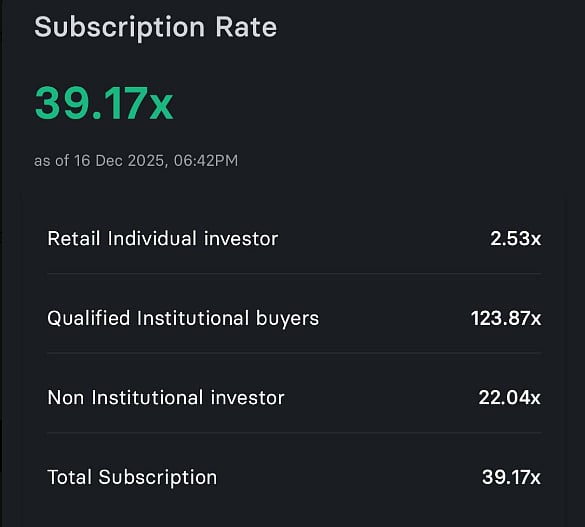

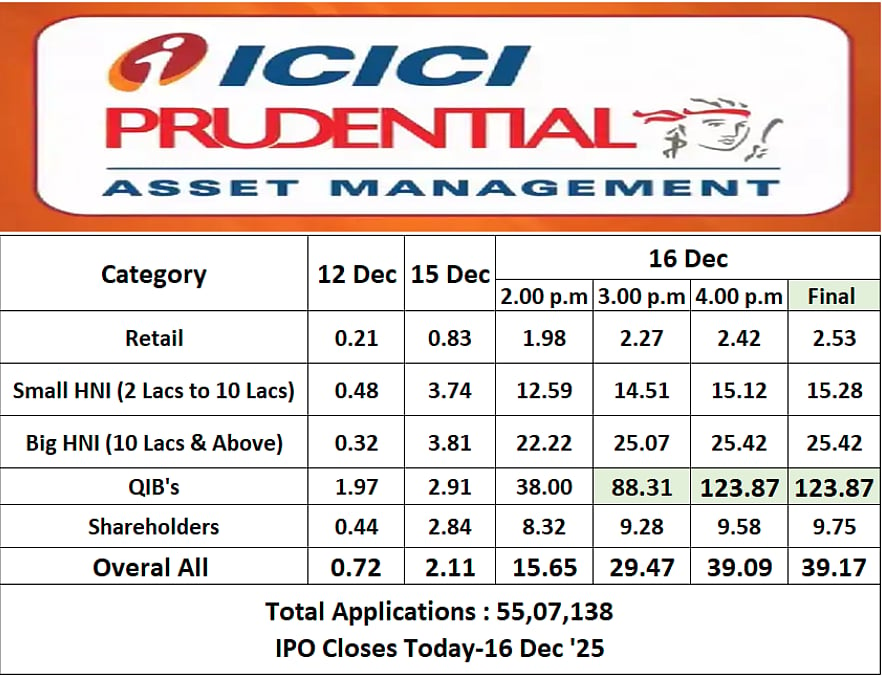

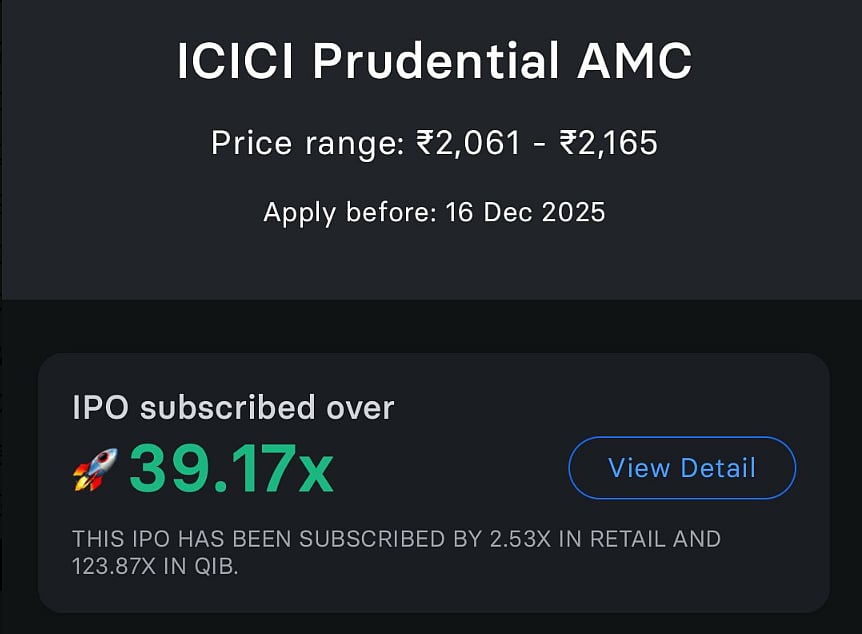

New Delhi: The initial public offering of ICICI Prudential Asset Management Company Ltd, an arm of the ICICI Bank, received 39.17 times subscription on the final day of bidding on Tuesday, led by heavy demand from institutional buyers.

File Image |

The Rs 10,602.65-crore IPO received bids for 1,37,14,88,316 shares against 3,50,15,691 shares on offer, according to details available with the NSE.

File Image |

The Qualified Institutional Buyers (QIBs) category fetched 123.87 times subscription, while the quota meant for non-institutional investors got subscribed 22.04 times. Retail Individual Investors (RIIs) portion received 2.53 times subscription. ICICI Prudential Asset Management Company (AMC) on Thursday said it has raised Rs 3,022 crore from anchor investors.

File Image |

The company has fixed a price band of Rs 2,061-2,165 per share for the issue, valuing it at about Rs 1.07 lakh crore (USD 11.86 billion). The initial public offering (IPO) is an entirely offer-for-sale of more than 4.89 crore shares by its promoter, UK-based Prudential Corporation Holdings, meaning the company will not receive any proceeds from the offering.

Currently, ICICI Bank holds 51 per cent in the AMC, while Prudential owns the remaining 49 per cent. Once listed, ICICI Prudential AMC will join asset managers such as HDFC AMC, UTI AMC, Aditya Birla Sun Life AMC, Shriram AMC, and Nippon Life India Asset Management. It will also be the fifth ICICI Group entity to be listed, after ICICI Bank, ICICI Prudential Life, ICICI Lombard, and ICICI Securities.

Disclaimer: This story is from the syndicated feed. Nothing has changed except the headline.