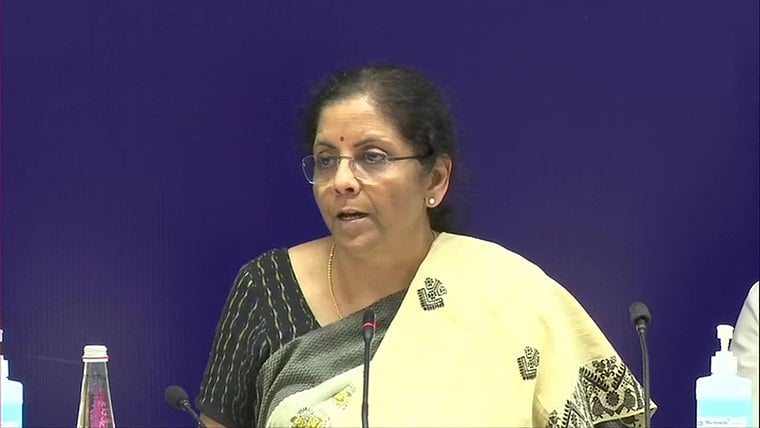

Finance Minister Nirmala Sitharaman on Saturday announced an overhaul of the Goods and Services Tax (GST) brackets for some items.

The GST rates for mobile phones and specific parts has been raised from 12% to 18%, the Union Minister announced today.

"There will be one rationalized rate of GST (Goods and Services Tax) which is 12% for both hand-made and machine-made matchsticks, she added, speaking at a press conference on Saturday.

Sitharaman added that the GST rate for Maintenance, Repair and Overhaul (MRO) services for an aircraft had been lowered, from 18% to 5% with full ITC. The MSME sector found mention on Saturday. According to Sithraman, there will now be relaxation to MSMEs from the furnishing of reconciliation statement in the form of GSTR 9C for the financial year 2018-19 for all taxpayers, having aggregate turnover below Rs 5 Crores.

The Finance Minister also announced that the due date for filing the annual return and the reconciliation statement for for FY19 was being extended until the last day of June 2020.

"Late fees not to be levied for the delayed filing of the annual return and reconciliation statement for 2017-18 & 2018-19 for taxpayers with aggregate turnover less than Rs 2 Crores," she added.

Earlier in the day, Sitharaman had chaired a GST Council meeting in New Delhi. The Finance Ministry recently issued a statement on the gross Goods and Services Tax (GST) collection in the month of February, which was pegged at Rs 1,05,366 crore.

According to the Ministry, GST revenues in February from domestic transactions have shown a growth of 12% over the revenue during February last year. Taking into account GST collected from the import of goods, the total revenue last month saw an increase of 8% compared to the revenue of February 2019. During this month, the GST on import of goods has shown a negative growth of 2% as compared to February 2019.

Earlier, the Finance Ministry had said that the country is saving Rs 1 lakh crore by removing corruption and wrongdoing through the efficient use of technology.

(With inputs from agencies)