New Delhi: Leela Palaces Hotels & Resorts delivered a very strong performance in the October–December quarter (Q3 FY26), reporting a sharp rise in profits on the back of higher room rates and healthy demand across its luxury properties. The company’s consolidated net profit more than doubled to Rs 147.88 crore in Q3 FY26, compared with Rs 56.40 crore in the same quarter last year.

The sharp rise in profit reflects both strong revenue growth and the company’s ability to manage costs while benefiting from premium pricing in the luxury hospitality segment.

Revenue growth drives profits

Revenue from operations grew steadily during the quarter, rising to Rs 457.43 crore from Rs 370.46 crore a year earlier. This growth highlights continued demand for high-end travel and stay experiences, especially in premium destinations.

At the same time, total expenses increased to Rs 219.60 crore from Rs 183.51 crore in the year-ago period. While costs went up due to higher operating activity, the increase was much slower than revenue growth, helping the company post a sharp improvement in its bottom line.

The company was earlier known as Schloss Bangalore Pvt Ltd and listed on the stock exchanges in June last year, marking an important milestone in its corporate journey.

Labour Codes impact explained

During the quarter, the company also reported an exceptional item linked to changes in labour regulations. It disclosed an incremental impact of Rs 6.4 crore related to the four Labour Codes notified by the central government in November.

These new codes combine 29 existing labour laws into four broad frameworks covering wages, industrial relations, social security, and workplace safety. The company said this impact is based on its current assessment and may change as central and state governments issue final rules and clarifications.

Leela Palaces added that it will continue to track these developments and adjust its accounting treatment if needed.

During the quarter, the company also signed a management agreement for The Leela Jaisalmer and made its first international strategic investment in Dubai, signalling disciplined and capital-efficient growth.

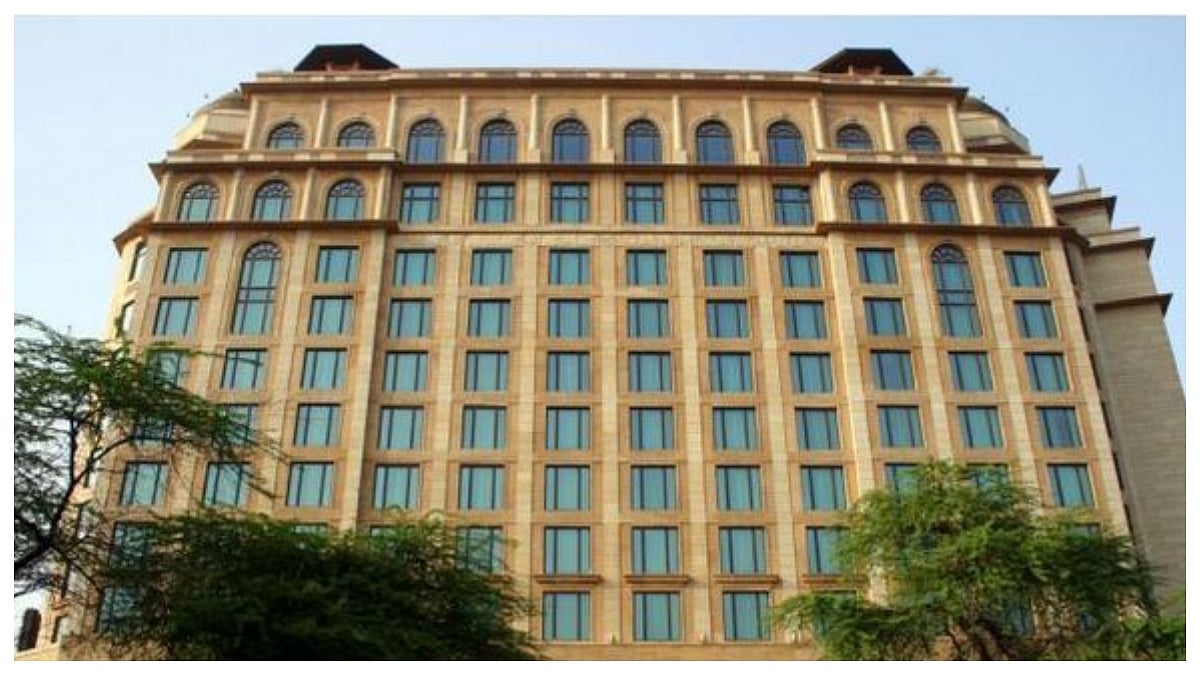

Leela Palaces, Hotels and Resorts remains India’s largest institutionally owned and managed pure-play luxury hospitality brand.

Disclaimer: This article is based on unaudited financial results released by the company. Figures are subject to revision upon audit and should not be considered as final or audited financial statements.