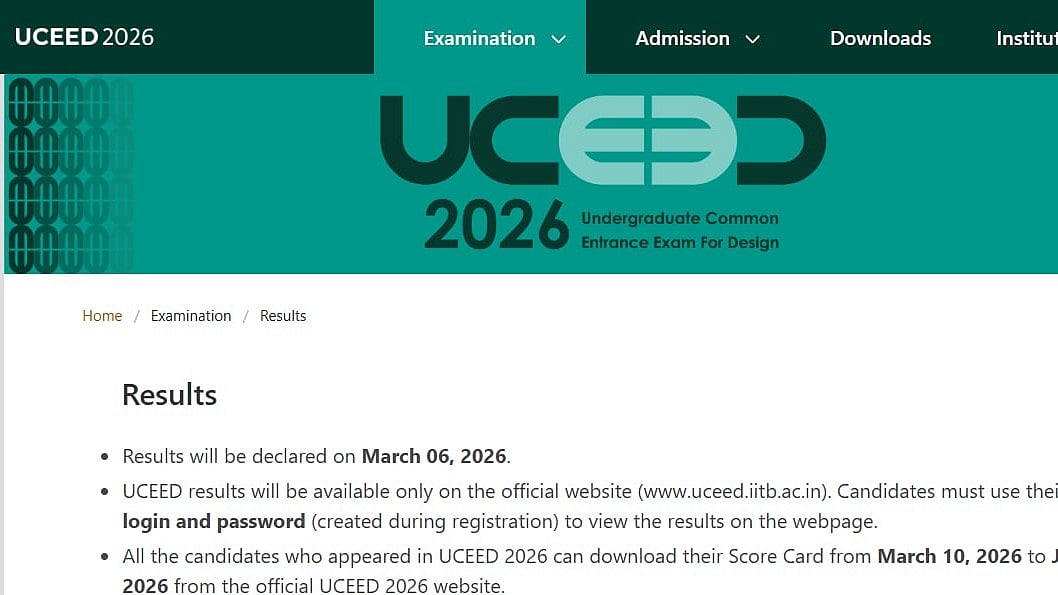

Indraprastha Gas' EBITDA in the fourth quarter for the financial year 2020 was reported at Rs 390 crore, up 14% since last year, was higher than the street estimates, due to higher industrial PNG volume and lower PNG cost for industries with a fall in LNG prices. Earnings growth was driven by a decline in gas cost by 9% since last year despite lower gas sales volume at 6.2 million metric standard meter per day (mmscmd) this quarter, due to COVID-19 lockdown in the last week of the quarter. EBITDA spread was at Rs 6.6 per scm and improved 14% since last year on continued benign spot LNG prices.

The profit for the company stood at Rs 290 crore, up by 26% as compared to Rs 230 crore in the previous quarter ended in March 2019.

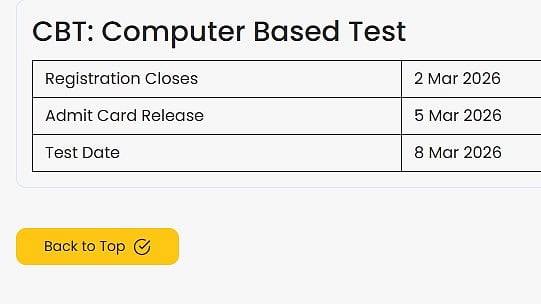

Volumes - Strong performance continues

The company reported a strong increase in volume by 9.1% since last year in the financial year 2020 with volume Compounded Annual Growth Rate (CAGR) at 12.5% over FY16-20. Indraprastha Gas saw an 8/17/18% growth in CNG/Domestic PNG and Ind/Comm segment. While the initial quarters will be impacted because of COVID-19 led lockdown, the growth will be back once everything is back to normal.

Associate company contributions, new areas are additional levers

Contribution of associate companies Maharashtra Natural Gas Ltd and Central UP Gas Ltd has been significant, with Rs 150 crore contribution net to Indraprastha Gas in the financial year 2020. The performance of these 2 companies likely to sustain at these levels over the next couple of years supporting group profitability. Coupled with additional growth from 4 areas won in CGD rounds 9 and 10 and the expected award of Gurugram sometime this year, expect some material levers for healthy growth for the company.

Downward factors

Lower than expected gas sales volume, in case of delay in volume recovery due to COVID-19 led demand slowdown. Any change in domestic gas allocation policy, depreciation of Indian rupee, and any adverse regulatory changes could affect margins and financial performance of the company.

Investment Theme

The government’s aim to increase the share of gas in India’s energy mix to ~15% by 2025 (from 6% currently) and the thrust to reduce air pollution in the NCR region provides a regulatory push for strong growth in CNG and industrial PNG volumes for Indraprastha Gas. Moreover, the development of new gas of Rewari, Karnal, and Gurugram and recent awarding of three new gas in the 10th round of CGD bidding would drive volume growth beyond its existing areas of operations.

The company’s margins are expected to remain strong given the expectation of further downward revision in the domestic gas prices for the second-half-yearly performance in the current financial year 2021 and low spot LNG prices. However, COVID-19 led lockdown to impact gas sales volume in the first half of the current financial year 2021.

Teji or Mandi?

Our Take is Teji for Indraprastha Gas as we believe that CNG demand would normalize in the second half of the current financial year 2021 as the government gradually eases lockdown norms. Moreover, gross margin outlook remains strongly supported by expectations of a further decline in domestic gas price post a recent sharp cut of 26% to $2.4 per metric million British thermal units (mmbtu).

Notwithstanding the impact of COVID-19, India’s gas demand is poised to grow strongly in the long term, supported by low gas price, a regulatory push to reduce pollution and the Government’s aim to increase the share of gas in India’s energy mix to ~15% by 2025 (from 6% currently) and thus the volume is expected to recover.

Teji Mandi is a proactive investment manager for everyone. To read more of our research, please visit https://tejimandi.com/research