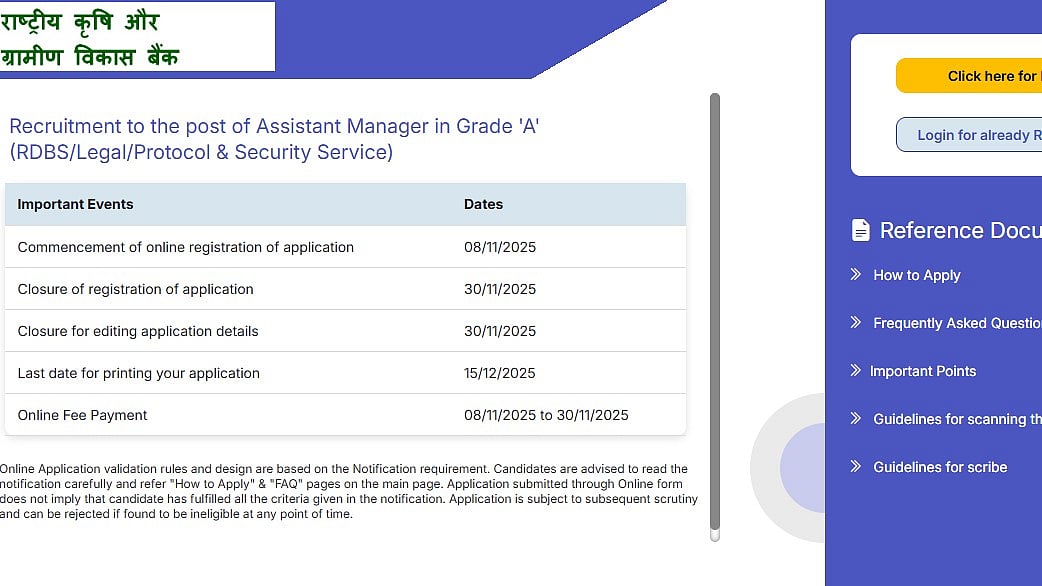

Mumbai: HDFC Bank just cut its Marginal Cost of Funds-based Lending Rate (MCLR) by up to 10 basis points for certain loan tenures. The new rates kicked in on November 7. If you’ve got a loan tied to HDFC’s internal benchmark, this change gives you a bit of breathing room. Now, the bank’s MCLR sits between 8.35 percent and 8.60 percent, down from the previous 8.45 percent to 8.65 percent.

Here’s how the new rates break down: overnight and one-month loans are now at 8.35 percent. If you’ve got a three-month loan, you’re looking at 8.40 percent. Six-month loans are at 8.45 percent, one-year at 8.50 percent, two-year at 8.55 percent, and three-year loans at 8.60 percent. HDFC made this move to share the benefits with customers as the market shifts.

So, who feels this change? If your home, auto, or personal loan is linked to MCLR, your interest rate will shift when your next reset comes up. That means lower EMIs and a little less strain on your wallet. But if your loan’s tied to an external benchmark like the RBI’s repo rate, nothing changes for you.

What is MCLR?

MCLR is the rate banks use internally to set lending rates. It factors in the cost of funds, operating costs, and how long your loan runs. The Reserve Bank of India rolled out MCLR in 2016 to make lending rates more transparent and responsive to policy changes. By tying loans to MCLR, banks can adjust rates quickly as their own costs change.

If you’re an HDFC borrower on MCLR, expect slightly lower EMIs after your next reset. It’s a small win, especially with borrowing costs climbing. The bank’s aiming to stay competitive and keep customers happy.