rebound of business traction in an underpenetrated market with improving the financialization of savings.

LIC's massive scale of operations and concomitant operating leverage, cost efficiencies, and stellar track record it has established over the decades have allowed it to emerge as a market leader and sustain its position despite the liberalization of the last 20 years.

The management also has plans to improve its VNB margins in the future through a focus on the sale of Non-Participating and group products.

At the upper hand of the price band, the IPO is valued at 1.1 P/EV, which is attractive as it is much lower than the listed private life insurance companies that trade at P/EV of 2.5-3.9x.

Rating: Subscribe on this issue for the long-term.

LIC IPO issue details

Price Band (Rs) Rs.902 – 949

Face Value (Rs) 10

Issue Size (Rs) 20,557Cr

Issue Type Book Building

Minimum lot 15 Shares

Issue Opens May 04, 2022

Issue Closes May 09, 2022

Listing on BSE, NSE

Indicative Timeline On or before Finalization of Basis of Allotment May 12, 2022

Unblocking of Funds May 13, 2022

Credit of shares to Demat Account May 16, 2022

Listing on exchange May 17, 2022

Choice Broking

Peer comparison and valuation

Despite the trimmed size of the IPO, LIC’s issue will be the biggest primary offering in domestic equity market. Despite opening up of the insurance market in 2000-01 to the private players, still today LIC commands a dominant position in the domestic market. This is mainly because of its brand image and being the household name.

As of 31 December. 2021, LIC has 61.4 percent market share in NBP. Further it had 71.8 percent and 88.8 percent market share in terms of number of individual and group policies issued, respectively. LIC had 13.3 lakh individual agents, which was 55 percent of the total agent network in India. Due to its poor presence in the ULIPs, pure protection etc., it is being losing market share to the private insurers. However, post change in the surplus distribution policy and expecting higher focus on the non-participating business, would strengthen LIC’s market positioning and returns for its shareholders. At the higher price band, LIC is demanding a P/EV multiple of 1.1x, which is at significant discount to the multiples of private players (ranging from 2.5-4.2x).

Rating: Considering the above observations, we assign a “Subscribe” rating for the issue.

Lead Managers

Kotak Mahindra Capital, BofA Securities, Citigroup Global, Goldman Sachs, ICICI Securities, JM Financial, J.P.Morgan, Nomura Financial, SBI Capital Markets. Axis Capital Limited

Registrar

KFin Technologies Limited

Discount Detail

Retail Category Rs.45 per share

LIC Employees Rs 45 per share

LIC Policyholders Rs 60 per share.