As the deadline for filing the income tax returns (ITR) loom or in sense the tax season approaches, many of the taxpayers are preparing to fulfill their annual obligation to the government.

Moreover, the process can be overwhelming, if you are not aware enough what are the documents you need. To make the tax filing more smoother, it is important to know exactly what paperwork you need to have and how to arrange it.

Here is a step by step guide to help you navigate tax filing for this year's tax filing season:

Deadline

The deadline for filing the ITR is July 31, 2024 (unless extended by the government).

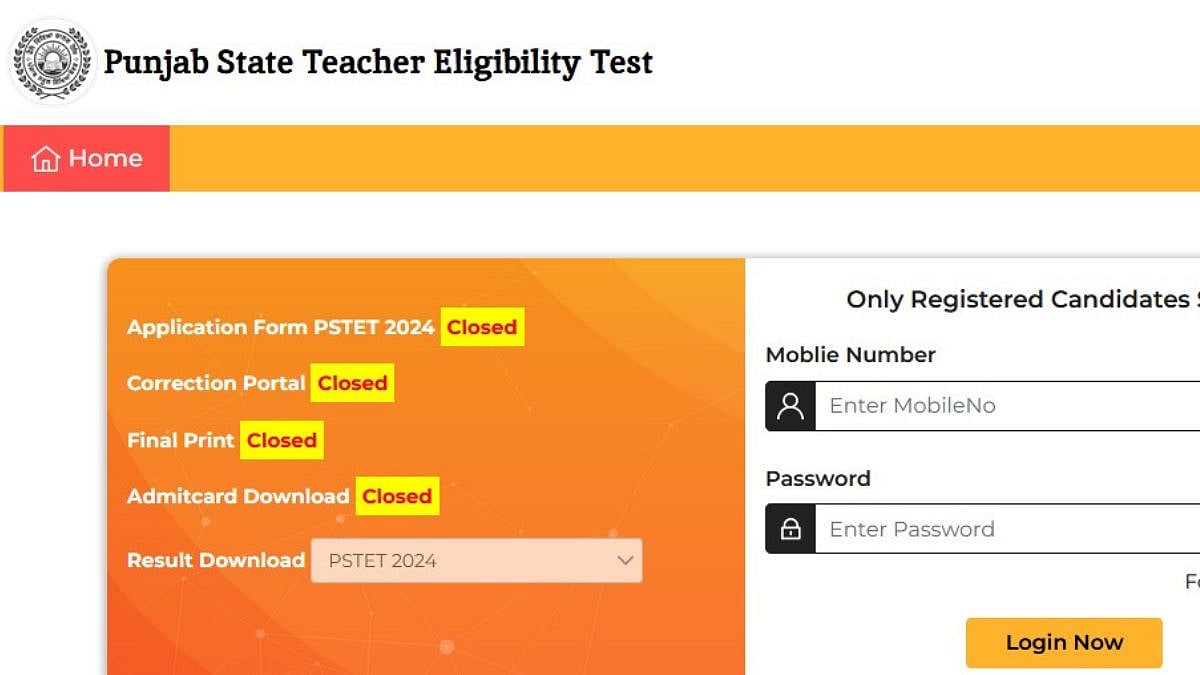

Image: Wikipedia (Representative)

What Documents Do You Need?

1. For salary records, make sure to have Form 16, bank statements, salary slips.

2. For business revenue keep the profit and loss statements, Invoices, Receipts.

3. For investments provide details of income from investments like dividends and capital gains, documents for Section 80C investments (PPF, NSC, ULIPs, ELSS, LIC policies).

4. For personal identification details use PAN card (essential for TDS deductions and tax refunds), and Aadhaar card (mandatory under Section 139AA of the Income Tax Act).

5. Forms which are important during the tax filing season includes: Form 16 (issued by employers, summarising salary and TDS), Form 16A (non-employment income and tax deductions), Form 16B (taxes on the sale of immovable property), Form 16C (taxes on rental income from house property), Form 26AS (summary from the Income Tax Department showing taxes deducted and paid), Annual Information Statement (detailed overview of Form 26AS), and Taxpayer Information Summary (aggregated summary of a taxpayer’s information).

6. Other important documents that needed to be kept in the process includes housing loan certificate (for claiming deductions on principal and interest paid), capital gains documentation (for selling shares, securities, or property), dividend income details (from broker statements or Demat account summaries), and donation certificate for Section 80G deductions.

The ITR deadline for FY 2023-24 is July 31, 2023. | Representative File

Selecting the Right ITR Form

Always choose the right ITR form is important for accurate income reporting, claiming eligible deductions, and avoiding delays or penalties. These includes:

1. Your income sources like salary, business income, capital gains, etc.

2. What is the residential status: Resident, non-resident, etc.

3. Other Considerations includes the type of business, foreign income, agricultural income, etc.

What are the commonly Used ITR Forms?

1. For residents with income from one house property, pensions, salaries, and other sources ITR-1 (Sahaj) is used.

2. ITR-2 is used for residents and Hindu Undivided Families (HUFs) with income from multiple sources, including capital gains.

3. ITR-3: For HUFs and individuals in business or related professions.

In the final steps, submit accurate bank details providing correct and up-to-date bank account details | Representative Picture

Reporting and Claiming Deductions

Make sure all the TCS deductions made during the year are accurately represented on your Form 26AS and AIS.

Final Steps

In the final steps, submit accurate bank details providing correct and up-to-date bank account details to receive tax refunds electronically.

Also make sure to avoid penalties and ensure timely refunds by filing your ITR before the July 31, 2024, deadline.

Furthermore, verify your ITR within 30 days of submission using Aadhaar OTP, net banking, or by sending a physical ITR-V form.