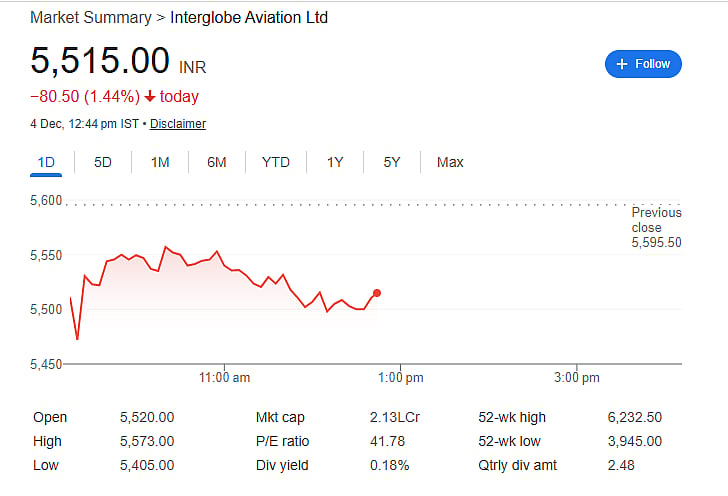

Mumbai: InterGlobe Aviation, the parent company of IndiGo, saw its share price fall nearly 3 percent on December 5, marking the second day of decline. The stock has dropped over 6 percent in just five sessions, mainly because IndiGo cancelled around 200 flights on Wednesday — one of the airline's biggest disruptions in years.

Despite the recent fall, IndiGo shares are still up 27 percent over the past year and have delivered over 217 percent returns in five years. But near-term sentiment has turned negative due to operational issues and legal uncertainties.

What Triggered the Sharp Sell-Off?

The main reason for the sudden plunge is the large number of flight cancellations. IndiGo struggled to manage crew availability after the introduction of new Flight Duty Time Limitation (FDTL) rules, which demand longer rest hours and better scheduling for pilots. The new rules have stretched IndiGo’s network and reduced its staffing flexibility.

Major airports saw heavy disruptions:

Delhi: At least 33 flights cancelled

Mumbai: Over 51 flights cancelled

Bengaluru: Nearly 73 flights cancelled on Thursday as the disruptions carried into the next day

Passengers faced long delays, last-minute cancellations, and major inconvenience.

DGCA Seeks Answers

The aviation regulator DGCA has stepped in and asked IndiGo to submit a detailed report. It said it is reviewing the situation and working with the airline to reduce delays and cancellations.

According to DGCA, the aim is to limit passenger inconvenience and understand the exact reasons that led to such a widespread operational breakdown. IndiGo has been told to present its mitigation plan and explain how it intends to prevent such disruptions in the coming days.

Legal Pressure Adds to Market Worries

Adding to the uncertainty is the upcoming Supreme Court hearing on IndiGo’s pending Rs 50,000-crore User Development Fee (UDF) case. The market is waiting to see if the verdict could have financial implications for the airline. This legal overhang, combined with flight chaos, has made investors nervous, leading to the stock’s decline.

Disclaimer: The Free Press Journal advises that this article is for informational purposes only. Readers should not consider it as investment advice and must consult financial experts before making investment decisions.