As a risk-averse investor, you may have options to choose from, and among these is the trusted fixed deposit. The FD allows you to build your wealth and plan your financial goals without worrying about the adverse effects of market volatility on your corpus and returns. With FD rates and a flexible tenor, you can invest comfortably to meet your short to mid-term goals. Based on your objectives, you can choose from fixed deposits such as cumulative, non-cumulative, tax-saving, senior citizen FDs, NRIs FDs and more.

A fixed deposit is also favourable for various other reasons, including the simple eligibility criteria and investment process. The simple eligibility criteria make the FD easily accessible to the majority. Additionally, modern issuers now offer digital methods, wherein you can invest online without going to a physical branch. While all these features may seem attractive, there are a few things to note about the FD before investing. Read on to know all about these crucial factors.

Eligibility criteria

Most issuers have defined eligibility criteria for their fixed deposit instruments. A standard requirement is that investors need to be above 18 to invest. The eligibility criteria may also depend on the type of FD you choose to invest in. If it is a senior citizen FD, you need to be above 60. On the other hand, as an NRI, you will only be able to invest in an NRI FD.

Other than this, the following entities are also eligible to invest in a fixed deposit:

· Proprietor

· Minors

· HUF (Hindu Undivided Family)

· Family trusts

· Societies

· Clubs or association

· Partnership firms

· Companies

Remember that the actual eligibility criteria may differ based on the bank or NBFC.

Documentation required

Generally, to invest in an FD, you must submit the basic KYC details for authentication and verification purposes. Documents typically required include the following:

· Identity proof

· Address proof

· Other KYC details

However, if you already have a relationship with the issuer, you won’t have to provide any documents. You can invest straight away with a digital application. With such digital advancements, you can now invest in an FD without visiting the issuer’s branch. Do note that you may have to submit updated KYC documents even as an existing customer. In such cases, you can upload the documents on the issuers portal and complete the process. If you are a non-individual investor, the issuer may ask for other documents depending on your position as an investor.

Payout modes

One of the most important factors to note about the FD is its multiple payout options. Based on a set frequency, these options dictate whether you receive your interest at maturity or periodically. The two types of FDs are called cumulative and non-cumulative fixed deposits, and knowing the differences is key to investing in your goals. For instance, if you need the steady returns of the FD every month, opting for the non-cumulative FD with the monthly payout mode is the right option. Here, you get your interest earnings every month.

Alternatively, if you intend to invest to meet a future goal, opt for the cumulative FD and let the corpus grow undisturbed. Do note that non-cumulative FDs generally have lower interest rates than cumulative FDs.

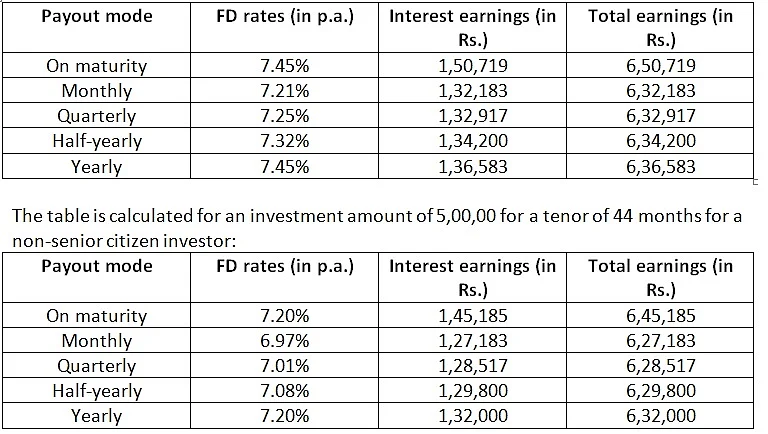

Refer to these tables to understand the differences in earnings for the payout options.

The table is calculated for an investment of Rs. 5,00,00 in Bajaj Finance Fixed Deposit, with a tenor of 44 months for a senior citizen investor:

Paying attention to these factors before investing is crucial to enjoying a smooth experience. Besides these, you should also know how to find the best offering in the market. Since both banks and NBFCs offer fixed deposits with different FD rates, the ideal approach compares offerings. An FD calculator can help, and you can use it to compute earnings and find the right one for you.

One offering that stands out is the Bajaj Finance Fixed Deposit. You can invest online, and existing customers enjoy a completely paperless process. Not only that, you can invest with minimum documents and get started with just Rs. 15,000. Invest online now and get your investment started in a matter of minutes!