Groww unveiled India's first Nifty non-cyclical consumer index fund. NFO was announced by Groww Mutual Fund (Groww's AMC business). The New Fund Offer (NFO) for this open-ended scheme, which tracks the Nifty Non-Cyclical Consumer Index-TRI, is scheduled to take place from May 2, 2024, to May 16, 2024. The scheme will be managed by Mr. Abhishek Jain.

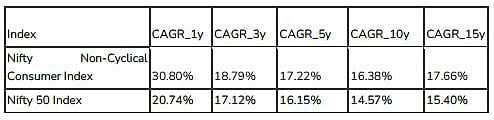

The fund invests in Nifty Non-Cyclical Consumer Index (TRI) securities in the same proportion and weight with the goal of producing long-term capital growth. The goal of this is to provide returns before costs that, subject to tracking errors, track the Nifty Non-Cyclical Consumer Index's overall return.

In order to establish a benchmark, the Nifty Non-Cyclical Consumer Index (Total Return Index) will be used. The index selection process is set up so that the largest companies in the chosen industries, measured by market capitalization, belong to the index.

As a result, the index comprises a selection of some of the most adored consumer brands in the nation right now. Companies with consumer brands that are seen and used daily have built trust over a long period of time. These businesses are viewed as non-cyclical sectors since consumers continue to spend money on these products, which tends to keep them somewhat immune to economic cycles.

Harsh Jain, Co-founder and COO Groww, said,The Groww Nifty Non-Cyclical Index fund is India’s first index fund, which enables people to invest in the top stocks from consumer industries such as FMCG, textiles, etc.

These companies, which manufacture items we need in our daily lives, tend to be slightly more insulated from economic cycles and therefore are seen as non-cyclical sectors.

This fund is tailored for investors who desire long-term, consistent wealth creation by investing in the top consumer brands seen and utilised by people across India.” jain added.

The plan will invest 95–100% in stocks and equity-related securities of businesses that are involved in or anticipated to profit from activities related to consumption, and 0-5% in debt and money market instruments, as well as units of debt schemes and debt ETFs.