The government's decision to increase the minimum taxable income to Rs 7 lakh has come as a relief to India's salaried class. But despite the exemption and new tax slabs, even those from the mid to lower income bracket are vulnerable to income tax fraud.

After a stationery shop owner in Rajasthan, a home guard in Uttar Pradesh has received an income tax notice over transactions worth Rs 54 crore, and he is clueless about it.

Unexpected chain of events

Caught off guard by the tax authority's action, the man posted at the Shamli district magistrate's office, only has two bank accounts.

One of them is for his salary, which doesn't go beyond Rs 20,000 a month for home guards in UP, and the other account is for agricultural income.

Apart from his full time job and a six acre farm in his village, the home guard named Sompal has no other source of income.

But the tax notice based on his PAN card's details shows that it had been used to transfer Rs 54 crore since 2018, without paying any income tax.

Salaried classes vulnerable

This points towards a scam where the GST ID numbers have been used to extract PAN details, which are than used for transactions via dubious accounts.

Apart from fraudulently obtaining a PAN number, scammers are also known to spot it from the third and 12th digit of the GST registration number.

Shocked by the notice for a massive amount, the home guard has filed a complaint with the SP and DM in the area.

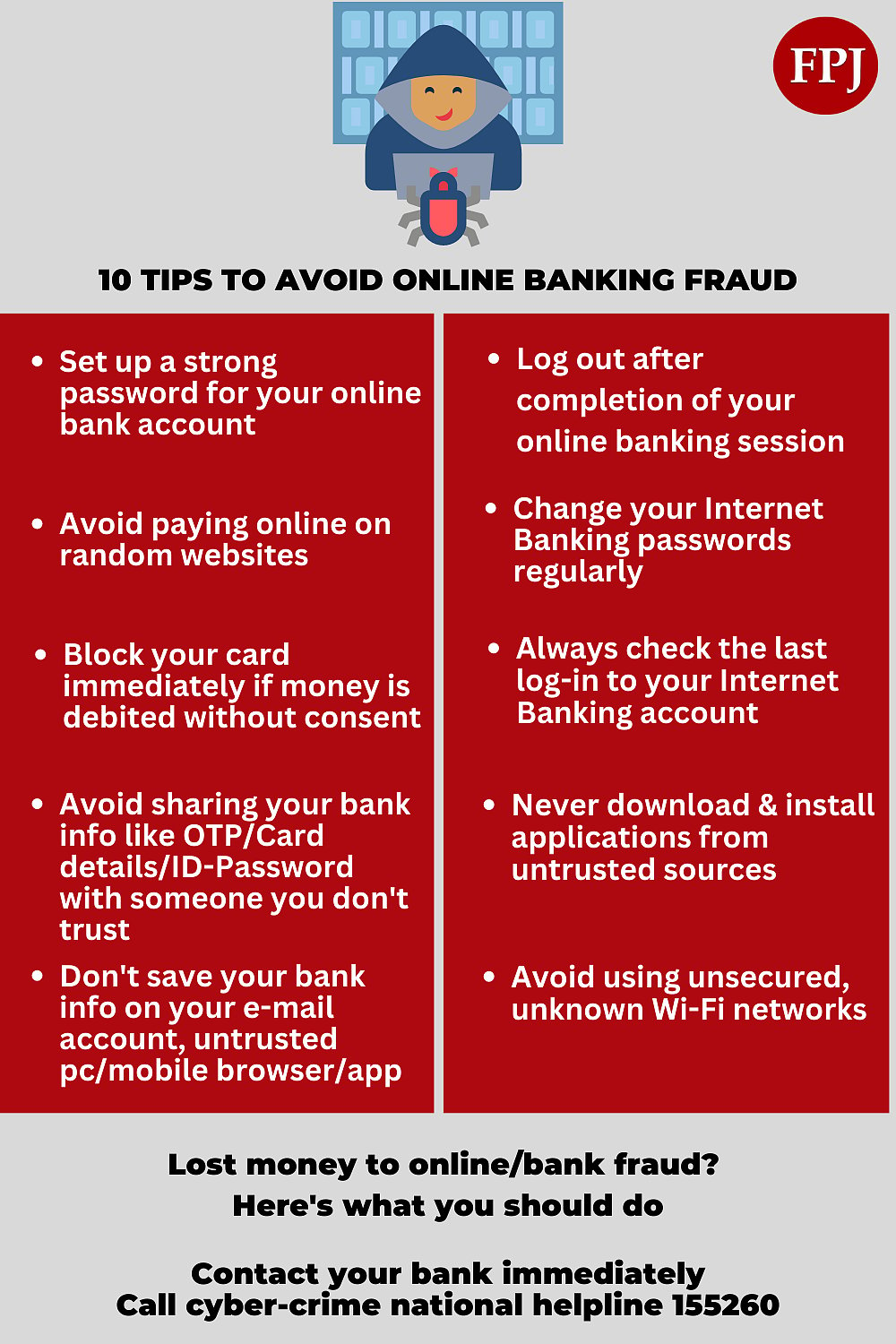

Apart from staying updated about credit scores, individuals can also check if their PAN card is being misused, by scanning financial statements on Paytm or similar apps.