New Delhi: ICICI Prudential Asset Management Company (AMC), an arm of the ICICI Bank, on Thursday said it has raised Rs 3,022 crore from anchor investors, a day before the opening of its mega-initial share-sale for public subscription.

Press Release |

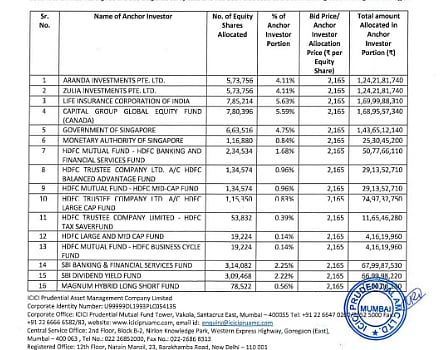

A wide range of foreign and domestic investors were allotted shares, including the government of Singapore, Abu Dhabi Investment Authority, Fidelity, Norges Bank, BlackRock, Aberdeen, Wellington, Capital World, J P Morgan Investment Management Inc., Goldman Sachs and Aranda Investments Pte. Limited, according to a circular uploaded on the Bombay Stock Exchange's (BSE) website.

Domestically, the anchor book also saw participation from the state-owned LIC and top mutual fund houses, such as SBI MF, Nippon India MF, Axis MF, HDFC MF and Aditya Birla Sun Life MF, among others.According to the circular, ICICI Prudential AMC has allotted 1.39 crore shares to 149 funds at Rs 2,165 apiece, which is also the higher end of the price band.This anchor allocation comes on the heels of a pre-IPO (initial public offering) funding round, where 26 domestic and foreign investors infused Rs 4,815 crore into ICICI Prudential AMC.

As part of this transaction, the asset management company undertook a private placement of 2,22,40,841 equity shares at an issue price of Rs 2,165 apiece, according to its public announcement on Wednesday.This substantial fundraise drew participation from a diverse set of investors, including Lunate Capital, the Estate of late Rakesh Jhunjhunwala,? IIFL Asset Management, 360 One Funds, Whiteoak Capital, HCL Capital, and market veterans Manish Chokani and Madhusudan Kela.Alongside external investors, the ICICI Bank itself invested Rs 2,140 crore to acquire an additional 2 per cent stake in the asset management company.

With the anchor round completed, the company is now gearing up for its Rs 10,602-crore maiden public offering, which will open on December 12 and close on December 16.ICICI Prudential AMC has set a price band of Rs 2,061 to Rs 2,165 per share for the issue, valuing the company at about Rs 1.07 lakh crore (USD 11.86 billion).The IPO will be an entirely offer-for-sale (OFS) of more than 4.89 crore shares by its promoter, UK-based Prudential Corporation Holdings, meaning the company will not receive any proceeds from the offering.Currently, the ICICI Bank holds 51 per cent in the AMC, while Prudential owns the remaining 49 per cent.

Once listed, ICICI Prudential AMC will become the latest asset manager to debut on Indian stock exchanges, joining players such as HDFC AMC, UTI AMC, Aditya Birla Sun Life AMC, Shriram AMC and Nippon Life India Asset Management.It will also be the fifth ICICI Group entity to be listed, after ICICI Bank, ICICI Prudential Life, ICICI Lombard and ICICI Securities.The company is scheduled to make its stock market debut on December 19.

Disclaimer: This story is from the syndicated feed. Nothing has changed except the headline.